Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UGANDA</strong><br />

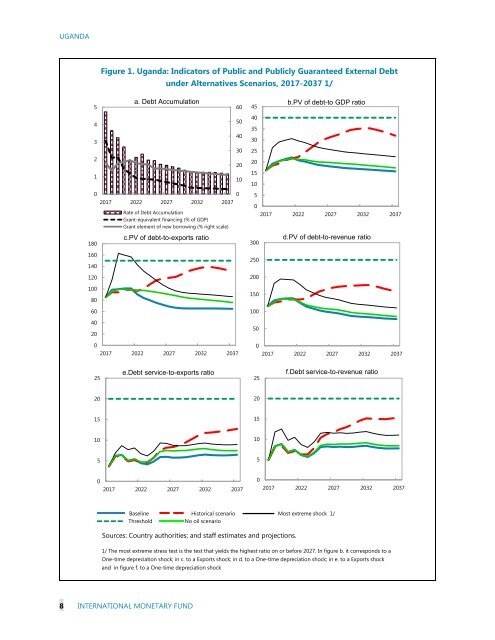

Figure 1. Uganda: Indicators of Public and Publicly Guaranteed External Debt<br />

under Alternatives Scenarios, 2017-2037 1/<br />

5<br />

4<br />

3<br />

2<br />

1<br />

a. Debt Accumulation<br />

0<br />

0<br />

2017 2022 2027 2032 2037<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Rate of Debt Accumulation<br />

Grant-equivalent financing (% of GDP)<br />

Grant element of new borrowing (% right scale)<br />

c.PV of debt-to-exports ratio<br />

0<br />

2017 2022 2027 2032 2037<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

b.PV of debt-to GDP ratio<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2017 2022 2027 2032 2037<br />

d.PV of debt-to-revenue ratio<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2017 2022 2027 2032 2037<br />

25<br />

e.Debt service-to-exports ratio<br />

25<br />

f.Debt service-to-revenue ratio<br />

20<br />

20<br />

15<br />

15<br />

10<br />

10<br />

5<br />

5<br />

0<br />

2017 2022 2027 2032 2037<br />

0<br />

2017 2022 2027 2032 2037<br />

Baseline Historical scenario Most extreme shock 1/<br />

Threshold<br />

No oil scenario<br />

Sources: Country authorities; and staff estimates and projections.<br />

1/ The most extreme stress test is the test that yields the highest ratio on or before 2027. In figure b. it corresponds to a<br />

One-time depreciation shock; in c. to a Exports shock; in d. to a One-time depreciation shock; in e. to a Exports shock<br />

and in figure f. to a One-time depreciation shock<br />

8 INTERNATIONAL MONETARY FUND