Asia Personal Care & Cosmetics Market Guide 2016

AsiaCosmeticsMarketGuide

AsiaCosmeticsMarketGuide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

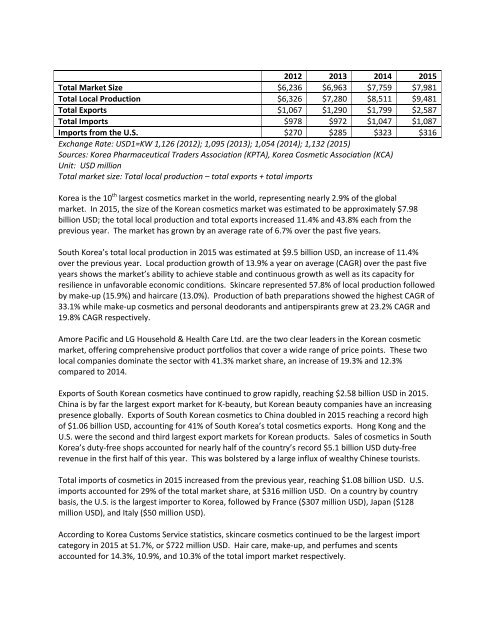

2012 2013 2014 2015<br />

Total <strong>Market</strong> Size $6,236 $6,963 $7,759 $7,981<br />

Total Local Production $6,326 $7,280 $8,511 $9,481<br />

Total Exports $1,067 $1,290 $1,799 $2,587<br />

Total Imports $978 $972 $1,047 $1,087<br />

Imports from the U.S. $270 $285 $323 $316<br />

Exchange Rate: USD1=KW 1,126 (2012); 1,095 (2013); 1,054 (2014); 1,132 (2015)<br />

Sources: Korea Pharmaceutical Traders Association (KPTA), Korea Cosmetic Association (KCA)<br />

Unit: USD million<br />

Total market size: Total local production – total exports + total imports<br />

Korea is the 10 th largest cosmetics market in the world, representing nearly 2.9% of the global<br />

market. In 2015, the size of the Korean cosmetics market was estimated to be approximately $7.98<br />

billion USD; the total local production and total exports increased 11.4% and 43.8% each from the<br />

previous year. The market has grown by an average rate of 6.7% over the past five years.<br />

South Korea’s total local production in 2015 was estimated at $9.5 billion USD, an increase of 11.4%<br />

over the previous year. Local production growth of 13.9% a year on average (CAGR) over the past five<br />

years shows the market’s ability to achieve stable and continuous growth as well as its capacity for<br />

resilience in unfavorable economic conditions. Skincare represented 57.8% of local production followed<br />

by make-up (15.9%) and haircare (13.0%). Production of bath preparations showed the highest CAGR of<br />

33.1% while make-up cosmetics and personal deodorants and antiperspirants grew at 23.2% CAGR and<br />

19.8% CAGR respectively.<br />

Amore Pacific and LG Household & Health <strong>Care</strong> Ltd. are the two clear leaders in the Korean cosmetic<br />

market, offering comprehensive product portfolios that cover a wide range of price points. These two<br />

local companies dominate the sector with 41.3% market share, an increase of 19.3% and 12.3%<br />

compared to 2014.<br />

Exports of South Korean cosmetics have continued to grow rapidly, reaching $2.58 billion USD in 2015.<br />

China is by far the largest export market for K-beauty, but Korean beauty companies have an increasing<br />

presence globally. Exports of South Korean cosmetics to China doubled in 2015 reaching a record high<br />

of $1.06 billion USD, accounting for 41% of South Korea’s total cosmetics exports. Hong Kong and the<br />

U.S. were the second and third largest export markets for Korean products. Sales of cosmetics in South<br />

Korea’s duty-free shops accounted for nearly half of the country’s record $5.1 billion USD duty-free<br />

revenue in the first half of this year. This was bolstered by a large influx of wealthy Chinese tourists.<br />

Total imports of cosmetics in 2015 increased from the previous year, reaching $1.08 billion USD. U.S.<br />

imports accounted for 29% of the total market share, at $316 million USD. On a country by country<br />

basis, the U.S. is the largest importer to Korea, followed by France ($307 million USD), Japan ($128<br />

million USD), and Italy ($50 million USD).<br />

According to Korea Customs Service statistics, skincare cosmetics continued to be the largest import<br />

category in 2015 at 51.7%, or $722 million USD. Hair care, make-up, and perfumes and scents<br />

accounted for 14.3%, 10.9%, and 10.3% of the total import market respectively.