2016 Annual Report For Web 7.3MB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

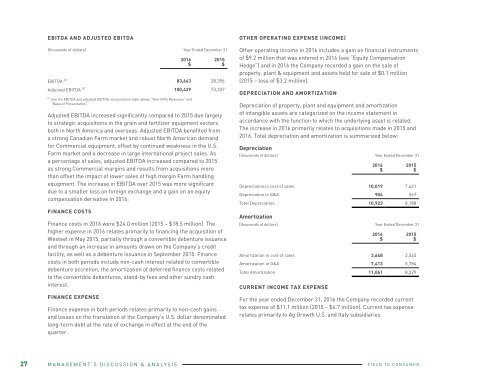

EBITDA AND ADJUSTED EBITDA<br />

[thousands of dollars] Year Ended December 31<br />

Adjusted EBITDA increased significantly compared to 2015 due largely<br />

to strategic acquisitions in the grain and fertilizer equipment sectors<br />

both in North America and overseas. Adjusted EBITDA benefited from<br />

a strong Canadian Farm market and robust North American demand<br />

for Commercial equipment, offset by continued weakness in the U.S.<br />

Farm market and a decrease in large international project sales. As<br />

a percentage of sales, adjusted EBITDA increased compared to 2015<br />

as strong Commercial margins and results from acquisitions more<br />

than offset the impact of lower sales of high margin Farm handling<br />

equipment. The increase in EBITDA over 2015 was more significant<br />

due to a smaller loss on foreign exchange and a gain on an equity<br />

compensation derivative in <strong>2016</strong>.<br />

FINANCE COSTS<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

EBITDA (1) 83,663 28,396<br />

Adjusted EBITDA (1) 100,429 73,337<br />

(1) See the EBITDA and adjusted EBITDA reconciliation table above, “Non-IFRS Measures” and<br />

“Basis of Presentation”.<br />

Finance costs in <strong>2016</strong> were $24.0 million (2015 – $18.5 million). The<br />

higher expense in <strong>2016</strong> relates primarily to financing the acquisition of<br />

Westeel in May 2015, partially through a convertible debenture issuance<br />

and through an increase in amounts drawn on the Company’s credit<br />

facility, as well as a debenture issuance in September 2015. Finance<br />

costs in both periods include non-cash interest related to convertible<br />

debenture accretion, the amortization of deferred finance costs related<br />

to the convertible debentures, stand-by fees and other sundry cash<br />

interest.<br />

OTHER OPERATING EXPENSE (INCOME)<br />

Other operating income in <strong>2016</strong> includes a gain on financial instruments<br />

of $9.2 million that was entered in <strong>2016</strong> (see “Equity Compensation<br />

Hedge”) and in <strong>2016</strong> the Company recorded a gain on the sale of<br />

property, plant & equipment and assets held for sale of $0.1 million<br />

(2015 – loss of $3.2 million).<br />

DEPRECIATION AND AMORTIZATION<br />

Depreciation of property, plant and equipment and amortization<br />

of intangible assets are categorized on the income statement in<br />

accordance with the function to which the underlying asset is related.<br />

The increase in <strong>2016</strong> primarily relates to acquisitions made in 2015 and<br />

<strong>2016</strong>. Total depreciation and amortization is summarized below:<br />

Depreciation<br />

[thousands of dollars] Year Ended December 31<br />

Amortization<br />

CURRENT INCOME TAX EXPENSE<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Depreciation in cost of sales 10,019 7,621<br />

Depreciation in G&A 904 567<br />

Total Depreciation 10,923 8,188<br />

[thousands of dollars] Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Amortization in cost of sales 3,648 2,545<br />

