Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 3.06 Switching — 61<br />

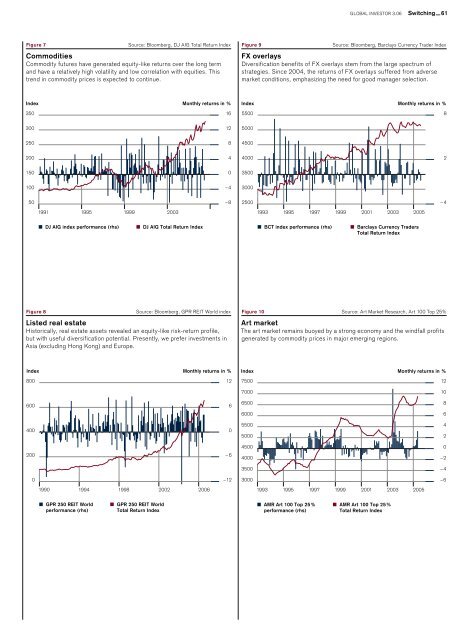

Figure 7<br />

Source: Bloomberg, DJ AIG Total Return Index<br />

Commodities<br />

Commodity futures have generated equity-like returns over the long term<br />

<strong>and</strong> have a relatively high volatility <strong>and</strong> low correlation with equities. This<br />

trend in commodity prices is expected to continue.<br />

Figure 9<br />

Source: Bloomberg, Barclays Currency Trader Index<br />

FX overlays<br />

Diversification benefits of FX overlays stem from the large spectrum of<br />

strategies. Since 2004, the returns of FX overlays suffered from adverse<br />

market conditions, emphasizing the need <strong>for</strong> good manager selection.<br />

Index Monthly returns in %<br />

350<br />

16<br />

Index Monthly returns in %<br />

5500<br />

8<br />

300<br />

12<br />

5000<br />

250<br />

8<br />

4500<br />

200<br />

4<br />

4000<br />

2<br />

150<br />

0<br />

3500<br />

100<br />

–4<br />

3000<br />

50<br />

–8<br />

2500<br />

– 4<br />

1991 1995 1999<br />

2003<br />

1993 1995 1997 1999 2001 2003 2005<br />

DJ AIG index per<strong>for</strong>mance (rhs)<br />

DJ AIG Total Return Index<br />

BCT index per<strong>for</strong>mance (rhs)<br />

Barclays Currency Traders<br />

Total Return Index<br />

Figure 8<br />

Source: Bloomberg, GPR REIT World index<br />

Listed real estate<br />

Historically, real estate assets revealed an equity-like risk-return profile,<br />

but with useful diversification potential. Presently, we prefer investments in<br />

Asia (excluding Hong Kong) <strong>and</strong> Europe.<br />

Figure 10 Source: Art Market Research, Art 100 Top 25%<br />

Art market<br />

The art market remains buoyed by a strong economy <strong>and</strong> the windfall profits<br />

generated by commodity prices in major emerging regions.<br />

Index Monthly returns in %<br />

800<br />

12<br />

Index Monthly returns in %<br />

7500<br />

12<br />

7000<br />

10<br />

600<br />

6<br />

6500<br />

6000<br />

8<br />

6<br />

400<br />

0<br />

5500<br />

5000<br />

4<br />

2<br />

200<br />

– 6<br />

4500<br />

4000<br />

0<br />

–2<br />

3500<br />

–4<br />

0<br />

–12<br />

3000<br />

–6<br />

1990 1994 1998<br />

2002 2006<br />

1993 1995 1997 1999 2001 2003 2005<br />

GPR 250 REIT World<br />

per<strong>for</strong>mance (rhs)<br />

GPR 250 REIT World<br />

Total Return Index<br />

AMR Art 100 Top 25%<br />

per<strong>for</strong>mance (rhs)<br />

AMR Art 100 Top 25%<br />

Total Return Index