2016 Annual Report For Web 7.3MB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

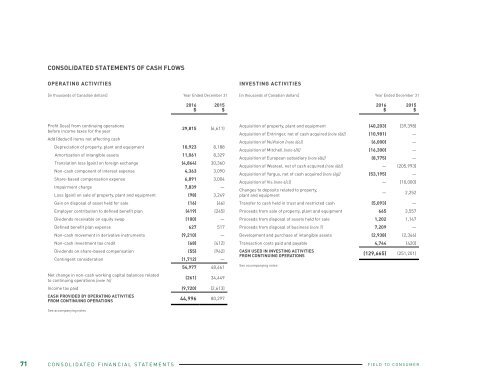

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

OPERATING ACTIVITIES<br />

[in thousands of Canadian dollars] Year Ended December 31<br />

INVESTING ACTIVITIES<br />

[in thousands of Canadian dollars] Year Ended December 31<br />

FINANCING ACTIVITIES<br />

[in thousands of Canadian dollars] Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Profit (loss) from continuing operations<br />

before income taxes for the year<br />

29,815 (6,611)<br />

Add (deduct) items not affecting cash<br />

Depreciation of property, plant and equipment 10,923 8,188<br />

Amortization of intangible assets 11,061 8,329<br />

Translation loss (gain) on foreign exchange (4,864) 30,360<br />

Non-cash component of interest expense 4,363 3,090<br />

Share-based compensation expense 6,891 3,004<br />

Impairment charge 7,839 —<br />

Loss (gain) on sale of property, plant and equipment (98) 3,249<br />

Gain on disposal of asset held for sale (16) (46)<br />

Employer contribution to defined benefit plan (419) (245)<br />

Dividends receivable on equity swap (100) —<br />

Defined benefit plan expense 627 517<br />

Non-cash movement in derivative instruments (9,210) —<br />

Non-cash investment tax credit (68) (412)<br />

Dividends on share-based compensation (55) (962)<br />

Contingent consideration (1,712) —<br />

54,977 48,461<br />

Net change in non-cash working capital balances related<br />

to continuing operations [note 16]<br />

(261) 34,449<br />

Income tax paid (9,720) (2,613)<br />

CASH PROVIDED BY OPERATING ACTIVITIES<br />

FROM CONTINUING OPERATIONS 44,996 80,297<br />

See accompanying notes<br />

Acquisition of property, plant and equipment (40,203) (39,398)<br />

Acquisition of Entringer, net of cash acquired [note 6[d]] (10,981) —<br />

Acquisition of NuVision [note 6[e]] (6,000) —<br />

Acquisition of Mitchell [note 6[f]] (16,300) —<br />

Acquisition of European subsidiary [note 6[b]] (8,775) —<br />

Acquisition of Westeel, net of cash acquired [note 6[b]] — (205,993)<br />

Acquisition of Yargus, net of cash acquired [note 6[g]] (53,195) —<br />

Acquisition of Vis [note 6[c]] — (10,000)<br />

Changes to deposits related to property,<br />

plant and equipment<br />

— 2,252<br />

Transfer to cash held in trust and restricted cash (5,093) —<br />

Proceeds from sale of property, plant and equipment 665 3,557<br />

Proceeds from disposal of assets held for sale 1,202 1,147<br />

Proceeds from disposal of business [note 7] 7,209 —<br />

Development and purchase of intangible assets (2,938) (2,346)<br />

Transaction costs paid and payable 4,744 (420)<br />

CASH USED IN INVESTING ACTIVITIES<br />

FROM CONTINUING OPERATIONS (129,665) (251,201)<br />

See accompanying notes<br />

Repayment of long-term debt (33,507) (63,394)<br />

Repayment of obligation under finance leases (353) (36)<br />

Issuance of long-term debt 93,821 174,731<br />

Costs related to issuance of long-term debt (194) —<br />

Issuance of convertible unsecured subordinated debentures — 71,491<br />

Common share issuance — 51,766<br />

Subscription receipts commission payable — (1,036)<br />

Subscription receipts financing costs — (123)<br />

Dividends paid in cash [note 21[d]] (30,079) (29,453)<br />

Dividend reinvestment plan costs incurred — (16)<br />

CASH PROVIDED BY FINANCING ACTIVITIES<br />

FROM CONTINUING OPERATIONS<br />

29,688 203,930<br />

Net increase (decrease) in cash and cash equivalents<br />

from continuing operations<br />

(54,981) 33,026<br />

Net decrease in cash and cash equivalents from<br />

discontinued operations [note 7]<br />

(479) (87)<br />

NET INCREASE (DECREASE) IN CASH AND CASH<br />

EQUIVALENTS DURING THE YEAR<br />

(55,460) 32,939<br />

Cash and cash equivalents, beginning of year 58,234 25,295<br />

CASH AND CASH EQUIVALENTS, END OF YEAR 2,774 58,234<br />

SUPPLEMENTAL CASH FLOW INFORMATION<br />

Interest paid 19,903 15,739<br />

See accompanying notes<br />

71 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 72