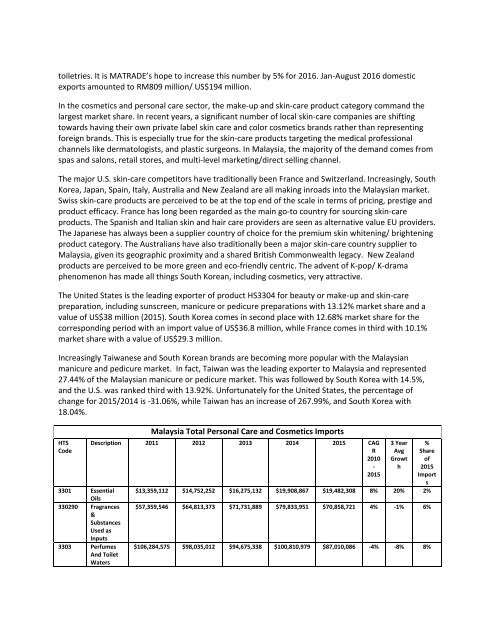

toiletries. It is MATRADE’s hope to increase this number by 5% for <strong>2016</strong>. Jan-August <strong>2016</strong> domestic exports amounted to RM809 million/ US$194 million. In the cosmetics and personal care sector, the make-up and skin-care product category command the largest market share. In recent years, a significant number of local skin-care companies are shifting towards having their own private label skin care and color cosmetics brands rather than representing foreign brands. This is especially true for the skin-care products targeting the medical professional channels like dermatologists, and plastic surgeons. In Malaysia, the majority of the demand comes from spas and salons, retail stores, and multi-level marketing/direct selling channel. The major U.S. skin-care competitors have traditionally been France and Switzerland. Increasingly, South Korea, Japan, Spain, Italy, Australia and New Zealand are all making inroads into the Malaysian market. Swiss skin-care products are perceived to be at the top end of the scale in terms of pricing, prestige and product efficacy. France has long been regarded as the main go-to country for sourcing skin-care products. The Spanish and Italian skin and hair care providers are seen as alternative value EU providers. The Japanese has always been a supplier country of choice for the premium skin whitening/ brightening product category. The Australians have also traditionally been a major skin-care country supplier to Malaysia, given its geographic proximity and a shared British Commonwealth legacy. New Zealand products are perceived to be more green and eco-friendly centric. The advent of K-pop/ K-drama phenomenon has made all things South Korean, including cosmetics, very attractive. The United States is the leading exporter of product HS3304 for beauty or make-up and skin-care preparation, including sunscreen, manicure or pedicure preparations with 13.12% market share and a value of US$38 million (2015). South Korea comes in second place with 12.68% market share for the corresponding period with an import value of US$36.8 million, while France comes in third with 10.1% market share with a value of US$29.3 million. Increasingly Taiwanese and South Korean brands are becoming more popular with the Malaysian manicure and pedicure market. In fact, Taiwan was the leading exporter to Malaysia and represented 27.44% of the Malaysian manicure or pedicure market. This was followed by South Korea with 14.5%, and the U.S. was ranked third with 13.92%. Unfortunately for the United States, the percentage of change for 2015/2014 is -31.06%, while Taiwan has an increase of 267.99%, and South Korea with 18.04%. HTS Code 3301 Essential Oils 330290 Fragrances & Substances Used as Inputs 3303 Perfumes And Toilet Waters Malaysia Total <strong>Personal</strong> <strong>Care</strong> and <strong>Cosmetics</strong> Imports Description 2011 2012 2013 2014 2015 CAG R 2010 - 2015 3 Year Avg Growt h % Share of 2015 Import s $13,359,112 $14,752,252 $16,275,132 $19,908,867 $19,482,308 8% 20% 2% $57,359,546 $64,813,373 $71,731,889 $79,833,951 $70,858,721 4% -1% 6% $106,284,575 $98,035,012 $94,675,338 $100,810,979 $87,010,086 -4% -8% 8%

