Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

114 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Notes on the Consolidated Income Statement<br />

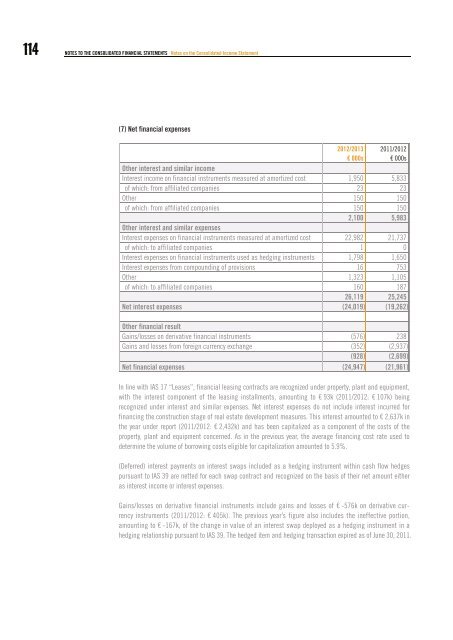

(7) Net financial expenses<br />

2012/2013 2011/2012<br />

€ 000s € 000s<br />

Other interest and similar income<br />

Interest income on financial instruments measured at amortized cost 1,950 5,833<br />

of which: from affiliated companies 23 23<br />

Other 150 150<br />

of which: from affiliated companies 150 150<br />

2,100 5,983<br />

Other interest and similar expenses<br />

Interest expenses on financial instruments measured at amortized cost 22,982 21,737<br />

of which: to affiliated companies 1 0<br />

Interest expenses on financial instruments used as hedging instruments 1,798 1,650<br />

Interest expenses from compounding of provisions 16 753<br />

Other 1,323 1,105<br />

of which: to affiliated companies 160 187<br />

26,119 25,245<br />

Net interest expenses (24,019) (19,262)<br />

Other financial result<br />

Gains/losses on derivative financial instruments (576) 238<br />

Gains and losses from foreign currency exchange (352) (2,937)<br />

(928) (2,699)<br />

Net financial expenses (24,947) (21,961)<br />

In line with IAS 17 “Leases”, financial leasing contracts are recognized under property, plant and equipment,<br />

with the interest component of the leasing installments, amounting to € 93k (2011/2012: € 107k) being<br />

recognized under interest and similar expenses. Net interest expenses do not include interest incurred for<br />

financing the construction stage of real estate development measures. This interest amounted to € 2,637k in<br />

the year under report (2011/2012: € 2,432k) and has been capitalized as a component of the costs of the<br />

property, plant and equipment concerned. As in the previous year, the average financing cost rate used to<br />

determine the volume of borrowing costs eligible for capitalization amounted to 5.9%.<br />

(Deferred) interest payments on interest swaps included as a hedging instrument within cash flow hedges<br />

pursuant to IAS 39 are netted for each swap contract and recognized on the basis of their net amount either<br />

as interest income or interest expenses.<br />

Gains/losses on derivative financial instruments include gains and losses of € -576k on derivative currency<br />

instruments (2011/2012: € 405k). The previous year’s figure also includes the ineffective portion,<br />

amounting to € -167k, of the change in value of an interest swap deployed as a hedging instrument in a<br />

hedging relationship pursuant to IAS 39. The hedged item and hedging transaction expired as of June 30, 2011.