Hornbach-Baumarkt-AG Group

PDF, 3,6 MB - Hornbach Holding AG

PDF, 3,6 MB - Hornbach Holding AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

148 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Other Disclosures<br />

In the 2010/2011 financial year, two floating-rate promissory note bonds with an equivalent value of<br />

€ 20 million each and terms running until August 31, 2015 were taken up in CHF and CZK.. The interest<br />

payable was hedged with congruent interest swaps. The half-yearly interest payable via the swaps was<br />

secured for the entire term at a level of 1.03% p.a. for the CHF promissory note bond and of 2.08% p.a. for<br />

the CZK promissory note bond, in both cases plus a bank margin.<br />

At the end of the 2012/2013 financial year, the <strong>Group</strong> had interest swaps amounting to € 111,177k<br />

(2011/2012: € 139,070k), with which a transformation from floating interest commitments to fixed interest<br />

commitments was achieved. The fair value of the interest swaps amounted to € -6,267k as of February 28,<br />

2013 (2011/2012: € -5,284k). Of this sum, € 6,267k has been recognized under financial debt (2011/2012:<br />

€ 5,284k).<br />

All interest rate swaps met hedge accounting requirements as of February 28, 2013. Changes in the fair<br />

values are recognized in the hedging reserve within equity until the results of the hedged transaction are also<br />

recognized.<br />

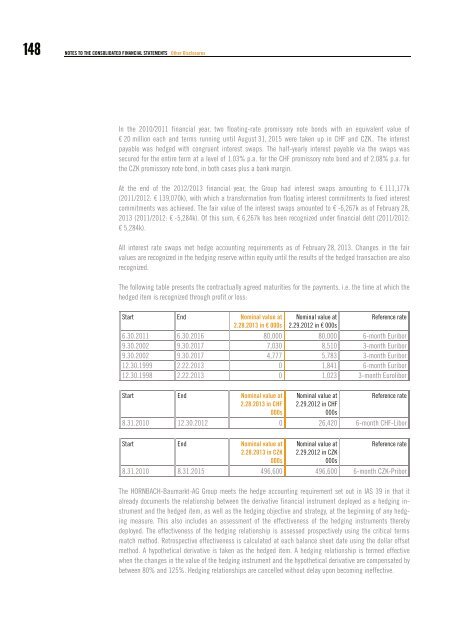

The following table presents the contractually agreed maturities for the payments, i.e. the time at which the<br />

hedged item is recognized through profit or loss:<br />

Start End Nominal value at<br />

2.28.2013 in € 000s<br />

Nominal value at<br />

2.29.2012 in € 000s<br />

Reference rate<br />

6.30.2011 6.30.2016 80,000 80,000 6-month Euribor<br />

9.30.2002 9.30.2017 7,030 8,510 3-month Euribor<br />

9.30.2002 9.30.2017 4,777 5,783 3-month Euribor<br />

12.30.1999 2.22.2013 0 1,841 6-month Euribor<br />

12.30.1998 2.22.2013 0 1,023 3-month Eurolibor<br />

Start End Nominal value at<br />

2.28.2013 in CHF<br />

000s<br />

Nominal value at<br />

2.29.2012 in CHF<br />

000s<br />

Reference rate<br />

8.31.2010 12.30.2012 0 26,420 6-month CHF-Libor<br />

Start End Nominal value at<br />

2.28.2013 in CZK<br />

000s<br />

Nominal value at<br />

2.29.2012 in CZK<br />

000s<br />

Reference rate<br />

8.31.2010 8.31.2015 496,600 496,600 6-month CZK-Pribor<br />

The HORNBACH-<strong>Baumarkt</strong>-<strong>AG</strong> <strong>Group</strong> meets the hedge accounting requirement set out in IAS 39 in that it<br />

already documents the relationship between the derivative financial instrument deployed as a hedging instrument<br />

and the hedged item, as well as the hedging objective and strategy, at the beginning of any hedging<br />

measure. This also includes an assessment of the effectiveness of the hedging instruments thereby<br />

deployed. The effectiveness of the hedging relationship is assessed prospectively using the critical terms<br />

match method. Retrospective effectiveness is calculated at each balance sheet date using the dollar offset<br />

method. A hypothetical derivative is taken as the hedged item. A hedging relationship is termed effective<br />

when the changes in the value of the hedging instrument and the hypothetical derivative are compensated by<br />

between 80% and 125%. Hedging relationships are cancelled without delay upon becoming ineffective.