Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 3.06 Lead — 13<br />

will increase dramatically. Both developments call <strong>for</strong> a clear shift<br />

in front units’ service strategies as well as in product <strong>and</strong> wealth<br />

management structures towards an embedded wealth management<br />

model.<br />

Infrastructure investments to boom further — The search <strong>for</strong><br />

work <strong>and</strong> prosperity is fueling the growth of the mega-cities. The<br />

United Nations expects close to 60% of the world’s population to<br />

be living in urban areas by 2030, up from 48.7% today. To grasp<br />

the true dimension of this development: this growth is equal to<br />

roughly one new city the size of Barcelona emerging every 10 days!<br />

The lion’s share of growth is expected to stem from the less developed<br />

regions in Asia <strong>and</strong> Africa. The percentage of the population<br />

living in urban areas in Africa is expected to increase from 14.7% in<br />

1950 to 50.7% in 2030, roughly 3.5 times more than at present.<br />

The same metrics in Asia imply more than a tripling of the urban<br />

population over the same period. The fact that investments in the<br />

infrastructure of emerging countries are necessary goes without<br />

saying. However, this is also true of older cities in developed markets,<br />

which have not been designed <strong>for</strong> the mobile urban citizen or<br />

the sheer size of the 21st century city. This will result in tremendous<br />

<strong>and</strong> costly long-term infrastructure investments as well as a<br />

trend towards more decentralization of the biggest cities around<br />

the globe. To find a way to finance the infrastructure investments<br />

of the 21st century, further privatization, such as plans currently<br />

calling <strong>for</strong> the privatization of parts of the German highway system<br />

– until now the country’s “sacred cow” – might soon become<br />

reality.<br />

Migration gains — The World Bank estimates that a rise in migration<br />

from developing countries would generate gains <strong>for</strong> the world<br />

economy to the benefit of all of us. Migration amounting up to 3%<br />

of the work<strong>for</strong>ce of high-income countries could lead to a global<br />

output gain of USD 356 <strong>billion</strong> by 2025. This is estimated to be<br />

double the global gain from full trade liberalization. Migrants’ level<br />

of education <strong>and</strong> salary has an effect on the amount of the remittances<br />

they send home. Studies done <strong>for</strong> the United States suggest<br />

that highly educated <strong>and</strong> well-paid migrants – 80% of Indians<br />

working in the USA have a college degree – tend to save <strong>and</strong> invest<br />

in the host country. It is quite likely that the majority of well-educated<br />

migrants come from well-situated families not requiring as<br />

much support from abroad. By contrast, less educated workers<br />

such as the Hispanics in Cali<strong>for</strong>nia or Texas tend to send home a<br />

higher amount, which is estimated at up to USD 500 per month on<br />

average. The migration revolution discussed thus far is leading to<br />

new opportunities in banking:<br />

<strong>Banking</strong> <strong>for</strong> 7 <strong>billion</strong> people: Today’s migration is impacting the<br />

whole range of banking services. Many of today’s migrants are<br />

displaced or are refugees with the potential to become the retail<br />

banking client of the near future. On top of this, the mobility of the<br />

21st century citizen is, thanks to short travel distances, higher than<br />

ever be<strong>for</strong>e, resulting in a rising number of high-skilled economic<br />

refugees <strong>and</strong> the flex-patriate group at the top end (see figure 7).<br />

<strong>Banking</strong> <strong>for</strong> 7 <strong>million</strong> people: The vast growth in private banking<br />

is currently being driven by Asia <strong>and</strong> Latin America. Aging in the<br />

developed part of the world leads to a generational wealth transfer<br />

in private banking. The different needs of new <strong>and</strong> younger clients,<br />

who, as studies show, have a higher degree of investment sophistication,<br />

are leading to changes in the structure of private banking<br />

services offered.<br />

Labor migration to heat up retail banking<br />

Globally, the number of people living outside their home countries is<br />

estimated to be at 175 <strong>million</strong> <strong>and</strong> rising rapidly. Although migrant<br />

remittances are an old issue in the migration debate, they have<br />

received greater attention in recent years. The obvious reason <strong>for</strong><br />

this is the sharp rise in the flow of remittances into developing countries<br />

(see table 1, figure 4), which makes this volume-driven business<br />

attractive. The aim of these people is often to support the family left<br />

at home. To do so, some <strong>for</strong>m of money transfer service, <strong>and</strong> hence<br />

banking relationship, is required. Migration is likely to give rise to a<br />

new group of banking clients <strong>and</strong> banks will have to adapt their<br />

<br />

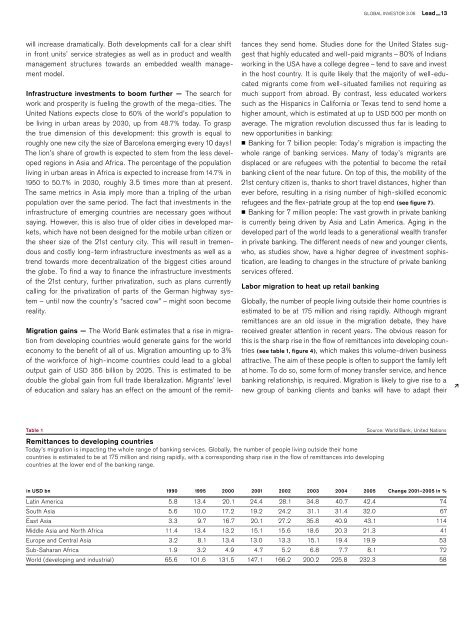

Table 1<br />

Remittances to developing countries<br />

Today’s migration is impacting the whole range of banking services. Globally, the number of people living outside their home<br />

countries is estimated to be at 175 <strong>million</strong> <strong>and</strong> rising rapidly, with a corresponding sharp rise in the flow of remittances into developing<br />

countries at the lower end of the banking range.<br />

Source: World Bank, United Nations<br />

in USD bn 1990 1995 2000 2001 2002 2003 2004 2005 Change 2001–2005 in %<br />

Latin America 5.8 13.4 20.1 24.4 28.1 34.8 40.7 42.4 74<br />

South Asia 5.6 10.0 17.2 19.2 24.2 31.1 31.4 32.0 67<br />

East Asia 3.3 9.7 16.7 20.1 27.2 35.8 40.9 43.1 114<br />

Middle Asia <strong>and</strong> North Africa 11.4 13.4 13.2 15.1 15.6 18.6 20.3 21.3 41<br />

Europe <strong>and</strong> Central Asia 3.2 8.1 13.4 13.0 13.3 15.1 19.4 19.9 53<br />

Sub-Saharan Africa 1.9 3.2 4.9 4.7 5.2 6.8 7.7 8.1 72<br />

World (developing <strong>and</strong> industrial) 65.6 101.6 131.5 147.1 166.2 200.2 225.8 232.3 58