Amortization in G&A 7,413 5,784<br />

Total Amortization 11,061 8,329<br />

DEFERRED INCOME TAX EXPENSE<br />

<strong>For</strong> the year ended December 31, <strong>2016</strong>, the Company recorded deferred<br />

tax recovery of ($0.3) million (2015 –$1.6 million). Deferred tax recovery<br />

in <strong>2016</strong> relates to the increase of deferred tax assets plus a decrease<br />

in deferred tax liabilities that related to recognition of temporary<br />

differences between the accounting and tax treatment of depreciable<br />

assets, intangible assets and convertible debentures.<br />

Upon conversion to a corporation from an income trust in June 2009<br />

(the “Conversion”) the Company received certain tax attributes that<br />

may be used to offset tax otherwise payable in Canada. The Company’s<br />

Canadian taxable income is based on the results of its divisions<br />

domiciled in Canada, including the corporate office, and realized gains<br />

or losses on foreign exchange. <strong>For</strong> the year ended December 31, <strong>2016</strong>,<br />

the Company offset $0.5 million of Canadian tax otherwise payable<br />

(2015 - generated new net Canadian tax losses of ($0.7) million).<br />

Through the use of these attributes and since the date of Conversion<br />

a cumulative amount of $38.2 million has been utilized. Utilization of<br />

these tax attributes is recognized in deferred income tax expense on the<br />

Company’s income statement. As at December 31, <strong>2016</strong>, the balance<br />

sheet asset related to these unused attributes was $16.8 million.<br />

EFFECTIVE TAX RATE<br />

[thousands of dollars] Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Current tax expense 11,122 4,722<br />

Deferred tax expense (260) (1,613)<br />

TOTAL TAX 10,862 3,109<br />

Profit (loss) before taxes 30,168 (22,120)<br />

Total tax % 36.0% (14.1%)<br />

PROFIT (LOSS) AND DILUTED PROFIT (LOSS) PER SHARE AND<br />

ADJUSTED DILUTED PROFIT (LOSS) PER SHARE<br />

In <strong>2016</strong> the Company reported profit of $19.3 million (2015 – loss of<br />

$25.2 million), basic profit per share of $1.31 (2015 – loss of $1.81) and<br />

a fully diluted profit per share of $1.29 (2015 – loss of $1.81).<br />

A reconciliation of adjusted profit per share is below:<br />

[thousands of dollars, other than per share data] Year Ended December 31<br />

<strong>2016</strong><br />

$<br />

2015<br />

$<br />

Profit as reported 19,306 (25,229)<br />

Diluted profit per share as reported 1.29 (1.81)<br />

Loss on foreign exchange 14,070 31,322<br />

Assets under review (353) 15,509<br />

Asset Impairment 7,839 0<br />

M&A expenses 3,018 5,405<br />

Contingent consideration expense 1,307 0<br />

Gain on financial instruments (9,210) 0<br />

Loss on sale of PP&E (114) 3,203<br />

Allowance for net Receivables 682 2,280<br />

Adjusted profit (1) 36,545 32,490<br />

Diluted adjusted profit per share (1) 2.44 2.33<br />

(1) See “Non-IFRS Measures”.<br />

FINANCE EXPENSE<br />

Finance expense in both periods relates primarily to non-cash gains<br />

and losses on the translation of the Company’s U.S. dollar denominated<br />

long-term debt at the rate of exchange in effect at the end of the<br />

quarter.<br />

<strong>For</strong> the year ended December 31, <strong>2016</strong> the Company recorded current<br />

tax expense of $11.1 million (2015 – $4.7 million). Current tax expense<br />

relates primarily to Ag Growth U.S. and Italy subsidiaries.<br />

The total tax percentage in 2015 and to a much lesser extent in <strong>2016</strong><br />

was impacted by items that were expensed for accounting purposes but<br />

were not deductible for tax purposes. These include non-cash losses<br />

on foreign exchange. See “Diluted profit per share and Diluted adjusted<br />

profit per share”.<br />

27 MANAGEMENT’S DISCUSSION & ANALYSIS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

MANAGEMENT’S DISCUSSION & ANALYSIS 28