Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 3.06 Basics — 26<br />

Use of New Energy by Electric Utilities,” covering new energies<br />

including wind, solar, biomass, small hydro <strong>and</strong> geothermal. It is<br />

also noted that many Asian governments are starting to provide<br />

incentives <strong>for</strong> alternative energy (see table 1).<br />

China’s renewable energy potential<br />

China is both the world’s second largest consumer of energy <strong>and</strong><br />

the second biggest emitter of greenhouses gases, behind the USA.<br />

The International Energy Agency claims that, by 2020, China will be<br />

consuming more energy than the USA today, <strong>and</strong> its GHG emissions<br />

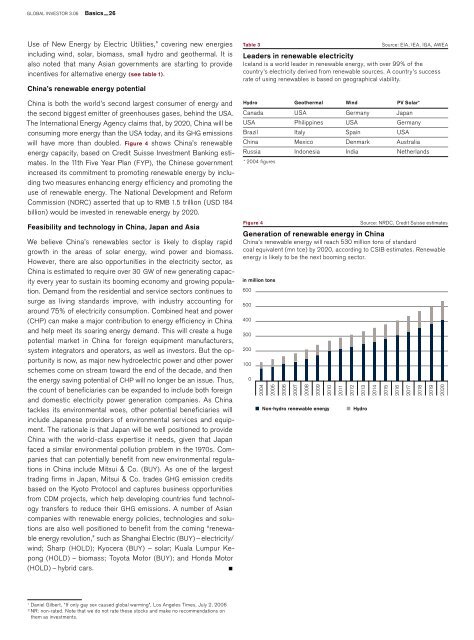

will have more than doubled. Figure 4 shows China’s renewable<br />

energy capacity, based on Credit Suisse Investment <strong>Banking</strong> estimates.<br />

In the 11th Five Year Plan (FYP), the Chinese government<br />

increased its commitment to promoting renewable energy by including<br />

two measures enhancing energy efficiency <strong>and</strong> promoting the<br />

use of renewable energy. The National Development <strong>and</strong> Re<strong>for</strong>m<br />

Commission (NDRC) asserted that up to RMB 1.5 trillion (USD 184<br />

<strong>billion</strong>) would be invested in renewable energy by 2020.<br />

Feasibility <strong>and</strong> technology in China, Japan <strong>and</strong> Asia<br />

We believe China’s renewables sector is likely to display rapid<br />

growth in the areas of solar energy, wind power <strong>and</strong> biomass.<br />

However, there are also opportunities in the electricity sector, as<br />

China is estimated to require over 30 GW of new generating capacity<br />

every year to sustain its booming economy <strong>and</strong> growing population.<br />

Dem<strong>and</strong> from the residential <strong>and</strong> service sectors continues to<br />

surge as living st<strong>and</strong>ards improve, with industry accounting <strong>for</strong><br />

around 75% of electricity consumption. Combined heat <strong>and</strong> power<br />

(CHP) can make a major contribution to energy efficiency in China<br />

<strong>and</strong> help meet its soaring energy dem<strong>and</strong>. This will create a huge<br />

potential market in China <strong>for</strong> <strong>for</strong>eign equipment manufacturers,<br />

system integrators <strong>and</strong> operators, as well as investors. But the opportunity<br />

is now, as major new hydroelectric power <strong>and</strong> other power<br />

schemes come on stream toward the end of the decade, <strong>and</strong> then<br />

the energy saving potential of CHP will no longer be an issue. Thus,<br />

the count of beneficiaries can be exp<strong>and</strong>ed to include both <strong>for</strong>eign<br />

<strong>and</strong> domestic electricity power generation companies. As China<br />

tackles its environmental woes, other potential beneficiaries will<br />

include Japanese providers of environmental services <strong>and</strong> equipment.<br />

The rationale is that Japan will be well positioned to provide<br />

China with the world-class expertise it needs, given that Japan<br />

faced a similar environmental pollution problem in the 1970s. Companies<br />

that can potentially benefit from new environmental regulations<br />

in China include Mitsui & Co. (BUY). As one of the largest<br />

trading firms in Japan, Mitsui & Co. trades GHG emission credits<br />

based on the Kyoto Protocol <strong>and</strong> captures business opportunities<br />

from CDM projects, which help developing countries fund technology<br />

transfers to reduce their GHG emissions. A number of Asian<br />

companies with renewable energy policies, technologies <strong>and</strong> solutions<br />

are also well positioned to benefit from the coming “renewable<br />

energy revolution,” such as Shanghai Electric (BUY) – electricity/<br />

wind; Sharp (HOLD); Kyocera (BUY) – solar; Kuala Lumpur Kepong<br />

(HOLD) – biomass; Toyota Motor (BUY); <strong>and</strong> Honda Motor<br />

(HOLD) – hybrid cars. <br />

<br />

Table 3<br />

Figure 4<br />

Source: NRDC, Credit Suisse estimates<br />

Generation of renewable energy in China<br />

China’s renewable energy will reach 530 <strong>million</strong> tons of st<strong>and</strong>ard<br />

coal equivalent (mn tce) by 2020, according to CSIB estimates. Renewable<br />

energy is likely to be the next booming sector.<br />

in <strong>million</strong> tons<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

Non-hydro renewable energy<br />

2011<br />

2012<br />

2013<br />

Hydro<br />

2014<br />

Source: EIA, IEA, IGA, AWEA<br />

Leaders in renewable electricity<br />

Icel<strong>and</strong> is a world leader in renewable energy, with over 99% of the<br />

country’s electricity derived from renewable sources. A country’s success<br />

rate of using renewables is based on geographical viability.<br />

Hydro Geothermal Wind PV Solar*<br />

Canada USA Germany Japan<br />

USA Philippines USA Germany<br />

Brazil Italy Spain USA<br />

China Mexico Denmark Australia<br />

Russia Indonesia India Netherl<strong>and</strong>s<br />

* 2004 figures<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

1<br />

Daniel Gilbert, “If only gay sex caused global warming”, Los Angeles Times, July 2, 2006<br />

2<br />

NR: non-rated. Note that we do not rate these stocks <strong>and</strong> make no recommendations on<br />

them as investments.