Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UGANDA</strong><br />

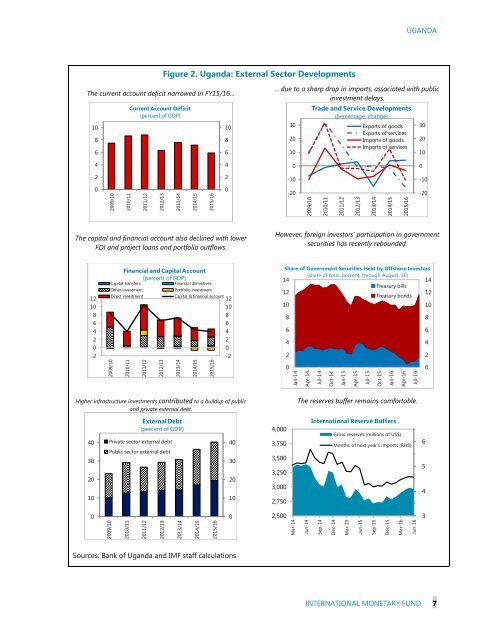

Figure 2. Uganda: External Sector Developments<br />

The current account deficit narrowed in FY15/16…<br />

10<br />

8<br />

6<br />

Current Account Deficit<br />

(percent of GDP)<br />

10<br />

8<br />

6<br />

… due to a sharp drop in imports, associated with public<br />

investment delays.<br />

30<br />

20<br />

10<br />

Trade and Service Developments<br />

(percentage change)<br />

Exports of goods<br />

Exports of services<br />

Imports of goods<br />

Imports of services<br />

30<br />

20<br />

10<br />

4<br />

4<br />

0<br />

0<br />

2<br />

2<br />

-10<br />

-10<br />

0<br />

2009/10<br />

2010/11<br />

2011/12<br />

2012/13<br />

2013/14<br />

2014/15<br />

2015/16<br />

0<br />

-20<br />

2009/10<br />

2010/11<br />

2011/12<br />

2012/13<br />

2013/14<br />

2014/15<br />

2015/16<br />

-20<br />

The capital and financial account also declined with lower<br />

FDI and project loans and portfolio outflows.<br />

However, foreign investors’ participation in government<br />

securities has recently rebounded.<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

Financial and Capital Account<br />

(percent of GDP)<br />

Capital transfers<br />

Financial derivatives<br />

Other investment<br />

Portfolio investment<br />

Direct investment<br />

Capital & financial account<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

2009/10<br />

2010/11<br />

2011/12<br />

2012/13<br />

2013/14<br />

2014/15<br />

2015/16<br />

Share of Government Securities Held by Offshore Investors<br />

14<br />

(share of total, percent, through August '16)<br />

14<br />

Treasury bills<br />

12<br />

Treasury bonds<br />

12<br />

10<br />

10<br />

8<br />

8<br />

6<br />

6<br />

4<br />

4<br />

2<br />

2<br />

0<br />

0<br />

Jan-14<br />

Apr-14<br />

Jul-14<br />

Oct-14<br />

Jan-15<br />

Apr-15<br />

Jul-15<br />

Oct-15<br />

Jan-16<br />

Apr-16<br />

Jul-16<br />

Higher infrastructure investments contributed to a buildup of public<br />

and private external debt.<br />

The reserves buffer remains comfortable.<br />

40<br />

30<br />

20<br />

10<br />

External Debt<br />

(percent of GDP)<br />

Private sector external debt<br />

Public sector external debt<br />

40<br />

30<br />

20<br />

10<br />

4,000<br />

3,750<br />

3,500<br />

3,250<br />

3,000<br />

2,750<br />

International Reserve Buffers<br />

Gross reserves (millions of US$)<br />

Months of next year's imports (RHS)<br />

6<br />

5<br />

4<br />

0<br />

2009/10<br />

2010/11<br />

2011/12<br />

2012/13<br />

2013/14<br />

2014/15<br />

2015/16<br />

0<br />

2,500<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

3<br />

Sources: Bank of Uganda and IMF staff calculations.<br />

INTERNATIONAL MONETARY FUND 7