3304 Make-Up & Skin-<strong>Care</strong> Preparation s 3305 Hair <strong>Care</strong> Products 3306 Oral & Dental Hygiene 3307 Cosmetic & Toilet Preparation s, Inc Shaving, Bath Prep and Deodorants 3401 Soap & Other Products to Wash the Skin 4803 Toilet, Facial Tissue, Towel Or Napkin Stock And Similar Paper, Cellulose Fiber Wadding And Webs, In Rolls Or Sheets 4818 <strong>Personal</strong> <strong>Care</strong> Wipes, Diapers, Tampons 5601 Sanitary Towels and Napkins 9603 <strong>Personal</strong> <strong>Care</strong> Brushes: Nail, Shaving, Tooth, etc 9605 Toilet Sets for <strong>Personal</strong> Travel 9619 Diapers and Fem Hygiene Total $1,116,494,85 $1,163,739,82 $1,157,672,23 $1,176,663,99 Imports 0 1 8 1 Source: Trade Policy Information System (TPIS), if marked with a * source is Global Trade Atlas $321,375,374 $310,411,726 $294,796,700 $292,996,168 $291,888,088 -2% -1% 26% $105,665,687 $123,821,502 $122,863,893 $104,811,273 $93,617,158 -2% -24% 8% $75,210,228 $86,478,121 $82,366,124 $90,271,076 $78,483,828 1% -5% 7% $108,525,534 $103,955,136 $109,440,248 $115,146,743 $108,757,686 0% -1% 10% $95,433,514 $99,497,854 $101,896,175 $108,839,692 $103,507,300 2% 2% 9% $38,054,019 $40,376,342 $44,625,538 $45,762,794 $50,029,282 6% 12% 4% $119,971,650 $133,361,903 $32,693,619 $33,853,854 $31,021,045 -24% -5% 3% $26,331,943 $33,046,560 $29,523,585 $32,105,595 $32,262,989 4% 9% 3% $46,590,320 $51,831,248 $43,959,100 $43,988,159 $57,040,585 4% 30% 5% $2,333,348 $3,358,792 $4,752,439 $4,629,647 $4,617,055 15% -3% 0% NA NA $108,072,458 $103,705,193 $96,483,874 NA -11% 9% $1,125,060,00 5 0% -3% 100%

- Page 1 and 2:

Asia Personal Care & Cosmetics Mark

- Page 3 and 4:

Table of Contents Country Guide: Au

- Page 5 and 6:

Overview of the Domestic Market Siz

- Page 7 and 8:

Table I: Total Imports of Personal

- Page 9 and 10:

interest, if the products are direc

- Page 11 and 12:

eached Australia, despite the count

- Page 13 and 14:

Cosmetics that make therapeutic cla

- Page 15 and 16:

Personal Care & Cosmetics Products

- Page 17 and 18:

Eye Shadow $15 $27 $48 $84 Mascara

- Page 19 and 20: Baby and child specific products ar

- Page 21 and 22: 2015 Key Figures: • 63,241 visits

- Page 23 and 24: • Stamped copies of power of atto

- Page 25 and 26: HS Code Description Tariff VAT Cons

- Page 27 and 28: Personal Care & Cosmetics Products:

- Page 29 and 30: Hong Kong’s total imports, includ

- Page 31 and 32: In developing a distribution strate

- Page 33 and 34: In premium skincare products, consu

- Page 35 and 36: Hong Kong. Other leading U.S. skinc

- Page 37 and 38: 3. “Dermo-skincare products” fo

- Page 39 and 40: Personal Care & Cosmetics Products

- Page 41 and 42: functional items to more advanced a

- Page 43 and 44: market in India. For a new imported

- Page 45 and 46: • Product Mix at the trade show:

- Page 47 and 48: - The office of the Drug Controller

- Page 49 and 50: Personal Care & Cosmetics Products

- Page 51 and 52: Distributors notice that products w

- Page 53 and 54: ecommended for substantial entry in

- Page 55 and 56: Imports from Southeast Asian neighb

- Page 57 and 58: - Issued by the manufacturer/princi

- Page 59 and 60: products. From the viewpoint of not

- Page 61 and 62: Fragrances, especially new product

- Page 63 and 64: Shaving Prep 3.00 6.00 13.00 65.00

- Page 65 and 66: Color Cosmetics Japanese women use

- Page 67 and 68: Upon receipt of the manufacturing o

- Page 69: Personal Care & Cosmetics Products

- Page 73 and 74: The younger generation females tend

- Page 75 and 76: The majority of the mass market cos

- Page 77 and 78: 27.44% of the Malaysian manicure or

- Page 79 and 80: to the Muslim consumers should be a

- Page 81 and 82: • Population changes will shape e

- Page 83 and 84: United Kingdom $23,932 4% $25,649 4

- Page 85 and 86: Personal Care & Cosmetics Products

- Page 87 and 88: In addition to personal care produc

- Page 89 and 90: purchases across all socio-economic

- Page 91 and 92: Personal Care & Cosmetics Products

- Page 93 and 94: Leading international brands contin

- Page 95 and 96: moisturizer than a foundation and y

- Page 97 and 98: 2. Hair care preparations (shampoos

- Page 99 and 100: There are no import or custom dutie

- Page 101 and 102: 2012 2013 2014 2015 Total Market Si

- Page 103 and 104: Since the demand for new retail cha

- Page 105 and 106: Overview of the Domestic Market US

- Page 107 and 108: Annex

- Page 109 and 110: COSMETICS MARKET READINESS ASSESSME

- Page 111 and 112: Product Function No Not required if

- Page 113 and 114: COSMETICS MARKET READINESS ASSESSME

- Page 115 and 116: COSMETICS MARKET READINESS ASSESSME

- Page 117 and 118: Product Notification Cosmetics prod

- Page 119 and 120: Percentage of Ingredients Claimed N

- Page 121 and 122:

