2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

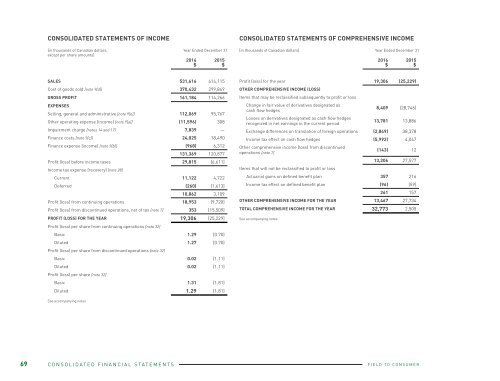

CONSOLIDATED STATEMENTS OF INCOME<br />

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME<br />

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY<br />

[in thousands of Canadian dollars,<br />

except per share amounts]<br />

Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

[in thousands of Canadian dollars] Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

[in thousands of Canadian dollars]<br />

COMMON<br />

SHARES<br />

$<br />

EQUITY<br />

COMPONENT<br />

OF CONVERTIBLE<br />

DEBENTURES<br />

$<br />

CONTRIBUTED<br />

SURPLUS<br />

$<br />

DEFICIT<br />

$<br />

CASH FLOW<br />

HEDGE<br />

RESERVE<br />

$<br />

FOREIGN<br />

CURRENCY<br />

RESERVE<br />

$<br />

DEFINED<br />

BENEFIT PLAN<br />

RESERVE<br />

$<br />

TOTAL<br />

EQUITY<br />

$<br />

SALES 531,616 414,115<br />

Cost of goods sold [note 9[d]] 370,432 299,849<br />

GROSS PROFIT 161,184 114,266<br />

EXPENSES<br />

Selling, general and administrative [note 9[e]] 112,069 95,767<br />

Other operating expense (income) [note 9[a]] (11,596) 308<br />

Impairment charge [notes 14 and 17] 7,839 —<br />

Finance costs [note 9[c]] 24,025 18,490<br />

Finance expense (income) [note 9[b]] (968) 6,312<br />

131,369 120,877<br />

Profit (loss) before income taxes 29,815 (6,611)<br />

Income tax expense (recovery) [note 28]<br />

Current 11,122 4,722<br />

Deferred (260) (1,613)<br />

10,862 3,109<br />

Profit (loss) from continuing operations 18,953 (9,720)<br />

Profit (loss) from discontinued operations, net of tax [note 7] 353 (15,509)<br />

PROFIT (LOSS) FOR THE YEAR 19,306 (25,229)<br />

Profit (loss) per share from continuing operations [note 32]<br />

Basic 1.29 (0.70)<br />

Diluted 1.27 (0.70)<br />

Profit (loss) per share from discontinued operations [note 32]<br />

Basic 0.02 (1.11)<br />

Diluted 0.02 (1.11)<br />

Profit (loss) per share [note 32]<br />

Basic 1.31 (1.81)<br />

Diluted 1.29 (1.81)<br />

See accompanying notes<br />

Profit (loss) for the year 19,306 (25,229)<br />

OTHER COMPREHENSIVE INCOME (LOSS)<br />

Items that may be reclassified subsequently to profit or loss<br />

Change in fair value of derivatives designated as<br />

cash flow hedges<br />

8,409 (28,746)<br />

Losses on derivatives designated as cash flow hedges<br />

recognized in net earnings in the current period<br />

13,781 13,886<br />

Exchange differences on translation of foreign operations (2,849) 38,378<br />

Income tax effect on cash flow hedges (5,992) 4,047<br />

Other comprehensive income (loss) from discontinued<br />

operations [note 7]<br />

(143) 12<br />

13,206 27,577<br />

Items that will not be reclassified to profit or loss<br />

Actuarial gains on defined benefit plan 357 216<br />

Income tax effect on defined benefit plan (96) (59)<br />

261 157<br />

OTHER COMPREHENSIVE INCOME FOR THE YEAR 13,467 27,734<br />

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 32,773 2,505<br />

See accompanying notes<br />

AS AT JANUARY 1, <strong>2016</strong> 244,840 6,912 10,193 (69,350) (17,358) 59,761 157 235,155<br />

Profit for the year — — — 19,306 — — — 19,306<br />

Other comprehensive income (loss) — — — — 16,198 (2,992) 261 13,467<br />

Share-based payment transactions [notes 21 and 22] 1,640 — 6,747 — — — — 8,387<br />

Dividend reinvestment plan [notes 21[d] and [e]] 5,218 — — — — — — 5,218<br />

Dividends to shareholders [note 21] — — — (35,297) — — — (35,297)<br />

Dividends on share-based compensation awards — — — (1,672) — — — (1,672)<br />

AS AT DECEMBER 31, <strong>2016</strong> 251,698 6,912 16,940 (87,013) (1,160) 56,769 418 244,564<br />

COMMON<br />

SHARES<br />

$<br />

EQUITY<br />

COMPONENT<br />

OF CONVERTIBLE<br />

DEBENTURES<br />

$<br />

CONTRIBUTED<br />

SURPLUS<br />

$<br />

DEFICIT<br />

$<br />

CASH FLOW<br />

HEDGE<br />

RESERVE<br />

$<br />

FOREIGN<br />

CURRENCY<br />

RESERVE<br />

$<br />

DEFINED<br />

BENEFIT PLAN<br />

RESERVE<br />

$<br />

AS AT JANUARY 1, 2015 184,771 3,135 12,954 (5,972) (6,545) 21,383 — 209,726<br />

Change in accounting policy [note 3] — — — (2,563) — — — (2,563)<br />

Loss for the year — — — (25,229) — — — (25,229)<br />

Other comprehensive income (loss) — — — — (10,813) 38,378 157 27,722<br />

Share-based payment transactions [notes 21 and 22] 5,695 — (2,761) — — — — 2,934<br />

Dividend reinvestment plan [notes 21[d] and [e]] 5,252 — — — — — — 5,252<br />

Dividends to shareholders [note 21] — — — (33,593) — — — (33,593)<br />

Issuance of 2015 convertible unsecured<br />

subordinated debentures [note 25]<br />

— 3,777 — — — — — 3,777<br />

Dividend reinvestment plan costs [notes 21[d] and [e]] (16) — — — — — — (16)<br />

Dividends on share-based compensation awards — — — (881) — — — (881)<br />

Dividends on subscription receipt — — — (1,112) — — — (1,112)<br />

Share issuance related to Westeel<br />

acquisition [note 6[b]]<br />

49,138 — — — — — — 49,138<br />

AS AT DECEMBER 31, 2015 244,840 6,912 10,193 (69,350) (17,358) 59,761 157 235,155<br />

TOTAL<br />

EQUITY<br />

$<br />

See accompanying notes<br />

69 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 70