2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

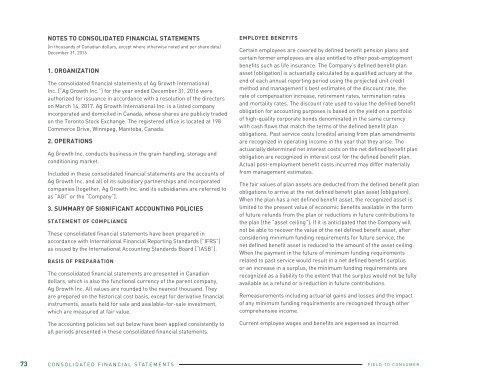

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

[in thousands of Canadian dollars, except where otherwise noted and per share data]<br />

December 31, <strong>2016</strong><br />

1. ORGANIZATION<br />

The consolidated financial statements of Ag Growth International<br />

Inc. [“Ag Growth Inc.”] for the year ended December 31, <strong>2016</strong> were<br />

authorized for issuance in accordance with a resolution of the directors<br />

on March 14, 2017. Ag Growth International Inc. is a listed company<br />

incorporated and domiciled in Canada, whose shares are publicly traded<br />

on the Toronto Stock Exchange. The registered office is located at 198<br />

Commerce Drive, Winnipeg, Manitoba, Canada.<br />

2. OPERATIONS<br />

Ag Growth Inc. conducts business in the grain handling, storage and<br />

conditioning market.<br />

Included in these consolidated financial statements are the accounts of<br />

Ag Growth Inc. and all of its subsidiary partnerships and incorporated<br />

companies [together, Ag Growth Inc. and its subsidiaries are referred to<br />

as “AGI” or the “Company”].<br />

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

STATEMENT OF COMPLIANCE<br />

These consolidated financial statements have been prepared in<br />

accordance with International Financial <strong>Report</strong>ing Standards [“IFRS”]<br />

as issued by the International Accounting Standards Board [“IASB”].<br />

BASIS OF PREPARATION<br />

The consolidated financial statements are presented in Canadian<br />

dollars, which is also the functional currency of the parent company,<br />

Ag Growth Inc. All values are rounded to the nearest thousand. They<br />

are prepared on the historical cost basis, except for derivative financial<br />

instruments, assets held for sale and available-for-sale investment,<br />

which are measured at fair value.<br />

The accounting policies set out below have been applied consistently to<br />

all periods presented in these consolidated financial statements.<br />

EMPLOYEE BENEFITS<br />

Certain employees are covered by defined benefit pension plans and<br />

certain former employees are also entitled to other post-employment<br />

benefits such as life insurance. The Company’s defined benefit plan<br />

asset (obligation) is actuarially calculated by a qualified actuary at the<br />

end of each annual reporting period using the projected unit credit<br />

method and management’s best estimates of the discount rate, the<br />

rate of compensation increase, retirement rates, termination rates<br />

and mortality rates. The discount rate used to value the defined benefit<br />

obligation for accounting purposes is based on the yield on a portfolio<br />

of high-quality corporate bonds denominated in the same currency<br />

with cash flows that match the terms of the defined benefit plan<br />

obligations. Past service costs (credits) arising from plan amendments<br />

are recognized in operating income in the year that they arise. The<br />

actuarially determined net interest costs on the net defined benefit plan<br />

obligation are recognized in interest cost for the defined benefit plan.<br />

Actual post-employment benefit costs incurred may differ materially<br />

from management estimates.<br />

The fair values of plan assets are deducted from the defined benefit plan<br />

obligations to arrive at the net defined benefit plan asset (obligation).<br />

When the plan has a net defined benefit asset, the recognized asset is<br />

limited to the present value of economic benefits available in the form<br />

of future refunds from the plan or reductions in future contributions to<br />

the plan [the “asset ceiling”]. If it is anticipated that the Company will<br />

not be able to recover the value of the net defined benefit asset, after<br />

considering minimum funding requirements for future service, the<br />

net defined benefit asset is reduced to the amount of the asset ceiling.<br />

When the payment in the future of minimum funding requirements<br />

related to past service would result in a net defined benefit surplus<br />

or an increase in a surplus, the minimum funding requirements are<br />

recognized as a liability to the extent that the surplus would not be fully<br />

available as a refund or a reduction in future contributions.<br />

Remeasurements including actuarial gains and losses and the impact<br />

of any minimum funding requirements are recognized through other<br />

comprehensive income.<br />

Current employee wages and benefits are expensed as incurred.<br />

REM<br />

2014<br />

REM has lead the grain<br />

vacuum industry over the last<br />

40 years. REM produces top<br />

of the line, quiet, efficient,<br />

high capacity GrainVacs with a<br />

broad line of accessories.<br />

73 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 06