Asia Personal Care & Cosmetics Market Guide 2016

AsiaCosmeticsMarketGuide

AsiaCosmeticsMarketGuide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

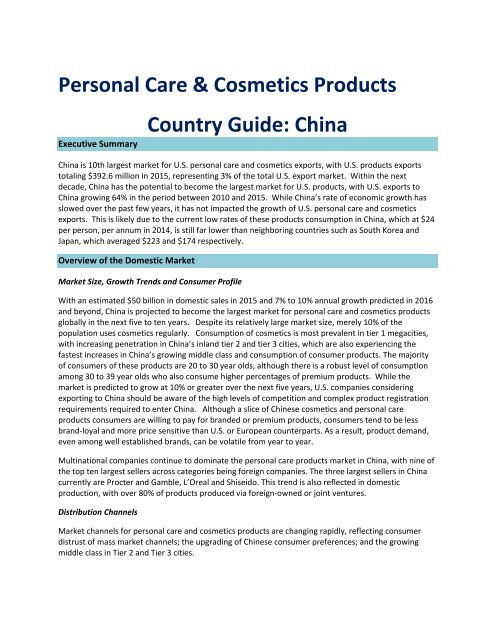

<strong>Personal</strong> <strong>Care</strong> & <strong>Cosmetics</strong> Products<br />

Executive Summary<br />

Country <strong>Guide</strong>: China<br />

China is 10th largest market for U.S. personal care and cosmetics exports, with U.S. products exports<br />

totaling $392.6 million in 2015, representing 3% of the total U.S. export market. Within the next<br />

decade, China has the potential to become the largest market for U.S. products, with U.S. exports to<br />

China growing 64% in the period between 2010 and 2015. While China’s rate of economic growth has<br />

slowed over the past few years, it has not impacted the growth of U.S. personal care and cosmetics<br />

exports. This is likely due to the current low rates of these products consumption in China, which at $24<br />

per person, per annum in 2014, is still far lower than neighboring countries such as South Korea and<br />

Japan, which averaged $223 and $174 respectively.<br />

Overview of the Domestic <strong>Market</strong><br />

<strong>Market</strong> Size, Growth Trends and Consumer Profile<br />

With an estimated $50 billion in domestic sales in 2015 and 7% to 10% annual growth predicted in <strong>2016</strong><br />

and beyond, China is projected to become the largest market for personal care and cosmetics products<br />

globally in the next five to ten years. Despite its relatively large market size, merely 10% of the<br />

population uses cosmetics regularly. Consumption of cosmetics is most prevalent in tier 1 megacities,<br />

with increasing penetration in China’s inland tier 2 and tier 3 cities, which are also experiencing the<br />

fastest increases in China’s growing middle class and consumption of consumer products. The majority<br />

of consumers of these products are 20 to 30 year olds, although there is a robust level of consumption<br />

among 30 to 39 year olds who also consume higher percentages of premium products. While the<br />

market is predicted to grow at 10% or greater over the next five years, U.S. companies considering<br />

exporting to China should be aware of the high levels of competition and complex product registration<br />

requirements required to enter China. Although a slice of Chinese cosmetics and personal care<br />

products consumers are willing to pay for branded or premium products, consumers tend to be less<br />

brand-loyal and more price sensitive than U.S. or European counterparts. As a result, product demand,<br />

even among well established brands, can be volatile from year to year.<br />

Multinational companies continue to dominate the personal care products market in China, with nine of<br />

the top ten largest sellers across categories being foreign companies. The three largest sellers in China<br />

currently are Procter and Gamble, L’Oreal and Shiseido. This trend is also reflected in domestic<br />

production, with over 80% of products produced via foreign-owned or joint ventures.<br />

Distribution Channels<br />

<strong>Market</strong> channels for personal care and cosmetics products are changing rapidly, reflecting consumer<br />

distrust of mass market channels; the upgrading of Chinese consumer preferences; and the growing<br />

middle class in Tier 2 and Tier 3 cities.