Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Other Disclosures 149<br />

Other hedging measures – foreign currency risk<br />

The HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> <strong>Group</strong> also deploys hedging measures which do not meet the hedge accounting<br />

requirements set out in IAS 39, but which nevertheless make an effective contribution towards hedging the<br />

<strong>Group</strong>’s financial risks in line its risk management principles. For example, the HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong><br />

<strong>Group</strong> hedges the foreign currency risks involved in select (planned) transactions, including the embedded<br />

foreign currency derivatives potentially resulting from the transactions, such as those involved in the purchase<br />

of merchandise in the Far East using US dollars, by working with forward exchange transactions or by<br />

making fixed deposit investments denominated in foreign currencies in the form of macro hedges.<br />

The fair value of forward exchange transactions, including the embedded forward exchange transactions,<br />

amounted to € -81k at February 28, 2013 (2011/2012: € -366k). Of this sum, € 226k (2011/2012: € 368k)<br />

has been recognized under financial debt and € 146k (2011/2012: € 2k) under other assets.<br />

No fair value hedges or net investment in a foreign operation hedges have been undertaken to date.<br />

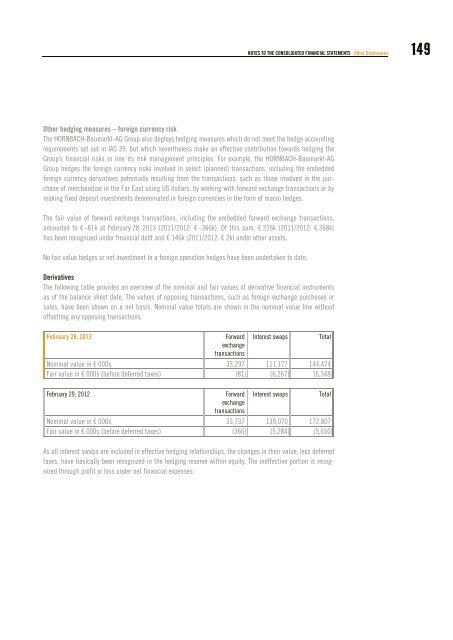

Derivatives<br />

The following table provides an overview of the nominal and fair values of derivative financial instruments<br />

as of the balance sheet date. The values of opposing transactions, such as foreign exchange purchases or<br />

sales, have been shown on a net basis. Nominal value totals are shown in the nominal value line without<br />

offsetting any opposing transactions.<br />

February 28, 2013<br />

Forward Interest swaps<br />

Total<br />

exchange<br />

transactions<br />

Nominal value in € 000s 33,297 111,177 144,474<br />

Fair value in € 000s (before deferred taxes) (81) (6,267) (6,348)<br />

February 29, 2012<br />

Forward Interest swaps<br />

Total<br />

exchange<br />

transactions<br />

Nominal value in € 000s 33,737 139,070 172,807<br />

Fair value in € 000s (before deferred taxes) (366) (5,284) (5,650)<br />

As all interest swaps are included in effective hedging relationships, the changes in their value, less deferred<br />

taxes, have basically been recognized in the hedging reserve within equity. The ineffective portion is recognized<br />

through profit or loss under net financial expenses: