2016 Annual Report For Web 7.3MB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

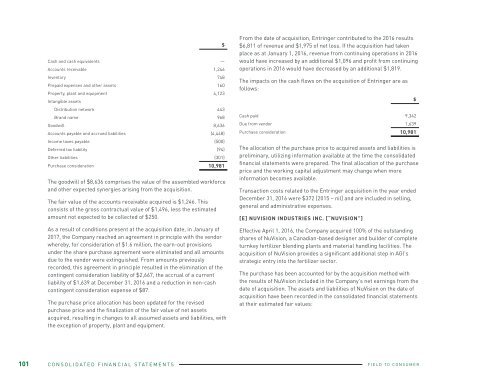

Cash and cash equivalents —<br />

Accounts receivable 1,246<br />

Inventory 748<br />

Prepaid expenses and other assets 160<br />

Property, plant and equipment 4,123<br />

Intangible assets<br />

Distribution network 443<br />

Brand name 968<br />

Goodwill 8,636<br />

Accounts payable and accrued liabilities (4,448)<br />

Income taxes payable (500)<br />

Deferred tax liability (94)<br />

Other liabilities (301)<br />

Purchase consideration 10,981<br />

The goodwill of $8,636 comprises the value of the assembled workforce<br />

and other expected synergies arising from the acquisition.<br />

The fair value of the accounts receivable acquired is $1,246. This<br />

consists of the gross contractual value of $1,496, less the estimated<br />

amount not expected to be collected of $250.<br />

As a result of conditions present at the acquisition date, in January of<br />

2017, the Company reached an agreement in principle with the vendor<br />

whereby, for consideration of $1.6 million, the earn-out provisions<br />

under the share purchase agreement were eliminated and all amounts<br />

due to the vendor were extinguished. From amounts previously<br />

recorded, this agreement in principle resulted in the elimination of the<br />

contingent consideration liability of $2,667, the accrual of a current<br />

liability of $1,639 at December 31, <strong>2016</strong> and a reduction in non-cash<br />

contingent consideration expense of $87.<br />

The purchase price allocation has been updated for the revised<br />

purchase price and the finalization of the fair value of net assets<br />

acquired, resulting in changes to all assumed assets and liabilities, with<br />

the exception of property, plant and equipment.<br />

$<br />

From the date of acquisition, Entringer contributed to the <strong>2016</strong> results<br />

$6,811 of revenue and $1,975 of net loss. If the acquisition had taken<br />

place as at January 1, <strong>2016</strong>, revenue from continuing operations in <strong>2016</strong><br />

would have increased by an additional $1,096 and profit from continuing<br />

operations in <strong>2016</strong> would have decreased by an additional $1,819.<br />

The impacts on the cash flows on the acquisition of Entringer are as<br />

follows:<br />

Cash paid 9,342<br />

Due from vendor 1,639<br />

Purchase consideration 10,981<br />

The allocation of the purchase price to acquired assets and liabilities is<br />

preliminary, utilizing information available at the time the consolidated<br />

financial statements were prepared. The final allocation of the purchase<br />

price and the working capital adjustment may change when more<br />

information becomes available.<br />

Transaction costs related to the Entringer acquisition in the year ended<br />

December 31, <strong>2016</strong> were $372 [2015 – nil] and are included in selling,<br />

general and administrative expenses.<br />

[E] NUVISION INDUSTRIES INC. [“NUVISION”]<br />

Effective April 1, <strong>2016</strong>, the Company acquired 100% of the outstanding<br />

shares of NuVision, a Canadian-based designer and builder of complete<br />

turnkey fertilizer blending plants and material handling facilities. The<br />

acquisition of NuVision provides a significant additional step in AGl’s<br />

strategic entry into the fertilizer sector.<br />

The purchase has been accounted for by the acquisition method with<br />

the results of NuVision included in the Company’s net earnings from the<br />

date of acquisition. The assets and liabilities of NuVision on the date of<br />

acquisition have been recorded in the consolidated financial statements<br />

at their estimated fair values:<br />

$<br />

101 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 102