Product Sample Labeling Country of

- Page 123 and 124:

ASEAN Table: Cosmetics Indonesia Ma

- Page 125 and 126:

Australia Personal Care and Cosmeti

- Page 127 and 128:

Australia Personal Care and Cosmeti

- Page 129 and 130:

Australia Personal Care and Cosmeti

- Page 131 and 132:

Australia Personal Care and Cosmeti

- Page 133 and 134:

Australia Personal Care and Cosmeti

- Page 135 and 136:

Australia Personal Care and Cosmeti

- Page 137 and 138:

Table 2: China Imports of Personal

- Page 139 and 140:

Table 4: China's Imports of Persona

- Page 141 and 142:

Table 6: China's Imports of Persona

- Page 143 and 144:

Table 8: China's Imports of Persona

- Page 145 and 146:

HTS Code Description 2011 2012 2013

- Page 147 and 148:

HONG KONG'S DOMESTIC EXPORTS BY PRO

- Page 149 and 150:

HONG KONG'S IMPORTS BY PRODUCTS, 20

- Page 151 and 152:

HONG KONG'S IMPORTS FROM THE U.S. B

- Page 153 and 154:

HONG KONG'S IMPORTS FROM FRANCE BY

- Page 155 and 156:

HONG KONG'S IMPORTS FROM KOREA (SOU

- Page 157 and 158:

India Personal Care and Cosmetics T

- Page 159 and 160:

India Personal Care and Cosmetics T

- Page 161 and 162:

India Personal Care and Cosmetics T

- Page 163 and 164:

India Personal Care and Cosmetics T

- Page 165 and 166:

Indonesia Personal Care and Cosmeti

- Page 167 and 168:

Indonesia Personal Care and Cosmeti

- Page 169 and 170:

Indonesia Personal Care and Cosmeti

- Page 171 and 172:

Indonesia Personal Care and Cosmeti

- Page 173 and 174:

Indonesia Personal Care and Cosmeti

- Page 175 and 176:

Japan Personal Care and Cosmetics T

- Page 177 and 178:

Japan Personal Care and Cosmetics T

- Page 179 and 180:

Japan Personal Care and Cosmetics T

- Page 181 and 182:

Japan Personal Care and Cosmetics T

- Page 183 and 184:

Japan Personal Care and Cosmetics T

- Page 185 and 186:

Japan Personal Care and Cosmetics T

- Page 187 and 188:

Malaysia Personal Care and Cosmetic

- Page 189 and 190:

Malaysia Personal Care and Cosmetic

- Page 191 and 192:

Malaysia Personal Care and Cosmetic

- Page 193 and 194:

Malaysia Personal Care and Cosmetic

- Page 195 and 196:

Malaysia Personal Care and Cosmetic

- Page 197 and 198:

Malaysia Personal Care and Cosmetic

- Page 199 and 200:

Table 2: Philippines Imports of Per

- Page 201 and 202:

Table 4: Philippines's Imports of P

- Page 203 and 204:

Table 6: Philippines's Imports of P

- Page 205 and 206:

Table 8: Philippines's Imports of P

- Page 207 and 208:

Table 10: Imported Products Share o

- Page 209 and 210:

Table 13: HS 37: Cosmetic & Toilet

- Page 211 and 212:

Singapore Personal Care and Cosmeti

- Page 213 and 214:

Singapore Personal Care and Cosmeti

- Page 215 and 216:

Singapore Personal Care and Cosmeti

- Page 217 and 218:

Singapore Personal Care and Cosmeti

- Page 219 and 220:

Singapore Personal Care and Cosmeti

- Page 221 and 222:

South Korea Personal Care and Cosme

- Page 223 and 224:

South Korea Personal Care and Cosme

- Page 225 and 226:

South Korea Personal Care and Cosme

- Page 227 and 228:

South Korea Personal Care and Cosme

- Page 229 and 230:

South Korea Personal Care and Cosme

- Page 231 and 232:

South Korea Personal Care and Cosme

- Page 233:

1401 Constitution Avenue, NW Washin