Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

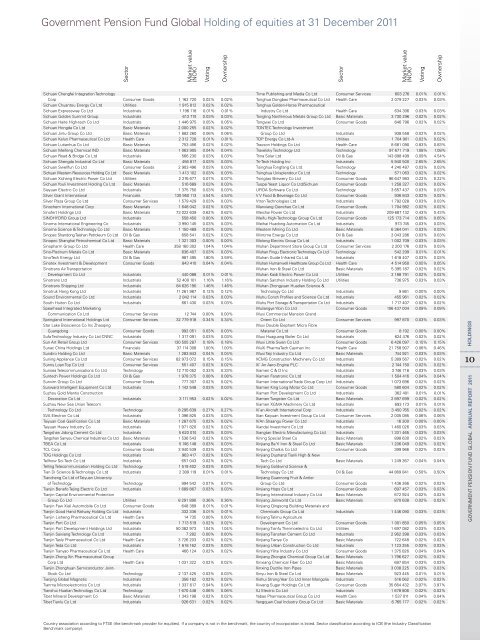

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

sichuan Chengfei integr<strong>at</strong>ion technology<br />

Corp Consumer Goods 1 162 720 0.02% 0.02%<br />

sichuan Chuantou energy Co ltd utilities 1 915 812 0.02% 0.02%<br />

sichuan expressway Co ltd industrials 1 196 118 0.01% 0.01%<br />

sichuan Golden summit Group industrials 613 774 0.03% 0.03%<br />

sichuan Haite High-tech Co ltd industrials 1 446 975 0.05% 0.05%<br />

sichuan Hongda Co ltd basic m<strong>at</strong>erials 2 000 255 0.02% 0.02%<br />

sichuan Jinlu Group Co ltd basic m<strong>at</strong>erials 1 882 260 0.06% 0.06%<br />

sichuan Kelun Pharmaceutical Co ltd Health Care 2 <strong>31</strong>2 728 0.01% 0.01%<br />

sichuan lutianhua Co ltd basic m<strong>at</strong>erials 753 456 0.02% 0.02%<br />

sichuan meifeng Chemical inD basic m<strong>at</strong>erials 1 063 905 0.04% 0.04%<br />

sichuan road & bridge Co ltd industrials 566 230 0.03% 0.03%<br />

sichuan shengda industrial Co ltd basic m<strong>at</strong>erials 456 817 0.03% 0.03%<br />

sichuan swellfun Co ltd Consumer Goods 2 903 496 0.03% 0.03%<br />

sichuan Western resources <strong>Holding</strong> Co ltd basic m<strong>at</strong>erials 1 413 102 0.03% 0.03%<br />

sichuan Xichang electric Power Co ltd utilities 2 276 677 0.07% 0.07%<br />

sichuan Youli investment <strong>Holding</strong> Co ltd basic m<strong>at</strong>erials 516 689 0.03% 0.03%<br />

sieyuan electric Co ltd industrials 1 375 750 0.03% 0.03%<br />

silver Grant intern<strong>at</strong>ional Financials 130 950 113 4.54% 4.54%<br />

silver Plaza Group Co ltd Consumer services 1 579 429 0.03% 0.03%<br />

sinochem intern<strong>at</strong>ional Corp basic m<strong>at</strong>erials 1 648 042 0.02% 0.02%<br />

sin<strong>of</strong>ert <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 73 022 639 0.62% 0.62%<br />

sinoHYDro Group ltd industrials 558 450 0.00% 0.00%<br />

sinoma intern<strong>at</strong>ional engineering Co industrials 3 990 145 0.03% 0.03%<br />

sinoma science & technology Co ltd basic m<strong>at</strong>erials 1 150 489 0.03% 0.03%<br />

sinopec shandong taishan Petroleum Co ltd oil & Gas 658 541 0.02% 0.02%<br />

sinopec shanghai Petrochemical Co ltd basic m<strong>at</strong>erials 1 321 303 0.00% 0.00%<br />

sinopharm Group Co ltd Health Care 358 160 302 1.04% 1.04%<br />

sino-Pl<strong>at</strong>inum metals Co ltd basic m<strong>at</strong>erials 636 407 0.03% 0.03%<br />

sinotech energy ltd oil & Gas 987 495 1.80% 3.59%<br />

sinotex investment & Development Consumer Goods 843 410 0.04% 0.04%<br />

sinotrans air transport<strong>at</strong>ion<br />

Development Co ltd industrials 440 088 0.01% 0.01%<br />

sinotrans ltd industrials 52 400 101 1.16% 1.16%<br />

sinotrans shipping ltd industrials 84 626 190 1.46% 1.46%<br />

sinotruk Hong Kong ltd industrials 11 261 987 0.12% 0.12%<br />

sound environmental Co ltd industrials 2 842 114 0.03% 0.03%<br />

south Huiton Co ltd industrials 661 430 0.03% 0.03%<br />

spearhead integr<strong>at</strong>ed marketing<br />

Communic<strong>at</strong>ion Co ltd Consumer services 12 744 0.00% 0.00%<br />

springland intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 32 779 918 0.34% 0.34%<br />

