Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Notes on the Consolidated Balance Sheet 129<br />

By resolution of the Annual General Meeting of HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> on July 7, 2011, revenue reserves of<br />

€ 47,710,500 were converted into share capital by issuing bonus shares in the 2011/2012 financial year<br />

(please see "Share capital").<br />

Disclosures concerning capital management<br />

The capital management practiced by HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> pursues the aim of maintaining a suitable<br />

equity base in the long term. The equity ratio is viewed as representing an important key figure for investors,<br />

analysts, banks and rating agencies. The company aims on the one hand to achieve the growth targets it has<br />

set itself while maintaining healthy financing structures and a stable dividend policy, and on the other hand<br />

to achieve long-term improvements in its key rating figures. The capital management instruments deployed<br />

include active debt capital management.<br />

The company has entered into covenants towards some providers of debt capital which, among other conditions,<br />

require it to maintain an equity ratio of at least 25%. The equity ratio, interest cover, debt/equity ratio<br />

and company liquidity (cash and cash equivalents plus available committed credit lines) are monitored<br />

monthly as part of the company’s internal risk management. Further key figures are calculated on a quarterly<br />

basis. Should the values fall short of certain target levels, then suitable countermeasures are initiated at an<br />

early stage. The covenants were complied with at all times during the 2011/2012 financial year. The equity<br />

ratio amounted to 51.4% as of February 28, 2013 (2011/2012: 48.6%).<br />

No changes were made to the company’s capital management approach in the financial year under report.<br />

(21) Distributable earnings and dividends<br />

The distributable amounts involve the unappropriated net profit reported in the balance sheet of HORNBACH-<br />

<strong>Baumarkt</strong>-<strong>AG</strong> prepared in accordance with German commercial law.<br />

HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> concluded the 2012/2013 financial year with an annual net surplus of<br />

€ 45,705,836.24.<br />

Following the allocation of € 22,802,336.24 to other revenue reserves, the unappropriated net profit amounts<br />

to € 22,903,500.00.<br />

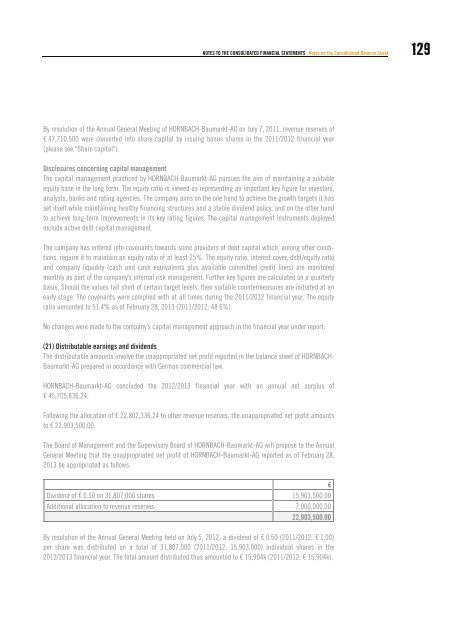

The Board of Management and the Supervisory Board of HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> will propose to the Annual<br />

General Meeting that the unappropriated net profit of HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> reported as of February 28,<br />

2013 be appropriated as follows:<br />

€<br />

Dividend of € 0.50 on 31,807,000 shares 15,903,500.00<br />

Additional allocation to revenue reserves 7,000,000.00<br />

22,903,500.00<br />

By resolution of the Annual General Meeting held on July 5, 2012, a dividend of € 0.50 (2011/2012: € 1.00)<br />

per share was distributed on a total of 31,807,000 (2011/2012: 15,903,000) individual shares in the<br />

2012/2013 financial year. The total amount distributed thus amounted to € 15,904k (2011/2012: € 15,904k).