2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

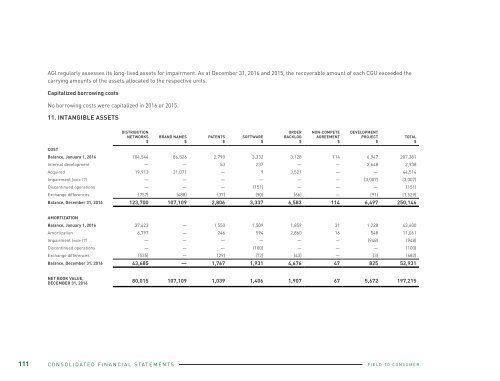

AGI regularly assesses its long-lived assets for impairment. As at December 31, <strong>2016</strong> and 2015, the recoverable amount of each CGU exceeded the<br />

carrying amounts of the assets allocated to the respective units.<br />

Capitalized borrowing costs<br />

No borrowing costs were capitalized in <strong>2016</strong> or 2015.<br />

11. INTANGIBLE ASSETS<br />

DISTRIBUTION<br />

NETWORKS<br />

$<br />

BRAND NAMES<br />

$<br />

PATENTS<br />

$<br />

SOFTWARE<br />

$<br />

ORDER<br />

BACKLOG<br />

$<br />

NON-COMPETE<br />

AGREEMENT<br />

$<br />

DEVELOPMENT<br />

PROJECT<br />

$<br />

COST<br />

Balance, January 1, <strong>2016</strong> 104,544 86,526 2,790 3,332 3,128 114 6,947 207,381<br />

Internal development — — 53 237 — — 2,648 2,938<br />

Acquired 19,913 21,071 — 9 3,521 — — 44,514<br />

Impairment [note 17] — — — — — — (3,007) (3,007)<br />

Discontinued operations — — — (151) — — — (151)<br />

Exchange differences (757) (488) (37) (90) (66) — (91) (1,529)<br />

Balance, December 31, <strong>2016</strong> 123,700 107,109 2,806 3,337 6,583 114 6,497 250,146<br />

AMORTIZATION<br />

Balance, January 1, <strong>2016</strong> 37,423 — 1,550 1,509 1,859 31 1,228 43,600<br />

Amortization 6,797 — 246 594 2,860 16 548 11,061<br />

Impairment [note 17] — — — — — — (948) (948)<br />

Discontinued operations — — — (100) — — — (100)<br />

Exchange differences (535) — (29) (72) (43) — (3) (682)<br />

Balance, December 31, <strong>2016</strong> 43,685 — 1,767 1,931 4,676 47 825 52,931<br />

TOTAL<br />

$<br />

DISTRIBUTION<br />

NETWORKS<br />

$<br />

BRAND NAMES<br />

$<br />

PATENTS<br />

$<br />

SOFTWARE<br />

$<br />

ORDER<br />

BACKLOG<br />

$<br />

NON-COMPETE<br />

AGREEMENT<br />

$<br />

DEVELOPMENT<br />

PROJECT<br />

$<br />

COST<br />

Balance, January 1, 2015 60,582 37,525 2,559 2,245 35 114 5,787 108,847<br />

Internal development — — 30 — — — 1,730 1,760<br />

Acquired 42,023 47,702 — 751 3,089 — — 93,565<br />

Impairment [note 17] (1,763) (839) — (43) — — (919) (3,564)<br />

Exchange differences 3,702 2,138 201 379 4 — 349 6,773<br />

Balance, December 31, 2015 104,544 86,526 2,790 3,332 3,128 114 6,947 207,381<br />

AMORTIZATION<br />

Balance, January 1, 2015 30,336 — 1,148 853 32 15 845 33,229<br />

Amortization 5,475 — 241 517 1,825 16 536 8,610<br />

Impairment [note 17] (1,184) — — (32) — — (163) (1,379)<br />

Exchange differences 2,796 — 161 171 2 — 10 3,140<br />

Balance, December 31, 2015 37,423 — 1,550 1,509 1,859 31 1,228 43,600<br />

NET BOOK VALUE,<br />

DECEMBER 31, 2015 67,121 86,526 1,240 1,823 1,269 83 5,719 163,781<br />

TOTAL<br />

$<br />

NET BOOK VALUE,<br />

DECEMBER 31, <strong>2016</strong> 80,015 107,109 1,039 1,406 1,907 67 5,672 197,215<br />

111 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 112