Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

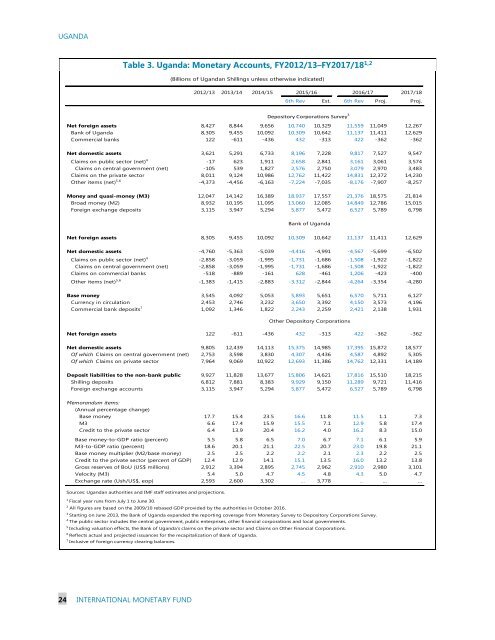

<strong>UGANDA</strong><br />

Table 3. Uganda: Monetary Accounts, FY2012/13–FY2017/18 1,2<br />

(Billions of Ugandan Shillings unless otherwise indicated)<br />

2012/13 2013/14 2014/15<br />

2015/16<br />

2016/17 2017/18<br />

6th Rev Est. 6th Rev Proj. Proj.<br />

Depository Corporations Survey 3<br />

Net foreign assets 8,427 8,844 9,656 10,740 10,329 11,559 11,049 12,267<br />

Bank of Uganda 8,305 9,455 10,092 10,309 10,642 11,137 11,411 12,629<br />

Commercial banks 122 -611 -436 432 -313 422 -362 -362<br />

Net domestic assets 3,621 5,291 6,733 8,196 7,228 9,817 7,527 9,547<br />

Claims on public sector (net) 4 -17 623 1,911 2,658 2,841 3,161 3,061 3,574<br />

Claims on central government (net) -105 539 1,827 2,576 2,750 3,079 2,970 3,483<br />

Claims on the private sector 8,011 9,124 10,986 12,762 11,422 14,831 12,372 14,230<br />

Other items (net) 5,6 -4,373 -4,456 -6,163 -7,224 -7,035 -8,176 -7,907 -8,257<br />

Money and quasi-money (M3) 12,047 14,142 16,389 18,937 17,557 21,376 18,575 21,814<br />

Broad money (M2) 8,932 10,195 11,095 13,060 12,085 14,849 12,786 15,015<br />

Foreign exchange deposits 3,115 3,947 5,294 5,877 5,472 6,527 5,789 6,798<br />

Bank of Uganda<br />

Net foreign assets 8,305 9,455 10,092 10,309 10,642 11,137 11,411 12,629<br />

Net domestic assets -4,760 -5,363 -5,039 -4,416 -4,991 -4,567 -5,699 -6,502<br />

Claims on public sector (net) 4 -2,858 -3,059 -1,995 -1,731 -1,686 -1,508 -1,922 -1,822<br />

Claims on central government (net) -2,858 -3,059 -1,995 -1,731 -1,686 -1,508 -1,922 -1,822<br />

Claims on commercial banks -518 -889 -161 628 -461 1,206 -423 -400<br />

Other items (net) 5,6 -1,383 -1,415 -2,883 -3,312 -2,844 -4,264 -3,354 -4,280<br />

Base money 3,545 4,092 5,053 5,893 5,651 6,570 5,711 6,127<br />

Currency in circulation 2,453 2,746 3,232 3,650 3,392 4,150 3,573 4,196<br />

Commercial bank deposits 7 1,092 1,346 1,822 2,243 2,259 2,421 2,138 1,931<br />

Other Depository Corporations<br />

Net foreign assets 122 -611 -436 432 -313 422 -362 -362<br />

Net domestic assets 9,805 12,439 14,113 15,375 14,985 17,395 15,872 18,577<br />

Of which Claims on central government (net) 2,753 3,598 3,830 4,307 4,436 4,587 4,892 5,305<br />

Of which Claims on private sector 7,964 9,069 10,922 12,693 11,386 14,762 12,331 14,189<br />

Deposit liabilities to the non-bank public 9,927 11,828 13,677 15,806 14,621 17,816 15,510 18,215<br />

Shilling deposits 6,812 7,881 8,383 9,929 9,150 11,289 9,721 11,416<br />

Foreign exchange accounts 3,115 3,947 5,294 5,877 5,472 6,527 5,789 6,798<br />

Memorandum items:<br />

(Annual percentage change)<br />

Base money 17.7 15.4 23.5 16.6 11.8 11.5 1.1 7.3<br />

M3 6.6 17.4 15.9 15.5 7.1 12.9 5.8 17.4<br />

Credit to the private sector 6.4 13.9 20.4 16.2 4.0 16.2 8.3 15.0<br />

Base money-to-GDP ratio (percent) 5.5 5.8 6.5 7.0 6.7 7.1 6.1 5.9<br />

M3-to-GDP ratio (percent) 18.6 20.1 21.1 22.5 20.7 23.0 19.8 21.1<br />

Base money multiplier (M2/base money) 2.5 2.5 2.2 2.2 2.1 2.3 2.2 2.5<br />

Credit to the private sector (percent of GDP) 12.4 12.9 14.1 15.1 13.5 16.0 13.2 13.8<br />

Gross reserves of BoU (US$ millions) 2,912 3,394 2,895 2,745 2,962 2,910 2,980 3,101<br />

Velocity (M3) 5.4 5.0 4.7 4.5 4.8 4.3 5.0 4.7<br />

Exchange rate (Ush/US$, eop) 2,593 2,600 3,302 … 3,778 … … …<br />

Sources: Ugandan authorities and IMF staff estimates and projections.<br />

1<br />

Fiscal year runs from July 1 to June 30.<br />

2 All figures are based on the 2009/10 rebased GDP provided by the authorities in October 2016.<br />

3<br />

Starting on June 2013, the Bank of Uganda expanded the reporting coverage from Monetary Survey to Depository Corporations Survey.<br />

4 The public sector includes the central government, public enterprises, other financial corporations and local governments.<br />

5<br />

Including valuation effects, the Bank of Uganda's claims on the private sector and Claims on Other Financial Corporations.<br />

6<br />

Reflects actual and projected issuances for the recapitalization of Bank of Uganda.<br />

7 Inclusive of foreign currency clearing balances.<br />

24 INTERNATIONAL MONETARY FUND