star lake bioscience Co inc Zhaoqing<br />

Guangdong Consumer Goods 992 051 0.03% 0.03%<br />

sufa technology industry Co ltd CnnC industrials 1 <strong>31</strong>7 091 0.03% 0.03%<br />

sun art retail Group ltd Consumer services 130 505 287 0.18% 0.18%<br />

sunac China <strong>Holding</strong>s ltd Financials 37 114 308 1.00% 1.00%<br />

sundiro <strong>Holding</strong> Co ltd basic m<strong>at</strong>erials 1 283 843 0.04% 0.04%<br />

suning appliance Co ltd Consumer services 82 973 072 0.15% 0.15%<br />

sunny loan top Co ltd Consumer services 551 407 0.02% 0.02%<br />

sunsea telecommunic<strong>at</strong>ions Co ltd technology 12 710 052 0.33% 0.33%<br />

suntech Power <strong>Holding</strong>s Co ltd oil & Gas 1 978 375 0.08% 0.08%<br />

sunvim Group Co ltd Consumer Goods 777 307 0.02% 0.02%<br />

sunward intelligent equipment Co ltd industrials 1 142 548 0.03% 0.03%<br />

suzhou Gold mantis Construction<br />

Decor<strong>at</strong>ion Co ltd industrials 3 111 953 0.02% 0.02%<br />

suzhou new sea union telecom<br />

technology Co ltd technology 8 295 639 0.27% 0.27%<br />

sva electron Co ltd industrials 1 396 825 0.03% 0.03%<br />

taiyuan Coal Gasific<strong>at</strong>ion Co ltd basic m<strong>at</strong>erials 1 287 675 0.02% 0.02%<br />

taiyuan Heavy industry Co industrials 1 971 820 0.02% 0.02%<br />

tangshan Jidong Cement Co ltd industrials 5 620 074 0.03% 0.03%<br />

tangshan sanyou Chemical industries Co ltd basic m<strong>at</strong>erials 1 536 543 0.02% 0.02%<br />

tbea Co ltd industrials 5 746 148 0.03% 0.03%<br />

tCl Corp Consumer Goods 3 940 539 0.03% 0.03%<br />

tDG <strong>Holding</strong>s Co ltd industrials 963 417 0.02% 0.02%<br />

tellhow sci-tech Co ltd industrials 657 043 0.02% 0.02%<br />

telling telecommunic<strong>at</strong>ion <strong>Holding</strong> Co ltd technology 1 519 402 0.03% 0.03%<br />

tian Di science & technology Co ltd industrials 2 389 119 0.01% 0.01%<br />

tiancheng Co ltd <strong>of</strong> taiyuan university<br />

<strong>of</strong> technology technology 994 542 0.07% 0.07%<br />

tianjin benefo tejing electric Co ltd industrials 1 689 867 0.03% 0.03%<br />

tianjin Capital environmental Protection<br />

Group Co ltd utilities 8 291 890 0.36% 0.36%<br />

tianjin Faw Xiali automobile Co ltd Consumer Goods 648 389 0.01% 0.01%<br />

tianjin Good Hand railway <strong>Holding</strong> Co ltd industrials 332 336 0.01% 0.01%<br />

tianjin lisheng Pharmaceutical Co ltd Health Care 14 735 0.00% 0.00%<br />

tianjin Port Co ltd industrials 1 713 519 0.02% 0.02%<br />

tianjin Port Development <strong>Holding</strong>s ltd industrials 50 382 973 1.04% 1.04%<br />

tianjin saixiang technology Co ltd industrials 7 282 0.00% 0.00%<br />

tianjin tasly Pharmaceutical Co ltd Health Care 3 726 203 0.02% 0.02%<br />

tianjin teda Co ltd industrials 1 618 162 0.03% 0.03%<br />

tianjin tianyao Pharmaceutical Co ltd Health Care 466 124 0.02% 0.02%<br />

tianjin Zhong Xin Pharmaceutical Group<br />

Corp ltd Health Care 1 0<strong>31</strong> 322 0.02% 0.02%<br />

tianjin Zhonghuan semiconductor Joint-<br />

stock Co ltd technology 2 137 425 0.03% 0.03%<br />

tianjing <strong>Global</strong> magnetic industrials 356 182 0.02% 0.02%<br />

tianma microelectronics Co ltd industrials 1 337 617 0.04% 0.04%<br />

tianshui Hu<strong>at</strong>ian technology Co ltd technology 1 670 448 0.06% 0.06%<br />

