Asia Personal Care & Cosmetics Market Guide 2016

AsiaCosmeticsMarketGuide

AsiaCosmeticsMarketGuide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

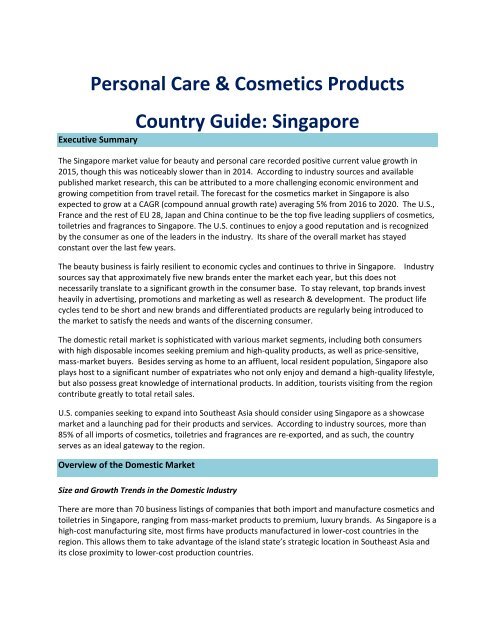

<strong>Personal</strong> <strong>Care</strong> & <strong>Cosmetics</strong> Products<br />

Country <strong>Guide</strong>: Singapore<br />

Executive Summary<br />

The Singapore market value for beauty and personal care recorded positive current value growth in<br />

2015, though this was noticeably slower than in 2014. According to industry sources and available<br />

published market research, this can be attributed to a more challenging economic environment and<br />

growing competition from travel retail. The forecast for the cosmetics market in Singapore is also<br />

expected to grow at a CAGR (compound annual growth rate) averaging 5% from <strong>2016</strong> to 2020. The U.S.,<br />

France and the rest of EU 28, Japan and China continue to be the top five leading suppliers of cosmetics,<br />

toiletries and fragrances to Singapore. The U.S. continues to enjoy a good reputation and is recognized<br />

by the consumer as one of the leaders in the industry. Its share of the overall market has stayed<br />

constant over the last few years.<br />

The beauty business is fairly resilient to economic cycles and continues to thrive in Singapore. Industry<br />

sources say that approximately five new brands enter the market each year, but this does not<br />

necessarily translate to a significant growth in the consumer base. To stay relevant, top brands invest<br />

heavily in advertising, promotions and marketing as well as research & development. The product life<br />

cycles tend to be short and new brands and differentiated products are regularly being introduced to<br />

the market to satisfy the needs and wants of the discerning consumer.<br />

The domestic retail market is sophisticated with various market segments, including both consumers<br />

with high disposable incomes seeking premium and high-quality products, as well as price-sensitive,<br />

mass-market buyers. Besides serving as home to an affluent, local resident population, Singapore also<br />

plays host to a significant number of expatriates who not only enjoy and demand a high-quality lifestyle,<br />

but also possess great knowledge of international products. In addition, tourists visiting from the region<br />

contribute greatly to total retail sales.<br />

U.S. companies seeking to expand into Southeast <strong>Asia</strong> should consider using Singapore as a showcase<br />

market and a launching pad for their products and services. According to industry sources, more than<br />

85% of all imports of cosmetics, toiletries and fragrances are re-exported, and as such, the country<br />

serves as an ideal gateway to the region.<br />

Overview of the Domestic <strong>Market</strong><br />

Size and Growth Trends in the Domestic Industry<br />

There are more than 70 business listings of companies that both import and manufacture cosmetics and<br />

toiletries in Singapore, ranging from mass-market products to premium, luxury brands. As Singapore is a<br />

high-cost manufacturing site, most firms have products manufactured in lower-cost countries in the<br />

region. This allows them to take advantage of the island state’s strategic location in Southeast <strong>Asia</strong> and<br />

its close proximity to lower-cost production countries.