Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 3.06 Basics — 28<br />

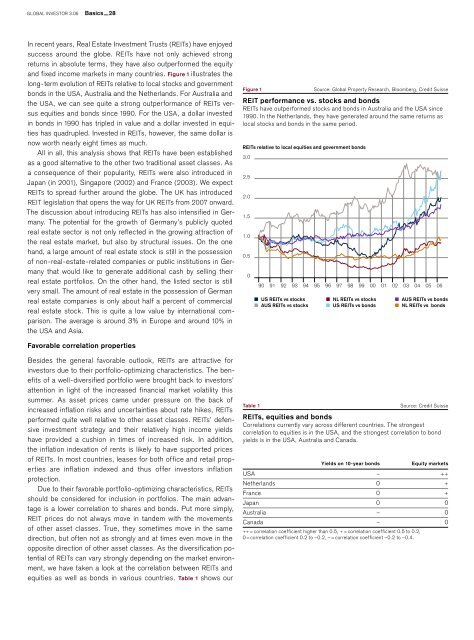

In recent years, Real Estate Investment Trusts (REITs) have enjoyed<br />

success around the globe. REITs have not only achieved strong<br />

returns in absolute terms, they have also outper<strong>for</strong>med the equity<br />

<strong>and</strong> fixed income markets in many countries. Figure 1 illustrates the<br />

long-term evolution of REITs relative to local stocks <strong>and</strong> government<br />

bonds in the USA, Australia <strong>and</strong> the Netherl<strong>and</strong>s. For Australia <strong>and</strong><br />

the USA, we can see quite a strong outper<strong>for</strong>mance of REITs versus<br />

equities <strong>and</strong> bonds since 1990. For the USA, a dollar invested<br />

in bonds in 1990 has tripled in value <strong>and</strong> a dollar invested in equities<br />

has quadrupled. Invested in REITs, however, the same dollar is<br />

now worth nearly eight times as much.<br />

All in all, this analysis shows that REITs have been established<br />

as a good alternative to the other two traditional asset classes. As<br />

a consequence of their popularity, REITs were also introduced in<br />

Japan (in 2001), Singapore (2002) <strong>and</strong> France (2003). We expect<br />

REITs to spread further around the globe. The UK has introduced<br />

REIT legislation that opens the way <strong>for</strong> UK REITs from 2007 onward.<br />

The discussion about introducing REITs has also intensified in Germany.<br />

The potential <strong>for</strong> the growth of Germany’s publicly quoted<br />

real estate sector is not only reflected in the growing attraction of<br />

the real estate market, but also by structural issues. On the one<br />

h<strong>and</strong>, a large amount of real estate stock is still in the possession<br />

of non-real-estate-related companies or public institutions in Germany<br />

that would like to generate additional cash by selling their<br />

real estate portfolios. On the other h<strong>and</strong>, the listed sector is still<br />

very small. The amount of real estate in the possession of German<br />

real estate companies is only about half a percent of commercial<br />

real estate stock. This is quite a low value by international comparison.<br />

The average is around 3% in Europe <strong>and</strong> around 10% in<br />

the USA <strong>and</strong> Asia.<br />

Figure 1<br />

REITs relative to local equities <strong>and</strong> government bonds<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06<br />

US REITs vs stocks<br />

AUS REITs vs stocks<br />

Source: Global Property Research, Bloomberg, Credit Suisse<br />

REIT per<strong>for</strong>mance vs. stocks <strong>and</strong> bonds<br />

REITs have outper<strong>for</strong>med stocks <strong>and</strong> bonds in Australia <strong>and</strong> the USA since<br />

1990. In the Netherl<strong>and</strong>s, they have generated around the same returns as<br />

local stocks <strong>and</strong> bonds in the same period.<br />

NL REITs vs stocks<br />

US REITs vs bonds<br />

AUS REITs vs bonds<br />

NL REITs vs bonds<br />

Favorable correlation properties<br />

Besides the general favorable outlook, REITs are attractive <strong>for</strong><br />

investors due to their portfolio-optimizing characteristics. The benefits<br />

of a well-diversified portfolio were brought back to investors’<br />

attention in light of the increased financial market volatility this<br />

summer. As asset prices came under pressure on the back of<br />

increased inflation risks <strong>and</strong> uncertainties about rate hikes, REITs<br />

per<strong>for</strong>med quite well relative to other asset classes. REITs’ defensive<br />

investment strategy <strong>and</strong> their relatively high income yields<br />

have provided a cushion in times of increased risk. In addition,<br />

the inflation indexation of rents is likely to have supported prices<br />

of REITs. In most countries, leases <strong>for</strong> both office <strong>and</strong> retail properties<br />

are inflation indexed <strong>and</strong> thus offer investors inflation<br />

protection.<br />

Due to their favorable portfolio-optimizing characteristics, REITs<br />

should be considered <strong>for</strong> inclusion in portfolios. The main advantage<br />

is a lower correlation to shares <strong>and</strong> bonds. Put more simply,<br />

REIT prices do not always move in t<strong>and</strong>em with the movements<br />

of other asset classes. True, they sometimes move in the same<br />

direction, but often not as strongly <strong>and</strong> at times even move in the<br />

opposite direction of other asset classes. As the diversification potential<br />

of REITs can vary strongly depending on the market environment,<br />

we have taken a look at the correlation between REITs <strong>and</strong><br />

equities as well as bonds in various countries. Table 1 shows our<br />

Table 1<br />

Source: Credit Suisse<br />

REITs, equities <strong>and</strong> bonds<br />

Correlations currently vary across different countries. The strongest<br />

correlation to equities is in the USA, <strong>and</strong> the strongest correlation to bond<br />

yields is in the USA, Australia <strong>and</strong> Canada.<br />

Yields on 10-year bonds<br />

Equity markets<br />

USA – ++<br />

Netherl<strong>and</strong>s 0 +<br />

France 0 +<br />

Japan 0 0<br />

Australia – 0<br />

Canada – 0<br />

++ = correlation coefficient higher than 0.5, + = correlation coefficient 0.5 to 0.2,<br />

0 = correlation coefficient 0.2 to –0.2, – = correlation coefficient –0.2 to –0.4.