2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

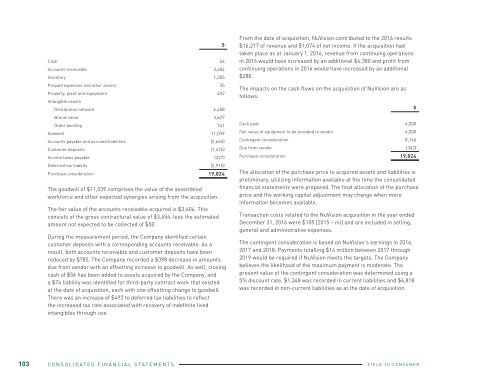

Cash 56<br />

Accounts receivable 3,604<br />

Inventory 1,205<br />

Prepaid expenses and other assets 35<br />

Property, plant and equipment 492<br />

Intangible assets<br />

Distribution network 6,408<br />

Brand name 3,627<br />

Order backlog 741<br />

Goodwill 11,039<br />

Accounts payable and accrued liabilities (2,665)<br />

Customer deposits (1,476)<br />

Income taxes payable (327)<br />

Deferred tax liability (2,915)<br />

Purchase consideration 19,824<br />

The goodwill of $11,039 comprises the value of the assembled<br />

workforce and other expected synergies arising from the acquisition.<br />

The fair value of the accounts receivable acquired is $3,604. This<br />

consists of the gross contractural value of $3,654, less the estimated<br />

amount not expected to be collected of $50.<br />

During the measurement period, the Company identified certain<br />

customer deposits with a corresponding accounts receivable. As a<br />

result, both accounts receivable and customer deposits have been<br />

reduced by $785. The Company recorded a $398 decrease in amounts<br />

due from vendor with an offsetting increase to goodwill. As well, closing<br />

cash of $56 has been added to assets acquired by the Company, and<br />

a $74 liability was identified for third-party contract work that existed<br />

at the date of acquisition, each with one offsetting change to goodwill.<br />

There was an increase of $492 to deferred tax liabilities to reflect<br />

the increased tax rate associated with recovery of indefinite lived<br />

intangibles through use.<br />

$<br />

From the date of acquisition, NuVision contributed to the <strong>2016</strong> results<br />

$16,217 of revenue and $1,074 of net income. If the acquisition had<br />

taken place as at January 1, <strong>2016</strong>, revenue from continuing operations<br />

in <strong>2016</strong> would have increased by an additional $4,380 and profit from<br />

continuing operations in <strong>2016</strong> would have increased by an additional<br />

$280.<br />

The impacts on the cash flows on the acquisition of NuVision are as<br />

follows:<br />

Cash paid 6,000<br />

Fair value of equipment to be provided to vendor 6,000<br />

Contingent consideration 8,166<br />

Due from vendor (342)<br />

Purchase consideration 19,824<br />

The allocation of the purchase price to acquired assets and liabilities is<br />

preliminary, utilizing information available at the time the consolidated<br />

financial statements were prepared. The final allocation of the purchase<br />

price and the working capital adjustment may change when more<br />

information becomes available.<br />

Transaction costs related to the NuVision acquisition in the year ended<br />

December 31, <strong>2016</strong> were $105 [2015 – nil] and are included in selling,<br />

general and administrative expenses.<br />

The contingent consideration is based on NuVision’s earnings in <strong>2016</strong>,<br />

2017 and 2018. Payments totalling $14 million between 2017 through<br />

2019 would be required if NuVision meets the targets. The Company<br />

believes the likelihood of the maximum payment is moderate. The<br />

present value of the contingent consideration was determined using a<br />

5% discount rate. $1,348 was recorded in current liabilities and $6,818<br />

was recorded in non-current liabilities as at the date of acquisition.<br />

$<br />

[F] MITCHELL MILL SYSTEMS CANADA LTD.<br />

AND MITCHELL MILL SYSTEMS USA<br />

Effective July 18, <strong>2016</strong>, the Company acquired 100% of the outstanding<br />

shares of Mitchell Mill Systems Canada Ltd., and its U.S. affiliate<br />

Mitchell Mill Systems USA [collectively, “Mitchell”]. Based in Canada<br />

with a second facility in the U.S., Mitchell manufactures handling<br />

equipment for grain, fertilizer, animal feed, food processing and<br />

industrial applications. The acquisition expands AGl’s commercial<br />

business into eastern Canada and the U.S. and also provides an<br />

expanded product offering.<br />

The purchase has been accounted for by the acquisition method with<br />

the results of Mitchell included in the Company’s net earnings from the<br />

date of acquisition. The assets and liabilities of Mitchell on the date of<br />

acquisition have been recorded in the consolidated financial statements<br />

at their estimated fair values:<br />

Accounts receivable 6,184<br />

Inventory 3,319<br />

Prepaid expenses and other assets 95<br />

Property, plant and equipment 6,923<br />

Intangible assets<br />

Brand name 3,607<br />

Distribution network 6,485<br />

Order backlog 223<br />

Goodwill 7,806<br />

Accounts payable and accrued liabilities (2,077)<br />

Customer deposits (1,340)<br />

Income taxes payable (483)<br />

Deferred tax liability (4,374)<br />

Purchase consideration 26,368<br />

The goodwill of $7,806 comprises the value of the assembled workforce<br />

and other expected synergies arising from the acquisition.<br />

$<br />

The fair value of the accounts receivable acquired is $6,184. This<br />

consists of the gross contractual value of $6,259, less the estimated<br />

amount not expected to be collected of $75.<br />

During the measurement period, a third-party valuation of the U.S.<br />

land and building was completed, resulting in an increase to property,<br />

plant and equipment of $610 with an offsetting decrease to goodwill.<br />

In addition, the estimated fair values of distribution network and order<br />

backlog were decreased by $99 and $997, respectively, based on a<br />

detailed review of the order backlog as at the acquisition date with<br />

offsetting increases to goodwill of $99 and $997, respectively. There<br />

was an increase to deferred tax liability of $412 to reflect an increase in<br />

the tax rate applied to indefinite lived intangibles.<br />

From the date of acquisition, Mitchell contributed to the <strong>2016</strong> results<br />

$9,382 of revenue and $176 of net loss. If the acquisition had taken<br />

place as at January 1, <strong>2016</strong>, revenue from continuing operations in<br />

<strong>2016</strong> would have increased by an additional $16,450 and profit from<br />

continuing operations in <strong>2016</strong> would have decreased by an additional<br />

$2,589.<br />

The impacts on the cash flows on the acquisition of Mitchell are as<br />

follows:<br />

Cash paid 16,300<br />

Due to vendor 500<br />

Contingent consideration 9,091<br />

Working capital adjustment payable 477<br />

Purchase consideration 26,368<br />

The allocation of the purchase price to acquired assets and liabilities is<br />

preliminary, utilizing information available at the time the consolidated<br />

financial statements were prepared. The final allocation of the purchase<br />

price and the working capital adjustment may change when more<br />

information becomes available.<br />

Transaction costs related to the Mitchell acquisition in the year ended<br />

December 31, <strong>2016</strong> were $182 [2015 – nil] and are included in selling,<br />

general and administrative expenses.<br />

$<br />

103 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 104