Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 3.06 Basics — 29<br />

results <strong>for</strong> various countries. REITs in Canada, Japan <strong>and</strong> Australia<br />

currently exhibit the most favorable portfolio optimization properties<br />

relative to equities.<br />

Interest rate risk lower if fundamentals are sound<br />

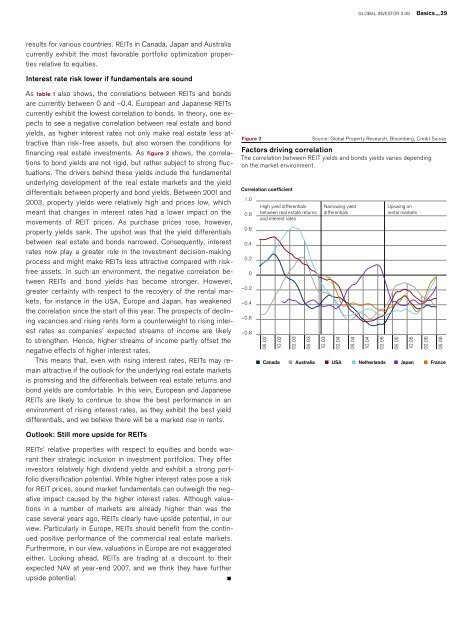

As table 1 also shows, the correlations between REITs <strong>and</strong> bonds<br />

are currently between 0 <strong>and</strong> –0.4. European <strong>and</strong> Japanese REITs<br />

currently exhibit the lowest correlation to bonds. In theory, one expects<br />

to see a negative correlation between real estate <strong>and</strong> bond<br />

yields, as higher interest rates not only make real estate less attractive<br />

than risk-free assets, but also worsen the conditions <strong>for</strong><br />

financing real estate investments. As figure 2 shows, the correlations<br />

to bond yields are not rigid, but rather subject to strong fluctuations.<br />

The drivers behind these yields include the fundamental<br />

underlying development of the real estate markets <strong>and</strong> the yield<br />

differentials between property <strong>and</strong> bond yields. Between 2001 <strong>and</strong><br />

2003, property yields were relatively high <strong>and</strong> prices low, which<br />

meant that changes in interest rates had a lower impact on the<br />

movements of REIT prices. As purchase prices rose, however,<br />

property yields sank. The upshot was that the yield differentials<br />

between real estate <strong>and</strong> bonds narrowed. Consequently, interest<br />

rates now play a greater role in the investment decision-making<br />

process <strong>and</strong> might make REITs less attractive compared with riskfree<br />

assets. In such an environment, the negative correlation between<br />

REITs <strong>and</strong> bond yields has become stronger. However,<br />

greater certainty with respect to the recovery of the rental markets,<br />

<strong>for</strong> instance in the USA, Europe <strong>and</strong> Japan, has weakened<br />

the correlation since the start of this year. The prospects of declining<br />

vacancies <strong>and</strong> rising rents <strong>for</strong>m a counterweight to rising interest<br />

rates as companies’ expected streams of income are likely<br />

to strengthen. Hence, higher streams of income partly offset the<br />

negative effects of higher interest rates.<br />

This means that, even with rising interest rates, REITs may remain<br />

attractive if the outlook <strong>for</strong> the underlying real estate markets<br />

is promising <strong>and</strong> the differentials between real estate returns <strong>and</strong><br />

bond yields are com<strong>for</strong>table. In this vein, European <strong>and</strong> Japanese<br />

REITs are likely to continue to show the best per<strong>for</strong>mance in an<br />

environment of rising interest rates, as they exhibit the best yield<br />

differentials, <strong>and</strong> we believe there will be a marked rise in rents.<br />

Figure 2<br />

Correlation coefficient<br />

1.0<br />

High yield differentials<br />

0.8 between real estate returns<br />

<strong>and</strong> interest rates<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

–0.2<br />

–0.4<br />

–0.6<br />

–0.8<br />

06.02<br />

10.02<br />

02.03<br />

06.03<br />

Source: Global Property Research, Bloomberg, Credit Suisse<br />

Factors driving correlation<br />

The correlation between REIT yields <strong>and</strong> bonds yields varies depending<br />

on the market environment.<br />

Narrowing yield<br />

differentials<br />

10.03<br />

02.04<br />

06.04<br />

Canada Australia USA Netherl<strong>and</strong>s Japan France<br />

10.04<br />

02.05<br />

Upswing on<br />

rental markets<br />

06.05<br />

10.05<br />

02.06<br />

06.06<br />

Outlook: Still more upside <strong>for</strong> REITs<br />

REITs’ relative properties with respect to equities <strong>and</strong> bonds warrant<br />

their strategic inclusion in investment portfolios. They offer<br />

investors relatively high dividend yields <strong>and</strong> exhibit a strong portfolio<br />

diversification potential. While higher interest rates pose a risk<br />

<strong>for</strong> REIT prices, sound market fundamentals can outweigh the negative<br />

impact caused by the higher interest rates. Although valuations<br />

in a number of markets are already higher than was the<br />

case several years ago, REITs clearly have upside potential, in our<br />

view. Particularly in Europe, REITs should benefit from the continued<br />

positive per<strong>for</strong>mance of the commercial real estate markets.<br />

Furthermore, in our view, valuations in Europe are not exaggerated<br />

either. Looking ahead, REITs are trading at a discount to their<br />

expected NAV at year-end 2007, <strong>and</strong> we think they have further<br />

upside potential.