Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UGANDA</strong><br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

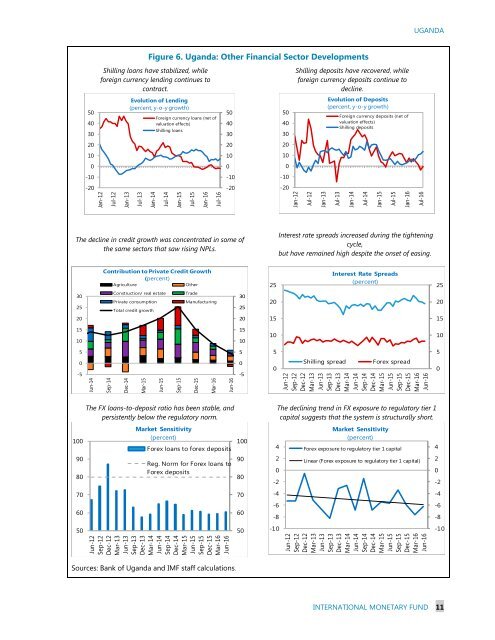

Figure 6. Uganda: Other Financial Sector Developments<br />

Shilling loans have stabilized, while<br />

foreign currency lending continues to<br />

contract.<br />

Evolution of Lending<br />

(percent, y-o-y growth)<br />

Jan-12<br />

Jul-12<br />

Jan-13<br />

Jul-13<br />

Jan-14<br />

Foreign currency loans (net of<br />

valuation effects)<br />

Shilling loans<br />

Jul-14<br />

Jan-15<br />

Jul-15<br />

Jan-16<br />

Jul-16<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

Shilling deposits have recovered, while<br />

foreign currency deposits continue to<br />

decline.<br />

Evolution of Deposits<br />

(percent, y-o-y growth)<br />

Jan-12<br />

Jul-12<br />

Jan-13<br />

Jul-13<br />

Foreign currency deposits (net of<br />

valuation effects)<br />

Shilling deposits<br />

Jan-14<br />

Jul-14<br />

Jan-15<br />

Jul-15<br />

Jan-16<br />

Jul-16<br />

The decline in credit growth was concentrated in some of<br />

the same sectors that saw rising NPLs.<br />

Interest rate spreads increased during the tightening<br />

cycle,<br />

but have remained high despite the onset of easing.<br />

Contribution to Private Credit Growth<br />

(percent)<br />

Agriculture<br />

Other<br />

25<br />

Interest Rate Spreads<br />

(percent)<br />

25<br />

30<br />

25<br />

20<br />

Construction/ real estate<br />

Private consumption<br />

Total credit growth<br />

Trade<br />

Manufacturing<br />

30<br />

25<br />

20<br />

20<br />

15<br />

20<br />

15<br />

15<br />

10<br />

15<br />

10<br />

10<br />

10<br />

5<br />

5<br />

5<br />

5<br />

0<br />

-5<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

0<br />

-5<br />

0<br />

Shilling spread<br />

Forex spread<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

0<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

The FX loans-to-deposit ratio has been stable, and<br />

persistently below the regulatory norm.<br />

Market Sensitivity<br />

(percent)<br />

Forex loans to forex deposits<br />

Reg. Norm for Forex loans to<br />

Forex deposits<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

The declining trend in FX exposure to regulatory tier 1<br />

capital suggests that the system is structurally short.<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

Market Sensitivity<br />

(percent)<br />

Forex exposure to regulatory tier 1 capital<br />

Linear (Forex exposure to regulatory tier 1 capital)<br />

Jun-12<br />

Sep-12<br />

Dec-12<br />

Mar-13<br />

Jun-13<br />

Sep-13<br />

Dec-13<br />

Mar-14<br />

Jun-14<br />

Sep-14<br />

Dec-14<br />

Mar-15<br />

Jun-15<br />

Sep-15<br />

Dec-15<br />

Mar-16<br />

Jun-16<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

Sources: Bank of Uganda and IMF staff calculations.<br />

INTERNATIONAL MONETARY FUND 11