Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 3.06 Services — 73<br />

As at the date of this report, Credit Suisse acts as a market maker or liquidity provider in the<br />

securities of the subject issuer AKAMAI TECHNOLOGIES, ALTRIA GROUP, BASF, BMW,<br />

CATERPILLAR INC, CITIGROUP, COCA-COLA CO, COLGATE-PALMOLIVE, DU PONT<br />

NEMOURS & CO, GENERAL ELECTRIC, GENERAL MOTORS, GOOGLE-A, HONDA MOTOR<br />

CO, INBEV, KYOCERA, MATSUSHITA EL INDL, PEPSICO, SHARP CORP OSAKA, SONY,<br />

TOYOTA MOTOR, UNILEVER CERT, WALT DISNEY, WASTE MANAGEMENT, YAHOO.<br />

Credit Suisse holds a trading position in the subject issuer AKAMAI TECHNOLOGIES,<br />

ALTRIA GROUP, BASF, BHP BILLITON, BHP BILLITON, BMW, BBVA R, BRIT AMER<br />

TOBACCO, CADBURY SCHWEPPES, CAMECO, CATERPILLAR INC, CITIGROUP, COCA-<br />

COLA CO, COLGATE-PALMOLIVE, DANONE, DIAGEO, DU PONT NEMOURS & CO,<br />

ENERGY RES AUST -A-, GENERAL ELECTRIC, GENERAL MOTORS, GOOGLE-A, HSBC<br />

HLDG, HONDA MOTOR CO, INBEV, KUALA LUMP.KEP.BER., KYOCERA, L’OREAL,<br />

LVMH, MATSUSHITA EL INDL, MITSUI & CO, NESTLE N, NEWS-A, NOKIA, OPAP,<br />

PEPSICO, PERNOD RICARD, SABMILLER, SHANGHAI ELECT -H-, SHARP CORP<br />

OSAKA, SHISEIDO CO LTD, SONY, THE SWATCH GRP, TOYOTA MOTOR, UNILEVER<br />

CERT, VIACOM-B, WALT DISNEY, WASTE MANAGEMENT, YAHOO, WILLIAM HILL.<br />

As at the end of the preceding month, Credit Suisse beneficially owned 1% or more of a class<br />

of common equity securities of BHP BILLITON, GENERAL MOTORS, HSBC HLDG.<br />

Swiss American Securities Inc. disclosures<br />

Swiss American Securities Inc. or its affiliates has managed or comanaged a public offering<br />

of securities <strong>for</strong> the subject issuer BMW, BRIT AMER TOBACCO, CITIGROUP, DIAGEO,<br />

GENERAL ELECTRIC, GENERAL MOTORS, GOOGLE-A, HSBC HLDG, HONDA MOTOR<br />

CO, NESTLE N, OPAP, SHANGHAI ELECT -H-, TOYOTA MOTOR, WALT DISNEY within<br />

the past 12 months.<br />

Swiss American Securities Inc. or its affiliates has received investment banking – related<br />

compensation from the subject issuer ALTRIA GROUP, BASF, BHP BILLITON, BMW, BBVA<br />

R, BRIT AMER TOBACCO, CATERPILLAR INC, CITIGROUP, COLGATE-PALMOLIVE,<br />

DIAGEO, DU PONT NEMOURS & CO, ENERGY RES AUST -A-, GENERAL ELECTRIC,<br />

GENERAL MOTORS, GOOGLE-A, HSBC HLDG, HONDA MOTOR CO, LVMH, MITSUI &<br />

CO, NESTLE N, NOKIA, OPAP, SHANGHAI ELECT -H-, SONY, TOYOTA MOTOR, VIACOM-<br />

B, WALT DISNEY within the past 12 months.<br />

Swiss American Securities Inc. or its affiliates expects to receive or intends to seek investment<br />

– banking related compensation from the subject issuer AKAMAI TECHNOLOGIES,<br />

