2016 Annual Report For Web 7.3MB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

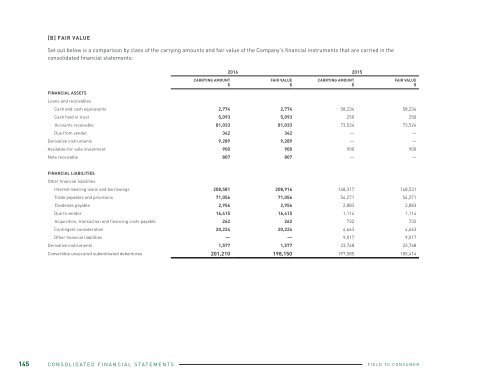

[B] FAIR VALUE<br />

Set out below is a comparison by class of the carrying amounts and fair value of the Company’s financial instruments that are carried in the<br />

consolidated financial statements:<br />

CARRYING AMOUNT<br />

$<br />

<strong>2016</strong> 2015<br />

FAIR VALUE<br />

$<br />

CARRYING AMOUNT<br />

$<br />

FAIR VALUE<br />

$<br />

FINANCIAL ASSETS<br />

Loans and receivables<br />

Cash and cash equivalents 2,774 2,774 58,234 58,234<br />

Cash held in trust 5,093 5,093 250 250<br />

Accounts receivable 81,033 81,033 73,524 73,524<br />

Due from vendor 342 342 — —<br />

Derivative instruments 9,289 9,289 — —<br />

Available-for-sale investment 900 900 900 900<br />

Note receivable 807 807 — —<br />

FINANCIAL LIABILITIES<br />

Other financial liabilities<br />

Interest-bearing loans and borrowings 208,581 208,916 148,317 148,531<br />

Trade payables and provisions 71,056 71,056 54,271 54,271<br />

Dividends payable 2,956 2,956 2,883 2,883<br />

Due to vendor 16,415 16,415 1,114 1,114<br />

Acquisition, transaction and financing costs payable 262 262 732 732<br />

Contingent consideration 20,224 20,224 4,663 4,663<br />

Other financial liabilities — — 9,017 9,017<br />

Derivative instruments 1,577 1,577 23,768 23,768<br />

Convertible unsecured subordinated debentures 201,210 198,150 197,585 185,414<br />

The fair value of the financial assets and liabilities are included at<br />

the amount at which the instrument could be exchanged in a current<br />

transaction between willing parties, other than in a forced or liquidation<br />

sale.<br />

The following methods and assumptions were used to estimate the fair<br />

values:<br />

• Cash and cash equivalents, cash held in trust, restricted cash,<br />

accounts receivable, dividends payable, acquisition, transaction and<br />

financing costs payable, accounts payable and accrued liabilities,<br />

due to vendor, contingent consideration and other liabilities<br />

approximate their carrying amounts largely due to the short-term<br />

maturities of these instruments.<br />

• The fair value of unquoted instruments and loans from banks is<br />

estimated by discounting future cash flows using rates currently<br />

available for debt on similar terms, credit risk and remaining<br />

maturities.<br />

• The Company enters into derivative financial instruments with<br />

financial institutions with investment grade credit ratings.<br />

Derivatives valued using valuation techniques with market<br />

observable inputs are mainly foreign exchange forward contracts.<br />

The most frequently applied valuation techniques include forward<br />

pricing, using present value calculations. The models incorporate<br />

various inputs including the credit quality of counterparties and<br />

foreign exchange spot and forward rates.<br />

• AGI includes its available-for-sale investment, which is in a<br />

private company, in Level 3 of the fair value hierarchy as it trades<br />

infrequently and has little price transparency. AGI reviews the fair<br />

value of this investment at each reporting period and when recent<br />

arm’s length market transactions are not available, management’s<br />

estimate of fair value is determined using a market approach based<br />

on external information and observable conditions where possible,<br />

supplemented by internal analysis as required.<br />

[C] FAIR VALUE [“FV”] HIERARCHY<br />

AGI uses the following hierarchy for determining and disclosing the fair<br />

value of financial instruments by valuation technique:<br />

145 CONSOLIDATED FINANCIAL STATEMENTS<br />

FIELD TO CONSUMER<br />

<strong>2016</strong> ANNUAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS 146