2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

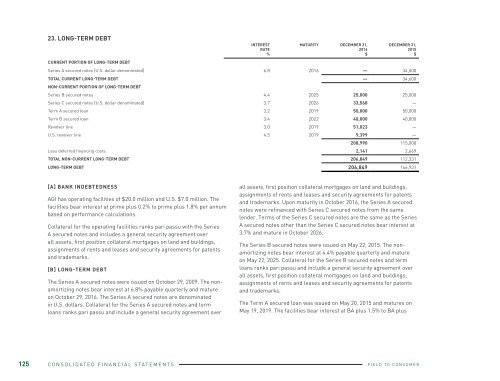

23. LONG-TERM DEBT<br />

CURRENT PORTION OF LONG-TERM DEBT<br />

INTEREST<br />

RATE<br />

%<br />

MATURITY DECEMBER 31,<br />

<strong>2016</strong><br />

$<br />

DECEMBER 31,<br />

2015<br />

$<br />

Series A secured notes [U.S. dollar denominated] 6.8 <strong>2016</strong> — 34,600<br />

TOTAL CURRENT LONG-TERM DEBT — 34,600<br />

NON-CURRENT PORTION OF LONG-TERM DEBT<br />

Series B secured notes 4.4 2025 25,000 25,000<br />

Series C secured notes [U.S. dollar denominated] 3.7 2026 33,568 —<br />

Term A secured loan 3.2 2019 50,000 50,000<br />

Term B secured loan 3.4 2022 40,000 40,000<br />

Revolver line 3.0 2019 51,023 —<br />

U.S. revolver line 4.5 2019 9,399 —<br />

208,990 115,000<br />

Less deferred financing costs 2,141 2,669<br />

TOTAL NON-CURRENT LONG-TERM DEBT 206,849 112,331<br />

LONG-TERM DEBT 206,849 146,931<br />

[A] BANK INDEBTEDNESS<br />

AGI has operating facilities of $20.0 million and U.S. $7.0 million. The<br />

facilities bear interest at prime plus 0.2% to prime plus 1.8% per annum<br />

based on performance calculations.<br />

Collateral for the operating facilities ranks pari passu with the Series<br />

A secured notes and includes a general security agreement over<br />

all assets, first position collateral mortgages on land and buildings,<br />

assignments of rents and leases and security agreements for patents<br />

and trademarks.<br />

[B] LONG-TERM DEBT<br />

The Series A secured notes were issued on October 29, 2009. The nonamortizing<br />

notes bear interest at 6.8% payable quarterly and mature<br />

on October 29, <strong>2016</strong>. The Series A secured notes are denominated<br />

in U.S. dollars. Collateral for the Series A secured notes and term<br />

loans ranks pari passu and include a general security agreement over<br />

all assets, first position collateral mortgages on land and buildings,<br />

assignments of rents and leases and security agreements for patents<br />

and trademarks. Upon maturity in October <strong>2016</strong>, the Series A secured<br />

notes were refinanced with Series C secured notes from the same<br />

lender. Terms of the Series C secured notes are the same as the Series<br />

A secured notes other than the Series C secured notes bear interest at<br />

3.7% and mature in October 2026.<br />

The Series B secured notes were issued on May 22, 2015. The nonamortizing<br />

notes bear interest at 4.4% payable quarterly and mature<br />

on May 22, 2025. Collateral for the Series B secured notes and term<br />

loans ranks pari passu and include a general security agreement over<br />

all assets, first position collateral mortgages on land and buildings,<br />

assignments of rents and leases and security agreements for patents<br />

and trademarks.<br />

The Term A secured loan was issued on May 20, 2015 and matures on<br />

May 19, 2019. The facilities bear interest at BA plus 1.5% to BA plus<br />

3.0% per annum based on performance calculations. Interest on the<br />

non-amortizing loan has been fixed at 3.6% through an interest rate<br />

swap contract [note 29]. Collateral for the Term A loan and secured<br />

notes ranks pari passu and includes a general security agreement over<br />

all assets, first position collateral mortgages on land and buildings,<br />

assignments of rents and leases and security agreements for patents<br />

and trademarks.<br />

The Term B secured loan was issued on May 20, 2015 and matures on<br />

May 19, 2022. The facilities bear interest at BA plus 2.5% per annum.<br />

Interest on the non-amortizing loan has been fixed at 4.3% through<br />

an interest rate swap contract [note 29]. Collateral for the Term B<br />

loan and secured notes ranks pari passu and includes a general<br />

security agreement over all assets, first position collateral mortgages<br />

on land and buildings, assignments of rents and leases and security<br />

agreements for patents and trademarks.<br />

AGI has revolver facilities of $80 million and U.S. $68 million. The<br />

facilities bear interest at LIBOR plus 1.5% to LIBOR plus 3.0% and<br />

prime plus 0.2% to prime plus 1.8% per annum based on performance<br />

calculations. As at December 31, <strong>2016</strong>, there was $60 million [2015 – nil]<br />

outstanding under these facilities. The facilities mature on May 19, 2019.<br />

Interest on the revolver line has been fixed at 3.7% through an interest<br />

rate swap contract [note 29]. Collateral for the revolving line ranks pari<br />

passu and includes a general security agreement over all assets, first<br />

position collateral mortgages on land and buildings, assignments of<br />

rents and leases and security agreements for patents and trademarks.<br />

[C] COVENANTS<br />

AGI is subject to certain financial covenants in its credit facility<br />

agreements that must be maintained to avoid acceleration of the<br />

termination of the agreement. The financial covenants require AGI to<br />

maintain a debt to earnings before interest, taxes, depreciation and<br />

amortization [“EBITDA”] ratio of less than 3.25 and to provide debt<br />

service coverage of a minimum of 1.0. The covenant calculations<br />

exclude the convertible unsecured subordinated debentures from the<br />

definition of debt. As at December 31, <strong>2016</strong> and December 31, 2015, AGI<br />

was in compliance with all financial covenants.<br />

125 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 126