2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

of accounting policies used and the reasonableness of accounting<br />

estimates made by management, as well as evaluating the overall<br />

presentation of the consolidated financial statements.<br />

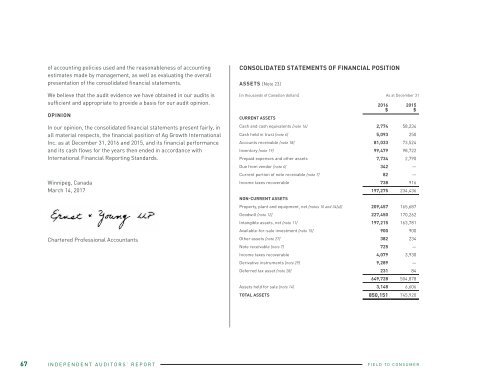

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION<br />

ASSETS [Note 23]<br />

LIABILITIES AND SHAREHOLDERS’ EQUITY<br />

SHAREHOLDERS’ EQUITY [Note 21]<br />

We believe that the audit evidence we have obtained in our audits is<br />

sufficient and appropriate to provide a basis for our audit opinion.<br />

[in thousands of Canadian dollars] As at December 31<br />

OPINION<br />

CURRENT ASSETS<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

[in thousands of Canadian dollars] As at December 31 [in thousands of Canadian dollars] As at December 31<br />

CURRENT LIABILITIES<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

In our opinion, the consolidated financial statements present fairly, in<br />

all material respects, the financial position of Ag Growth International<br />

Inc. as at December 31, <strong>2016</strong> and 2015, and its financial performance<br />

and its cash flows for the years then ended in accordance with<br />

International Financial <strong>Report</strong>ing Standards.<br />

Cash and cash equivalents [note 16] 2,774 58,234<br />

Cash held in trust [note 6] 5,093 250<br />

Accounts receivable [note 18] 81,033 73,524<br />

Inventory [note 19] 99,479 98,722<br />

Prepaid expenses and other assets 7,734 2,790<br />

Accounts payable and accrued liabilities [note 26] 64,402 47,721<br />

Customer deposits 22,428 21,461<br />

Dividends payable 2,956 2,883<br />

Current portion of contingent consideration [note 6] 4,023 2,687<br />

Due to vendor [note 6] 16,415 1,114<br />

Common shares 251,698 244,840<br />

Accumulated other comprehensive income 56,027 42,560<br />

Equity component of convertible debentures 6,912 6,912<br />

Contributed surplus 16,940 10,193<br />

Deficit (87,013) (69,350)<br />

Due from vendor [note 6] 342 —<br />

Acquisition, transaction and financing costs payable 262 732<br />

TOTAL SHAREHOLDERS’ EQUITY 244,564 235,155<br />

Winnipeg, Canada<br />

March 14, 2017<br />

Current portion of note receivable [note 7] 82 —<br />

Income taxes recoverable 738 916<br />

197,275 234,436<br />

NON-CURRENT ASSETS<br />

Other financial liabilities [note 6[b]] — 9,017<br />

Income taxes payable 6,411 4,472<br />

Current portion of long-term debt [note 23] — 34,600<br />

Current portion of obligations under finance lease [note 24] 353 209<br />

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 850,151 745,920<br />

See accompanying notes<br />

Property, plant and equipment, net [notes 10 and 34[a]] 209,457 165,687<br />

Current portion of derivative instruments [note 29] 862 20,577<br />

Goodwill [note 12] 227,450 170,262<br />

Provisions [note 20] 6,654 6,550<br />

Intangible assets, net [note 11] 197,215 163,781<br />

124,766 152,023<br />

Available-for-sale investment [note 15] 900 900<br />

NON-CURRENT LIABILITIES<br />

Chartered Professional Accountants<br />

Other assets [note 27] 382 234<br />

Note receivable [note 7] 725 —<br />

Income taxes recoverable 4,079 3,930<br />

Long-term debt [note 23] 206,849 112,331<br />

Due to vendor [note 8] 776 800<br />

Contingent consideration [note 6] 16,201 1,976<br />

On behalf of the Board of Directors:<br />

Derivative instruments [note 29] 9,289 —<br />

Convertible unsecured subordinated debentures [note 25] 201,210 197,585<br />

Deferred tax asset [note 28] 231 84<br />

Obligations under finance lease [note 24] 1,379 1,177<br />

649,728 504,878<br />

Derivative instruments [note 29] 715 3,191<br />

Assets held for sale [note 14] 3,148 6,606<br />

Deferred tax liability [note 28] 53,691 41,682<br />

TOTAL ASSETS 850,151 745,920<br />

480,821 358,742<br />

TOTAL LIABILITIES 605,587 510,765<br />

Bill Lambert, Director<br />

David A. White, CA, ICD.D, Director<br />

67 INDEPENDENT AUDITORS’ REPORT<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 68