ALTRIA GROUP, BASF, BHP BILLITON, BMW, BBVA R, BRIT AMER TOBACCO, CADBURY<br />

SCHWEPPES, CAMECO, CATERPILLAR INC, CITIGROUP, COCA-COLA CO, COLGATE-<br />

PALMOLIVE, DANONE, DIAGEO, DU PONT NEMOURS & CO, ENERGY RES AUST -A-,<br />

GENERAL ELECTRIC, GENERAL MOTORS, GOOGLE-A, HSBC HLDG, HONDA MOTOR<br />

CO, INBEV, KYOCERA, L’OREAL, LVMH, MATSUSHITA EL INDL, MITSUI & CO, NESTLE N,<br />

NEWS-A, NOKIA, OPAP, PEPSICO, PERNOD RICARD, SABMILLER, SHANGHAI ELECT<br />

-H-, SHARP CORP OSAKA, SHISEIDO CO LTD, SONY, TOYOTA MOTOR, VIACOM-B,<br />

WALT DISNEY, WASTE MANAGEMENT, YAHOO within the next three months.<br />

As of the date of this report, Swiss American Securities Inc. acts as a market maker or<br />

liquidity provider in the equity securities of the subject issuer ALTRIA GROUP, BASF, BHP<br />

BILLITON, BBVA R, CADBURY SCHWEPPES, CAMECO, CATERPILLAR INC, CITIGROUP,<br />

COCA-COLA CO, COLGATE-PALMOLIVE, DIAGEO, DU PONT NEMOURS & CO, GENERAL<br />

ELECTRIC, GENERAL MOTORS, HONDA MOTOR CO, MATSUSHITA EL INDL, PEPSICO,<br />

SONY, TOYOTA MOTOR, VIACOM-B, WALT DISNEY, WASTE MANAGEMENT.<br />

Swiss American Securities Inc. or its affiliates holds a trading position in the subject<br />

issuer AKAMAI TECHNOLOGIES, ALTRIA GROUP, BASF, BHP BILLITON, BHP<br />

BILLITON, BMW, BBVA R, BRIT AMER TOBACCO, CADBURY SCHWEPPES, CAMECO,<br />

CATERPILLAR INC, CITIGROUP, COCA-COLA CO, COLGATE-PALMOLIVE, DANONE,<br />

DIAGEO, DU PONT NEMOURS & CO, ENERGY RES AUST -A-, GENERAL ELECTRIC,<br />

GENERAL MOTORS, GOOGLE-A, HSBC HLDG, HONDA MOTOR CO, INBEV, KUALA<br />

LUMP.KEP.BER., KYOCERA, L’OREAL, LVMH, MATSUSHITA EL INDL, MITSUI &<br />

CO, NESTLE N, NEWS-A, NOKIA, OPAP, PEPSICO, PERNOD RICARD, SABMILLER,<br />

SHANGHAI ELECT -H-, SHARP CORP OSAKA, SHISEIDO CO LTD, SONY, THE SWATCH<br />

GRP, TOYOTA MOTOR, UNILEVER CERT, VIACOM-B, WALT DISNEY, WASTE MANAGE-<br />

MENT, YAHOO, WILLIAM HILL.<br />

Additional disclosures <strong>for</strong> the following jurisdictions<br />

Hong Kong: Other than any interests held by the analyst <strong>and</strong>/or associates as disclosed<br />

in this report, Credit Suisse Hong Kong branch does not hold any disclosable interests.<br />

United Kingdom: For fixed income disclosure in<strong>for</strong>mation <strong>for</strong> clients of Credit Suisse (UK)<br />

Limited <strong>and</strong> Credit Suisse Securities (Europe) Limited, please call +41 44 333 12 11.<br />

For further in<strong>for</strong>mation, including disclosures with respect to any other issuers, please<br />

