Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

112 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Notes on the Consolidated Income Statement<br />

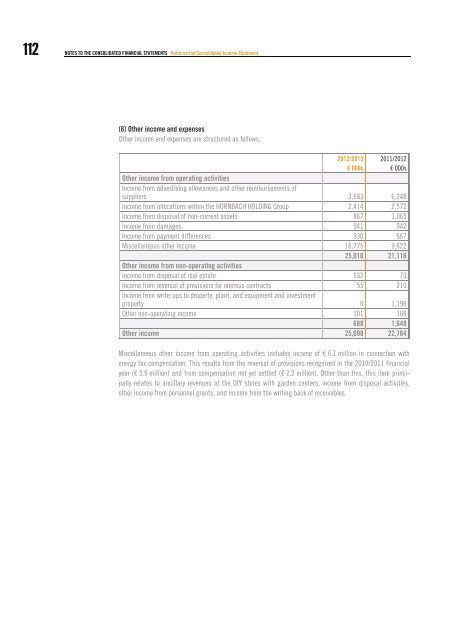

(6) Other income and expenses<br />

Other income and expenses are structured as follows:<br />

2012/2013 2011/2012<br />

€ 000s € 000s<br />

Other income from operating activities<br />

Income from advertising allowances and other reimbursements of<br />

suppliers 3,683 6,248<br />

Income from allocations within the HORNBACH HOLDING <strong>Group</strong> 2,414 2,572<br />

Income from disposal of non-current assets 867 1,065<br />

Income from damages 941 942<br />

Income from payment differences 330 667<br />

Miscellaneous other income 16,775 9,622<br />

25,010 21,116<br />

Other income from non-operating activities<br />

Income from disposal of real estate 532 73<br />

Income from reversal of provisions for onerous contracts 55 210<br />

Income from write-ups to property, plant, and equipment and investment<br />

property 0 1,196<br />

Other non-operating income 101 169<br />

688 1,648<br />

Other income 25,698 22,764<br />

Miscellaneous other income from operating activities includes income of € 6.1 million in connection with<br />

energy tax compensation. This results from the reversal of provisions recognized in the 2010/2011 financial<br />

year (€ 3.9 million) and from compensation not yet settled (€ 2.2 million). Other than this, this item principally<br />

relates to ancillary revenues at the DIY stores with garden centers, income from disposal activities,<br />

other income from personnel grants, and income from the writing back of receivables.