2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

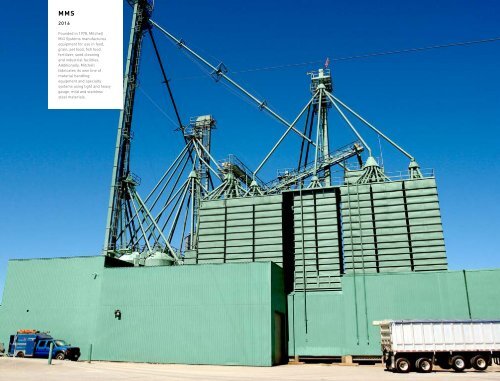

MMS<br />

<strong>2016</strong><br />

Founded in 1978, Mitchell<br />

Mill Systems manufactures<br />

equipment for use in feed,<br />

grain, pet food, fish food,<br />

fertilizer, seed cleaning<br />

and industrial facilities.<br />

Additionally, Mitchell<br />

fabricates its own line of<br />

material handling<br />

equipment and specialty<br />

systems using light and heavy<br />

gauge, mild and stainless<br />

steel materials.<br />

Change in fixed-income security yields<br />

A decrease in corporate fixed-income security yields will increase plan<br />

liabilities, although this will be partially offset by an increase in the<br />

value of the plan’s fixed-income security holdings.<br />

Life expectancy<br />

The plan’s obligation is to provide benefits for the life of the member,<br />

so increases in life expectancy will result in an increase in the plan’s<br />

liability.<br />

28. INCOME TAXES<br />

The major components of income tax expense for the years ended<br />

December 31, <strong>2016</strong> and 2015 are as follows:<br />

CONSOLIDATED STATEMENTS OF INCOME<br />

CURRENT TAX EXPENSE<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Current income tax charge 11,122 4,722<br />

DEFERRED TAX RECOVERY<br />

Origination and reversal of temporary differences (260) (1,613)<br />

INCOME TAX EXPENSE REPORTED IN THE<br />

CONSOLIDATED STATEMENTS OF INCOME 10,862 3,109<br />

The reconciliation between tax expense and the product of accounting<br />

profit multiplied by the Company’s domestic tax rate for the years ended<br />

December 31, <strong>2016</strong> and 2015 is as follows:<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

ACCOUNTING PROFIT (LOSS) BEFORE INCOME TAX 30,168 (22,120)<br />

At the Company’s statutory income tax rate of 27%<br />

[2015 – 26.80%]<br />

8,145 (5,928)<br />

Tax rate changes (481) (9)<br />

Additional deductions allowed in a foreign jurisdiction (600) (259)<br />

Tax losses not recognized as a deferred tax asset 1,413 1,984<br />

Withholding tax on dividend — 1,652<br />

<strong>For</strong>eign rate differential 1,517 897<br />

Non-deductible SAIP expense 536 608<br />

State income tax, net of federal tax benefit 496 251<br />

Unrealized foreign exchange loss (gain) (776) 3,519<br />

Impairment of goodwill 18 —<br />

Permanent differences and others 594 394<br />

AT THE EFFECTIVE INCOME TAX RATE 36.09%<br />

[2015 – (14.05%)] 10,862 3,109<br />

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

DEFERRED TAX RELATED TO ITEMS CHARGED OR<br />

CREDITED DIRECTLY TO OTHER COMPREHENSIVE<br />

INCOME DURING THE PERIOD<br />

Unrealized gain (loss) on derivatives 5,992 (4,047)<br />

Defined benefit plan reserve 96 59<br />

Exchange differences on translation of foreign operations (268) 1,895<br />

INCOME TAX CREDITED DIRECTLY TO OTHER<br />

COMPREHENSIVE INCOME 5,820 (2,093)<br />

05 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 136