refer to the Credit Suisse Global Research Disclosure site at:<br />

https://entry4.credit-suisse.ch/csfs/research/p/d/de/disclosure_en.html<br />

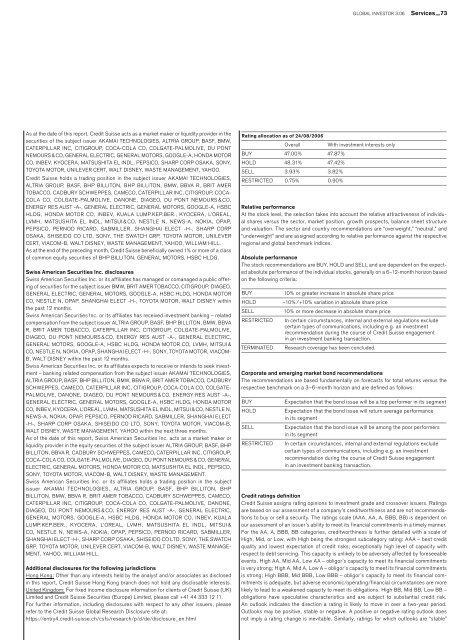

Rating allocation as of 24/08/2006<br />

Overall<br />

With investment interests only<br />

BUY 47.00% 47.87%<br />

HOLD 48.31% 47.42%<br />

SELL 3.93% 3.82%<br />

RESTRICTED 0.75% 0.90%<br />

Relative per<strong>for</strong>mance<br />

At the stock level, the selection takes into account the relative attractiveness of individual<br />

shares versus the sector, market position, growth prospects, balance sheet structure<br />

<strong>and</strong> valuation. The sector <strong>and</strong> country recommendations are “overweight,” “neutral,” <strong>and</strong><br />

“underweight” <strong>and</strong> are assigned according to relative per<strong>for</strong>mance against the respective<br />

regional <strong>and</strong> global benchmark indices.<br />

Absolute per<strong>for</strong>mance<br />

The stock recommendations are BUY, HOLD <strong>and</strong> SELL <strong>and</strong> are dependent on the expected<br />

absolute per<strong>for</strong>mance of the individual stocks, generally on a 6–12-month horizon based<br />

on the following criteria:<br />

BUY<br />

HOLD<br />

SELL<br />

RESTRICTED<br />

TERMINATED<br />

10% or greater increase in absolute share price<br />

–10%/+10% variation in absolute share price<br />

10% or more decrease in absolute share price<br />

In certain circumstances, internal <strong>and</strong> external regulations exclude<br />

certain types of communications, including e.g. an investment<br />

recommendation during the course of Credit Suisse engagement<br />

in an investment banking transaction.<br />

Research coverage has been concluded.<br />

Corporate <strong>and</strong> emerging market bond recommendations<br />

The recommendations are based fundamentally on <strong>for</strong>ecasts <strong>for</strong> total returns versus the<br />

respective benchmark on a 3–6-month horizon <strong>and</strong> are defined as follows:<br />

BUY<br />

HOLD<br />

SELL<br />

RESTRICTED<br />

Expectation that the bond issue will be a top per<strong>for</strong>mer in its segment<br />

Expectation that the bond issue will return average per<strong>for</strong>mance<br />

in its segment<br />

Expectation that the bond issue will be among the poor per<strong>for</strong>mers<br />

in its segment<br />

In certain circumstances, internal <strong>and</strong> external regulations exclude<br />

certain types of communications, including e.g. an investment<br />

recommendation during the course of Credit Suisse engagement<br />

in an investment banking transaction.<br />

Credit ratings definition<br />

Credit Suisse assigns rating opinions to investment grade <strong>and</strong> crossover issuers. Ratings<br />

are based on our assessment of a company’s creditworthiness <strong>and</strong> are not recommendations<br />

to buy or sell a security. The ratings scale (AAA, AA, A, BBB, BB) is dependent on<br />

our assessment of an issuer’s ability to meet its financial commitments in a timely manner.<br />

For the AA, A, BBB, BB categories, creditworthiness is further detailed with a scale of<br />

High, Mid, or Low, with High being the strongest subcategory rating: AAA – best credit<br />

quality <strong>and</strong> lowest expectation of credit risks; exceptionally high level of capacity with<br />

respect to debt servicing. This capacity is unlikely to be adversely affected by <strong>for</strong>eseeable<br />

events. High AA, Mid AA, Low AA – obligor’s capacity to meet its financial commitments<br />

is very strong; High A, Mid A, Low A – obligor’s capacity to meet its financial commitments<br />

is strong; High BBB, Mid BBB, Low BBB – obligor’s capacity to meet its financial commitments<br />

is adequate, but adverse economic/operating/financial circumstances are more<br />

likely to lead to a weakened capacity to meet its obligations. High BB, Mid BB, Low BB –<br />

obligations have speculative characteristics <strong>and</strong> are subject to substantial credit risk.<br />

An outlook indicates the direction a rating is likely to move in over a two-year period.<br />

Outlooks may be positive, stable or negative. A positive or negative rating outlook does<br />

not imply a rating change is inevitable. Similarly, ratings <strong>for</strong> which outlooks are “stable”