Asia Personal Care & Cosmetics Market Guide 2016

AsiaCosmeticsMarketGuide

AsiaCosmeticsMarketGuide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

interest, if the products are directly sent to individual consumers, thereby passing the need for product<br />

registration.<br />

There are between 20-25 distributors that sell cosmetics into the mass market. These distributors tend<br />

to focus on sundry items but some do represent premium brands. The line between premium and mass<br />

market in Australia is somewhat blurred—as mass market products move to masstique and premium<br />

markets heretofore not available in discount retail stores.<br />

Retail concentration is high in Australia. The grocery market is dominated by Coles and Woolworths<br />

who between them account for 72 percent of grocery sales. Coles (Wesfarmers) and Woolworths also<br />

own the three discount department store chains – Kmart, Target and Big W. These five outlets account<br />

for a very significant share of personal care product sales.<br />

Premium brands are sold through pharmacy chains and Australia’s only two department store chains –<br />

Myer and David Jones. By contrast there are about 5,000 pharmacies in Australia, 12 percent of these<br />

are independents, and 25 percent are controlled by three discount pharmacy chains. The Chemist<br />

Warehouse is the biggest of these chains and, according to a Roy Morgan Research survey conducted in<br />

2014, had six percent share of cosmetic sales. The same survey found that Priceline (a major pharmacy<br />

chain exclusively focused on beauty products) had 15 percent, Myer had 15 percent and David Jones had<br />

nine percent.<br />

In terms of the professional beauty segment there are about 17,000 hairdressing salons, 3,000 beauty<br />

salons, 3,000 nail salons, 1,000 day spas and 120 medi spas nationally. The professional beauty industry<br />

is growing by about one percent annually. Franchised systems are gaining some share but most salons<br />

are small owner-operated business. There are between 80-100 distributors/wholesalers that cater for<br />

this segment. There are only about 10 distributors with the capability to promote cosmeceuticals via<br />

doctor directed channels.<br />

Product Trends<br />

Australia is not generally known for setting trends but consumers are considered early adopters of<br />

international trends. This in part is due to the fact that Australia has the highest internet penetration<br />

rate in the <strong>Asia</strong> Pacific Region. By way of example Australia has 31 million active mobile phone<br />

subscriptions serving a population of 23 million. 85 percent of those are smart phones.<br />

Australia is also very culturally diverse. More than one quarter of the Australian population (28%) was<br />

born overseas. Beauty trends from Europe, North America and the <strong>Asia</strong> Pacific very quickly find their<br />

way to Australia.<br />

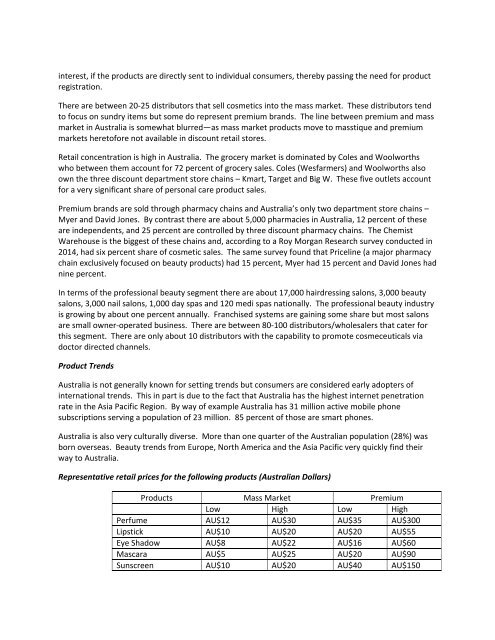

Representative retail prices for the following products (Australian Dollars)<br />

Products Mass <strong>Market</strong> Premium<br />

Low High Low High<br />

Perfume AU$12 AU$30 AU$35 AU$300<br />

Lipstick AU$10 AU$20 AU$20 AU$55<br />

Eye Shadow AU$8 AU$22 AU$16 AU$60<br />

Mascara AU$5 AU$25 AU$20 AU$90<br />

Sunscreen AU$10 AU$20 AU$40 AU$150