Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

130 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Notes on the Consolidated Balance Sheet<br />

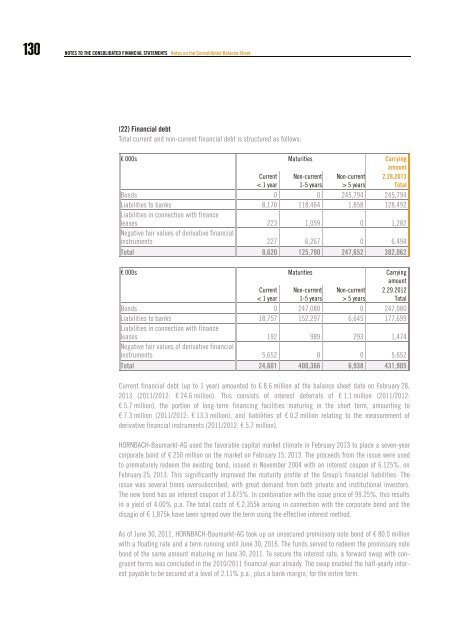

(22) Financial debt<br />

Total current and non-current financial debt is structured as follows:<br />

€ 000s Maturities Carrying<br />

amount<br />

Current<br />

< 1 year<br />

Non-current<br />

1-5 years<br />

Non-current<br />

> 5 years<br />

2.28.2013<br />

Total<br />

Bonds 0 0 245,794 245,794<br />

Liabilities to banks 8,170 118,464 1,858 128,492<br />

Liabilities in connection with finance<br />

leases 223 1,059 0 1,282<br />

Negative fair values of derivative financial<br />

instruments 227 6,267 0 6,494<br />

Total 8,620 125,790 247,652 382,062<br />

€ 000s Maturities Carrying<br />

amount<br />

Current<br />

< 1 year<br />

Non-current<br />

1-5 years<br />

Non-current<br />

> 5 years<br />

2.29.2012<br />

Total<br />

Bonds 0 247,080 0 247,080<br />

Liabilities to banks 18,757 152,297 6,645 177,699<br />

Liabilities in connection with finance<br />

leases 192 989 293 1,474<br />

Negative fair values of derivative financial<br />

instruments 5,652 0 0 5,652<br />

Total 24,601 400,366 6,938 431,905<br />

Current financial debt (up to 1 year) amounted to € 8.6 million at the balance sheet date on February 28,<br />

2013 (2011/2012: € 24.6 million). This consists of interest deferrals of € 1.1 million (2011/2012:<br />

€ 5.7 million), the portion of long-term financing facilities maturing in the short term, amounting to<br />

€ 7.3 million (2011/2012: € 13.3 million), and liabilities of € 0.2 million relating to the measurement of<br />

derivative financial instruments (2011/2012: € 5.7 million).<br />

HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> used the favorable capital market climate in February 2013 to place a seven-year<br />

corporate bond of € 250 million on the market on February 15, 2013. The proceeds from the issue were used<br />

to prematurely redeem the existing bond, issued in November 2004 with an interest coupon of 6.125%, on<br />

February 25, 2013. This significantly improved the maturity profile of the <strong>Group</strong>’s financial liabilities. The<br />

issue was several times oversubscribed, with great demand from both private and institutional investors.<br />

The new bond has an interest coupon of 3.875%. In combination with the issue price of 99.25%, this results<br />

in a yield of 4.00% p.a. The total costs of € 2,355k arising in connection with the corporate bond and the<br />

disagio of € 1,875k have been spread over the term using the effective interest method.<br />

As of June 30, 2011, HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> took up an unsecured promissory note bond of € 80.0 million<br />

with a floating rate and a term running until June 30, 2016. The funds served to redeem the promissory note<br />

bond of the same amount maturing on June 30, 2011. To secure the interest rate, a forward swap with congruent<br />

terms was concluded in the 2010/2011 financial year already. The swap enabled the half-yearly interest<br />

payable to be secured at a level of 2.11% p.a., plus a bank margin, for the entire term.