Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

44 GROUP MAN<strong>AG</strong>EMENT REPORT Earnings Performance<br />

Earnings Performance<br />

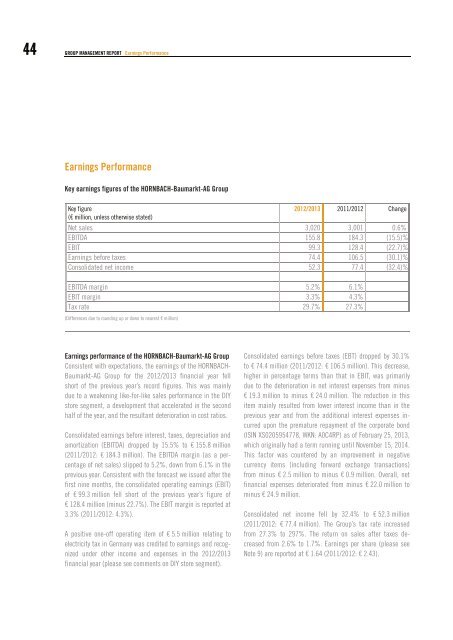

Key earnings figures of the HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> <strong>Group</strong><br />

Key figure<br />

2012/2013 2011/2012 Change<br />

(€ million, unless otherwise stated)<br />

Net sales 3,020 3,001 0.6%<br />

EBITDA 155.8 184.3 (15.5)%<br />

EBIT 99.3 128.4 (22.7)%<br />

Earnings before taxes 74.4 106.5 (30.1)%<br />

Consolidated net income 52.3 77.4 (32.4)%<br />

EBITDA margin 5.2% 6.1%<br />

EBIT margin 3.3% 4.3%<br />

Tax rate 29.7% 27.3%<br />

(Differences due to rounding up or down to nearest € million)<br />

Earnings performance of the HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> <strong>Group</strong><br />

Consistent with expectations, the earnings of the HORNBACH-<br />

<strong>Baumarkt</strong>-<strong>AG</strong> <strong>Group</strong> for the 2012/2013 financial year fell<br />

short of the previous year’s record figures. This was mainly<br />

due to a weakening like-for-like sales performance in the DIY<br />

store segment, a development that accelerated in the second<br />

half of the year, and the resultant deterioration in cost ratios.<br />

Consolidated earnings before interest, taxes, depreciation and<br />

amortization (EBITDA) dropped by 15.5% to € 155.8 million<br />

(2011/2012: € 184.3 million). The EBITDA margin (as a percentage<br />

of net sales) slipped to 5.2%, down from 6.1% in the<br />

previous year. Consistent with the forecast we issued after the<br />

first nine months, the consolidated operating earnings (EBIT)<br />

of € 99.3 million fell short of the previous year’s figure of<br />

€ 128.4 million (minus 22.7%). The EBIT margin is reported at<br />

3.3% (2011/2012: 4.3%).<br />

A positive one-off operating item of € 5.5 million relating to<br />

electricity tax in Germany was credited to earnings and recognized<br />

under other income and expenses in the 2012/2013<br />

financial year (please see comments on DIY store segment).<br />

Consolidated earnings before taxes (EBT) dropped by 30.1%<br />

to € 74.4 million (2011/2012: € 106.5 million). This decrease,<br />

higher in percentage terms than that in EBIT, was primarily<br />

due to the deterioration in net interest expenses from minus<br />

€ 19.3 million to minus € 24.0 million. The reduction in this<br />

item mainly resulted from lower interest income than in the<br />

previous year and from the additional interest expenses incurred<br />

upon the premature repayment of the corporate bond<br />

(ISIN XS0205954778, WKN: A0C4RP) as of February 25, 2013,<br />

which originally had a term running until November 15, 2014.<br />

This factor was countered by an improvement in negative<br />

currency items (including forward exchange transactions)<br />

from minus € 2.5 million to minus € 0.9 million. Overall, net<br />

financial expenses deteriorated from minus € 22.0 million to<br />

minus € 24.9 million.<br />

Consolidated net income fell by 32.4% to € 52.3 million<br />

(2011/2012: € 77.4 million). The <strong>Group</strong>’s tax rate increased<br />

from 27.3% to 297%. The return on sales after taxes decreased<br />

from 2.6% to 1.7%. Earnings per share (please see<br />

Note 9) are reported at € 1.64 (2011/2012: € 2.43).