Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46 GROUP MAN<strong>AG</strong>EMENT REPORT Earnings Performance<br />

year. As a percentage of net sales, selling and store expenses<br />

rose from 30.3% to 31.1%.<br />

Due to the higher number of new store openings, pre-opening<br />

expenses grew from € 6.2 million to € 9.6 million (please also<br />

see Note 4). After three new store openings in the 2011/2012<br />

financial year, operations began at five new HORNBACH locations<br />

in the year under report. The pre-opening expense ratio<br />

increased from 0.2% to 0.3% as a result.<br />

Administration expenses grew by 16.2% to € 123.2 million in<br />

the year under report (2011/2012: € 106.1 million). As in the<br />

previous year, a major share of this increase was due to important<br />

forward-looking projects in the <strong>Group</strong>’s administrative<br />

departments. Among others, these include developing and<br />

extending our online retail and customer service activities, as<br />

well as innovations aimed at further optimizing our operating<br />

processes. In view of this, the administration expense ratio<br />

increased from 3.5% to 4.1%.<br />

Other income and expenses<br />

Other income and expenses showed a marked increase from<br />

€ 15.7 million to € 20.5 million in the year under report. One<br />

prime reason for this increase was the conclusive clarification<br />

of outstanding issues in connection with the supply of utility<br />

energies in Germany by the energy-related services provider<br />

we commissioned to this end. On this basis, it was possible to<br />

reverse provisions of € 3.9 million recognized in previous<br />

years. Other than this, other income and expenses also include<br />

an amount of € 1.6 million for compensation not yet<br />

invoiced, net of service amounts. A further reason for the<br />

increase in this item related to income from the group allocation,<br />

which rose from € 3.6 million to € 4.1 million. Furthermore,<br />

other income and expenses were positively influenced<br />

by a base effect within other non-operating income and expenses.<br />

In the 2011/2012 financial year, impairment losses in<br />

Romania were the main reason for negative other nonoperating<br />

income and expenses of minus € 1.4 million. In the<br />

year under report, by contrast, there were no material nonoperating<br />

items within other income and expenses.<br />

EBITDA and EBIT<br />

EBITDA in the DIY store segment fell 29.1% to € 107.7 million<br />

in the 2012/2013 financial year (2011/2012: € 152.0 million),<br />

equivalent to an EBITDA margin of 3.6% (2011/2012: 5.1%).<br />

Operating earnings (EBIT) dropped 35.9% to € 74.2 million<br />

(2011/2012: € 115.7 million). EBIT was equivalent to 2.5% of<br />

net sales in the year under report (2011/2012: 3.9%).<br />

Earnings performance in the real estate segment<br />

All the real estate activities in the HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong><br />

<strong>Group</strong> are pooled in the real estate segment. Its main business<br />

activities involve building and subsequently letting DIY<br />

store properties within the <strong>Group</strong>. These either remain in<br />

group ownership or are sold following construction to an<br />

external investor and then leased back. The respective DIY<br />

store properties are charged to the DIY store segment on<br />

rental and other terms customary to the market. Earnings in<br />

the real estate segment were significantly ahead of the previous<br />

year’s figures in the 2012/2013 financial year.<br />

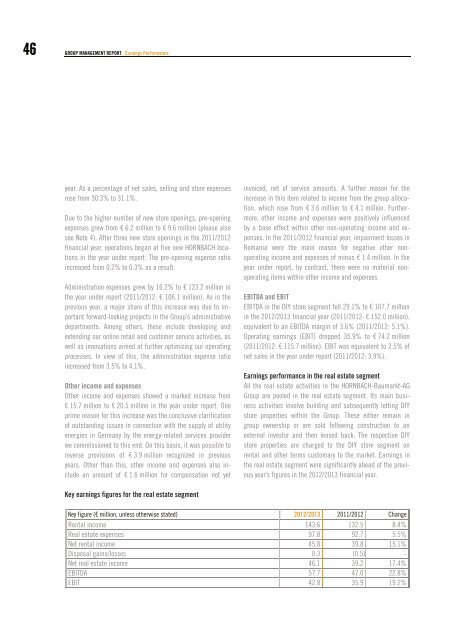

Key earnings figures for the real estate segment<br />

Key figure (€ million, unless otherwise stated) 2012/2013 2011/2012 Change<br />

Rental income 143.6 132.5 8.4%<br />

Real estate expenses 97.8 92.7 5.5%<br />

Net rental income 45.8 39.8 15.1%<br />

Disposal gains/losses 0.3 (0.5) -<br />

Net real estate income 46.1 39.2 17.4%<br />

EBITDA 57.7 47.0 22.8%<br />

EBIT 42.8 35.9 19.2%