tibet mineral Development Co basic m<strong>at</strong>erials 1 343 198 0.02% 0.02%<br />

tibet tianlu Co ltd industrials 926 6<strong>31</strong> 0.02% 0.02%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

time Publishing and media Co ltd Consumer services 603 276 0.01% 0.01%<br />

tonghua Dongbao Pharmaceutical Co ltd Health Care 2 079 227 0.03% 0.03%<br />

tonghua Golden-Horse Pharmaceutical<br />

industry Co ltd Health Care 634 306 0.03% 0.03%<br />

tongling nonferrous metals Group Co ltd basic m<strong>at</strong>erials 3 730 296 0.02% 0.02%<br />

tongwei Co ltd Consumer Goods 646 796 0.02% 0.02%<br />

tonteC technology investment<br />

Group Co ltd industrials 938 558 0.02% 0.02%<br />

toP energy Co ltd-a utilities 1 704 901 0.02% 0.02%<br />

trauson <strong>Holding</strong>s Co ltd Health Care 8 681 090 0.83% 0.83%<br />

travelsky technology ltd technology 97 671 719 1.08% 1.08%<br />

trina solar ltd oil & Gas 143 898 499 0.09% 4.54%<br />

tri-tech <strong>Holding</strong> inc industrials 5 940 500 2.65% 2.65%<br />

tsinghua tongfang Co ltd technology 4 240 487 0.03% 0.03%<br />

tsinghua unisplendour Co ltd technology 571 063 0.02% 0.02%<br />

tsingtao brewery Co ltd Consumer Goods 96 647 983 0.22% 0.22%<br />

tuopai Yeast liquor Co ltd/sichuan Consumer Goods 1 258 327 0.02% 0.02%<br />

uFiDa s<strong>of</strong>tware Co ltd technology 3 657 437 0.03% 0.03%<br />

v v Food & beverage Co ltd Consumer Goods 936 843 0.02% 0.02%<br />

vtron technologies ltd industrials 1 792 028 0.03% 0.03%<br />

Wanxiang Qianchao Co ltd Consumer Goods 1 704 982 0.02% 0.02%<br />

Weichai Power Co ltd industrials 209 687 132 0.43% 0.43%<br />

Weifu High-technology Group Co ltd Consumer Goods 125 173 714 0.65% 0.65%<br />

Weihai Huadong autom<strong>at</strong>ion Co ltd industrials 973 745 0.03% 0.03%<br />

Western mining Co ltd basic m<strong>at</strong>erials 6 364 041 0.03% 0.03%<br />

Wintime energy Co ltd oil & Gas 2 043 286 0.03% 0.03%<br />

Wolong electric Group Co ltd industrials 1 002 709 0.03% 0.03%<br />

Wuhan Department store Group Co ltd Consumer services 2 200 176 0.03% 0.03%<br />

Wuhan Fingu electronic technology Co ltd technology 542 299 0.01% 0.01%<br />

Wuhan Guide infrared Co ltd industrials 1 618 407 0.03% 0.03%<br />

Wuhan Humanwell Healthcare Group Co ltd Health Care 4 514 950 0.05% 0.05%<br />

Wuhan iron & steel Co ltd basic m<strong>at</strong>erials 5 395 187 0.02% 0.02%<br />

Wuhan Kaidi electric Power Co ltd utilities 2 188 791 0.02% 0.02%<br />

Wuhan sanzhen industry <strong>Holding</strong> Co ltd utilities 736 975 0.03% 0.03%<br />

Wuhan Zhongyuan Huadian science &<br />

technology Co ltd industrials 9 861 0.00% 0.00%<br />

Wuhu Conch Pr<strong>of</strong>iles and science Co ltd industrials 455 961 0.02% 0.02%<br />

Wuhu Port storage & transport<strong>at</strong>ion Co ltd industrials 1 717 407 0.02% 0.02%<br />

Wuliangye Yibin Co ltd Consumer Goods 106 437 004 0.09% 0.09%<br />

Wuxi Commercial mansion Grand<br />

orient Co ltd Consumer services 997 870 0.03% 0.03%<br />

Wuxi Double elephant micro Fibre<br />

m<strong>at</strong>erial Co ltd Consumer Goods 8 192 0.00% 0.00%<br />

Wuxi Huaguang boiler Co ltd industrials 624 476 0.02% 0.02%<br />

Wuxi little swan Co ltd Consumer Goods 6 426 097 0.15% 0.15%<br />

WuXi Pharm<strong>at</strong>ech Cayman inc Health Care 21 758 907 0.06% 0.46%<br />

