2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

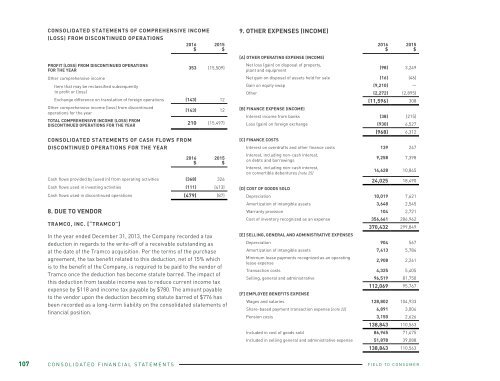

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME<br />

(LOSS) FROM DISCONTINUED OPERATIONS<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

PROFIT (LOSS) FROM DISCONTINUED OPERATIONS<br />

FOR THE YEAR<br />

8. DUE TO VENDOR<br />

TRAMCO, INC. [“TRAMCO”]<br />

353 (15,509)<br />

Other comprehensive income<br />

Item that may be reclassified subsequently<br />

to profit or (loss)<br />

Exchange difference on translation of foreign operations (143) 12<br />

Other comprehensive income (loss) from discontinued<br />

operations for the year<br />

(143) 12<br />

TOTAL COMPREHENSIVE INCOME (LOSS) FROM<br />

DISCONTINUED OPERATIONS FOR THE YEAR 210 (15,497)<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS FROM<br />

DISCONTINUED OPERATIONS FOR THE YEAR<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Cash flows provided by (used in) from operating activities (368) 326<br />

Cash flows used in investing activities (111) (413)<br />

Cash flows used in discontinued operations (479) (87)<br />

In the year ended December 31, 2013, the Company recorded a tax<br />

deduction in regards to the write-off of a receivable outstanding as<br />

at the date of the Tramco acquisition. Per the terms of the purchase<br />

agreement, the tax benefit related to this deduction, net of 15% which<br />

is to the benefit of the Company, is required to be paid to the vendor of<br />

Tramco once the deduction has become statute barred. The impact of<br />

this deduction from taxable income was to reduce current income tax<br />

expense by $118 and income tax payable by $780. The amount payable<br />

to the vendor upon the deduction becoming statute barred of $776 has<br />

been recorded as a long-term liability on the consolidated statements of<br />

financial position.<br />

9. OTHER EXPENSES (INCOME)<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

[A] OTHER OPERATING EXPENSE (INCOME)<br />

Net loss (gain) on disposal of property,<br />

plant and equipment<br />

(98) 3,249<br />

Net gain on disposal of assets held for sale (16) (46)<br />

Gain on equity swap (9,210) —<br />

Other (2,272) (2,895)<br />

(11,596) 308<br />

[B] FINANCE EXPENSE (INCOME)<br />

Interest income from banks (38) (215)<br />

Loss (gain) on foreign exchange (930) 6,527<br />

(968) 6,312<br />

[C] FINANCE COSTS<br />

Interest on overdrafts and other finance costs 139 247<br />

Interest, including non-cash interest,<br />

on debts and borrowings<br />

9,258 7,398<br />

Interest, including non-cash interest,<br />

on convertible debentures [note 25]<br />

14,628 10,845<br />

24,025 18,490<br />

[D] COST OF GOODS SOLD<br />

Depreciation 10,019 7,621<br />

Amortization of intangible assets 3,648 2,545<br />

Warranty provision 104 2,721<br />

Cost of inventory recognized as an expense 356,661 286,962<br />

370,432 299,849<br />

[E] SELLING, GENERAL AND ADMINISTRATIVE EXPENSES<br />

Depreciation 904 567<br />

Amortization of intangible assets 7,413 5,784<br />

Minimum lease payments recognized as an operating<br />

lease expense<br />

2,908 2,261<br />

Transaction costs 4,325 5,405<br />

Selling, general and administrative 96,519 81,750<br />

112,069 95,767<br />

[F] EMPLOYEE BENEFITS EXPENSE<br />

Wages and salaries 128,802 104,933<br />

Share-based payment transaction expense [note 22] 6,891 3,004<br />

Pension costs 3,150 2,626<br />

138,843 110,563<br />

Included in cost of goods sold 86,965 71,475<br />

Included in selling general and administrative expense 51,878 39,088<br />

138,843 110,563<br />

VIS<br />

2015<br />

VIS manufactures bulk<br />

storage and material handling<br />

solutions for the feed,<br />

fertilizer and grain handling<br />

industries. The VIS product<br />

line includes overhead bin<br />

systems, bucket elevators,<br />

drag, belt and screw<br />

conveyors, distributors, gates<br />

and diverter valves. VIS works<br />

together with their clients<br />

on system design to<br />

determine the best selection<br />

of equipment for their<br />

application.<br />

107 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 06