Asia Personal Care & Cosmetics Market Guide 2016

AsiaCosmeticsMarketGuide

AsiaCosmeticsMarketGuide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

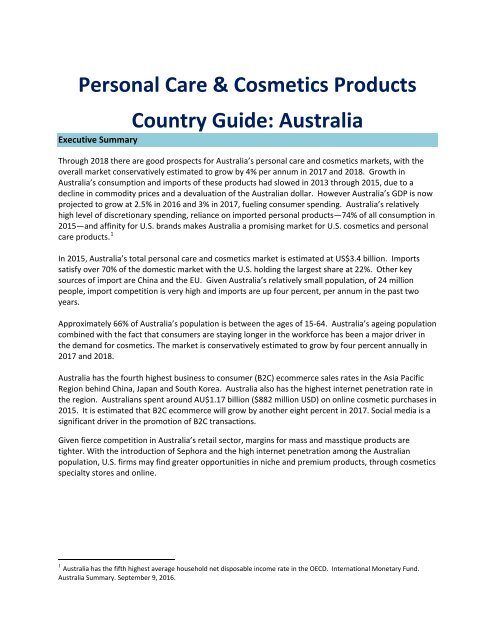

<strong>Personal</strong> <strong>Care</strong> & <strong>Cosmetics</strong> Products<br />

Country <strong>Guide</strong>: Australia<br />

Executive Summary<br />

Through 2018 there are good prospects for Australia’s personal care and cosmetics markets, with the<br />

overall market conservatively estimated to grow by 4% per annum in 2017 and 2018. Growth in<br />

Australia’s consumption and imports of these products had slowed in 2013 through 2015, due to a<br />

decline in commodity prices and a devaluation of the Australian dollar. However Australia’s GDP is now<br />

projected to grow at 2.5% in <strong>2016</strong> and 3% in 2017, fueling consumer spending. Australia’s relatively<br />

high level of discretionary spending, reliance on imported personal products—74% of all consumption in<br />

2015—and affinity for U.S. brands makes Australia a promising market for U.S. cosmetics and personal<br />

care products. 1<br />

In 2015, Australia’s total personal care and cosmetics market is estimated at US$3.4 billion. Imports<br />

satisfy over 70% of the domestic market with the U.S. holding the largest share at 22%. Other key<br />

sources of import are China and the EU. Given Australia’s relatively small population, of 24 million<br />

people, import competition is very high and imports are up four percent, per annum in the past two<br />

years.<br />

Approximately 66% of Australia’s population is between the ages of 15-64. Australia’s ageing population<br />

combined with the fact that consumers are staying longer in the workforce has been a major driver in<br />

the demand for cosmetics. The market is conservatively estimated to grow by four percent annually in<br />

2017 and 2018.<br />

Australia has the fourth highest business to consumer (B2C) ecommerce sales rates in the <strong>Asia</strong> Pacific<br />

Region behind China, Japan and South Korea. Australia also has the highest internet penetration rate in<br />

the region. Australians spent around AU$1.17 billion ($882 million USD) on online cosmetic purchases in<br />

2015. It is estimated that B2C ecommerce will grow by another eight percent in 2017. Social media is a<br />

significant driver in the promotion of B2C transactions.<br />

Given fierce competition in Australia’s retail sector, margins for mass and masstique products are<br />

tighter. With the introduction of Sephora and the high internet penetration among the Australian<br />

population, U.S. firms may find greater opportunities in niche and premium products, through cosmetics<br />

specialty stores and online.<br />

1 Australia has the fifth highest average household net disposable income rate in the OECD. International Monetary Fund.<br />

Australia Summary. September 9, <strong>2016</strong>.