Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UGANDA</strong><br />

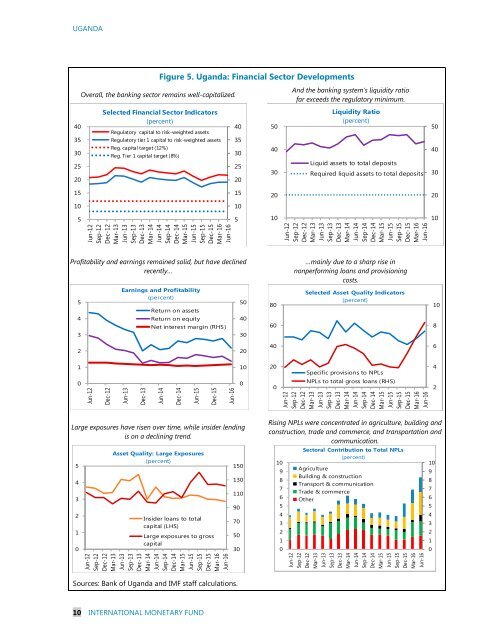

Figure 5. Uganda: Financial Sector Developments<br />

Overall, the banking sector remains well-capitalized.<br />

And the banking system’s liquidity ratio<br />

far exceeds the regulatory minimum.<br />

40<br />

35<br />

30<br />

25<br />

20<br />

Selected Financial Sector Indicators<br />

(percent)<br />

Regulatory capital to risk-weighted assets<br />

Regulatory tier 1 capital to risk-weighted assets<br />

Reg. capital target (12%)<br />

Reg. Tier 1 capital target (8%)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

50<br />

40<br />

30<br />

Liquidity Ratio<br />

(percent)<br />

Liquid assets to total deposits<br />

Required liquid assets to total deposits<br />

50<br />

40<br />

30<br />

15<br />

15<br />

20<br />

20<br />

10<br />

10<br />

5<br />

5<br />

10<br />

10<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

Profitability and earnings remained solid, but have declined<br />

recently…<br />

…mainly due to a sharp rise in<br />

nonperforming loans and provisioning<br />

costs.<br />

5<br />

4<br />

3<br />

Earnings and Profitability<br />

(percent)<br />

Return on assets<br />

Return on equity<br />

Net interest margin (RHS)<br />

50<br />

40<br />

30<br />

80<br />

60<br />

Selected Asset Quality Indicators<br />

(percent)<br />

10<br />

8<br />

2<br />

20<br />

40<br />

6<br />

1<br />

10<br />

20<br />

Specific provisions to NPLs<br />

4<br />

0<br />

Jun-12<br />

Dec-12<br />

Jun-13<br />

Dec-13<br />

Jun-14<br />

Dec-14<br />

Jun-15<br />

Dec-15<br />

Jun-16<br />

0<br />

0<br />

NPLs to total gross loans (RHS)<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

2<br />

Large exposures have risen over time, while insider lending<br />

is on a declining trend.<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Asset Quality: Large Exposures<br />

(percent)<br />

Insider loans to total<br />

capital (LHS)<br />

Large exposures to gross<br />

capital<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

150<br />

130<br />

110<br />

90<br />

70<br />

50<br />

30<br />

Rising NPLs were concentrated in agriculture, building and<br />

construction, trade and commerce, and transportation and<br />

communication.<br />

Sectoral Contribution to Total NPLs<br />

(percent)<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Agriculture<br />

Building & construction<br />

Transport & communication<br />

Trade & commerce<br />

Other<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Sources: Bank of Uganda and IMF staff calculations.<br />

10 INTERNATIONAL MONETARY FUND