Banking for 7 billion and 7 million

New challenges and opportunities of globalization Global Investor, 03/2006 Credit Suisse

New challenges and opportunities of globalization

Global Investor, 03/2006

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 3.06 Basics — 39<br />

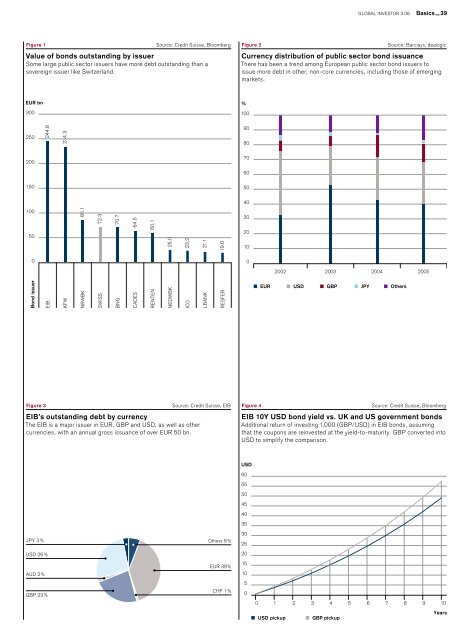

Figure 1<br />

Source: Credit Suisse, Bloomberg<br />

Value of bonds outst<strong>and</strong>ing by issuer<br />

Some large public sector issuers have more debt outst<strong>and</strong>ing than a<br />

sovereign issuer like Switzerl<strong>and</strong>.<br />

Figure 2<br />

Source: Barclays, dealogic<br />

Currency distribution of public sector bond issuance<br />

There has been a trend among European public sector bond issuers to<br />

issue more debt in other, non-core currencies, including those of emerging<br />

markets.<br />

EUR bn<br />

300<br />

%<br />

100<br />

250<br />

244.8<br />

234.3<br />

90<br />

80<br />

200<br />

70<br />

60<br />

150<br />

50<br />

40<br />

100<br />

50<br />

86.1<br />

72.3<br />

70.7<br />

64.5<br />

60.1<br />

25.0<br />

23.2<br />

21.1<br />

19.6<br />

30<br />

20<br />

10<br />

0<br />

0<br />

2002 2003 2004 2005<br />

Bond issuer<br />

EIB<br />

KFW<br />

NRWBK<br />

SWISS<br />

BNG<br />

CADES<br />

RENTEN<br />

NEDWBK<br />

ICO<br />

LBANK<br />

RESFER<br />

EUR USD GBP JPY Others<br />

Figure 3<br />

Source: Credit Suisse, EIB<br />

EIB’s outst<strong>and</strong>ing debt by currency<br />

The EIB is a major issuer in EUR, GBP <strong>and</strong> USD, as well as other<br />

currencies, with an annual gross issuance of over EUR 50 bn.<br />

Figure 4<br />

Source: Credit Suisse, Bloomberg<br />

EIB 10Y USD bond yield vs. UK <strong>and</strong> US government bonds<br />

Additional return of investing 1,000 (GBP/USD) in EIB bonds, assuming<br />

that the coupons are reinvested at the yield-to-maturity. GBP converted into<br />

USD to simplify the comparison.<br />

JPY 3%<br />

USD 26%<br />

AUD 2%<br />

GBP 23%<br />

Others 6%<br />

EUR 39%<br />

CHF 1%<br />

USD<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

0 1 2 3 4 5 6 7 8 9 10<br />

Years<br />

USD pickup GBP pickup