Wuxi taiji industry Co ltd basic m<strong>at</strong>erials 744 921 0.03% 0.03%<br />

XCmG Construction machinery Co ltd industrials 5 389 567 0.02% 0.02%<br />

Xi’ an aero-engine PlC industrials 2 744 150 0.02% 0.02%<br />

Xiamen C & D inc industrials 3 746 718 0.03% 0.03%<br />

Xiamen Far<strong>at</strong>ronic Co ltd industrials 1 504 416 0.04% 0.04%<br />

Xiamen intern<strong>at</strong>ional trade Group Corp ltd industrials 1 073 696 0.02% 0.02%<br />

Xiamen King long motor Co ltd Consumer Goods 580 604 0.02% 0.02%<br />

Xiamen Port Development Co ltd industrials 362 401 0.01% 0.01%<br />

Xiamen tungsten Co ltd basic m<strong>at</strong>erials 2 897 699 0.02% 0.02%<br />

Xiamen XGma machinery Co ltd industrials 693 173 0.01% 0.01%<br />

Xi’an aircraft intern<strong>at</strong>ional Corp industrials 3 450 765 0.02% 0.02%<br />

Xian Kaiyuan investment Group Co ltd Consumer services 2 005 085 0.06% 0.06%<br />

Xi’an shaangu Power Co ltd industrials 16 300 0.00% 0.00%<br />

Xiandai investment Co ltd industrials 1 460 026 0.03% 0.03%<br />

Xiangtan electric manufacturing Co ltd industrials 1 3<strong>31</strong> 465 0.03% 0.03%<br />

Xining special steel Co basic m<strong>at</strong>erials 898 630 0.02% 0.02%<br />

Xinjiang ba Yi iron & steel Co ltd basic m<strong>at</strong>erials 1 206 049 0.02% 0.02%<br />

Xinjiang Chalkis Co ltd Consumer Goods 399 966 0.02% 0.02%<br />

Xinjiang Dushanzi tianli High & new<br />

tech Co ltd basic m<strong>at</strong>erials 1 249 367 0.04% 0.04%<br />

Xinjiang Goldwind science &<br />

technology Co ltd oil & Gas 44 869 841 0.50% 0.50%<br />

Xinjiang Guannong Fruit & antler<br />

Group Co ltd Consumer Goods 1 436 266 0.02% 0.02%<br />

Xinjiang Hops Co ltd Consumer Goods 697 457 0.03% 0.03%<br />

Xinjiang intern<strong>at</strong>ional industry Co ltd basic m<strong>at</strong>erials 672 924 0.02% 0.02%<br />

Xinjiang Joinworld Co ltd basic m<strong>at</strong>erials 870 638 0.02% 0.02%<br />

Xinjiang Qingsong building m<strong>at</strong>erials and<br />

Chemicals Group Co ltd industrials 1 446 090 0.03% 0.03%<br />

Xinjiang talimu agriculture<br />

Development Co ltd Consumer Goods 1 001 850 0.05% 0.05%<br />

Xinjiang tianfu thermoelectric Co ltd utilities 1 697 082 0.03% 0.03%<br />

Xinjiang tianshan Cement Co ltd industrials 2 962 398 0.03% 0.03%<br />

Xinjiang tianye Co basic m<strong>at</strong>erials 722 648 0.02% 0.02%<br />

Xinjiang urban Construction Co ltd industrials 1 123 255 0.03% 0.03%<br />

Xinjiang Yilite industry Co ltd Consumer Goods 1 375 826 0.04% 0.04%<br />

Xinjiang Zhongtai Chemical Group Co ltd basic m<strong>at</strong>erials 1 796 627 0.02% 0.02%<br />

Xinxiang Chemical Fiber Co ltd basic m<strong>at</strong>erials 687 854 0.03% 0.03%<br />

Xinxing Ductile iron Pipes basic m<strong>at</strong>erials 3 038 225 0.03% 0.03%<br />

Xinyu iron & steel Co ltd basic m<strong>at</strong>erials 923 445 0.01% 0.01%<br />

Xishui strong Year Co ltd inner mongolia industrials 516 062 0.02% 0.02%<br />

Xiwang sugar <strong>Holding</strong>s Co ltd Consumer Goods 35 664 432 3.97% 3.97%<br />

XJ electric Co ltd industrials 1 678 806 0.02% 0.02%<br />

Yabao Pharmaceutical Group Co ltd Health Care 1 537 011 0.04% 0.04%<br />

Yangquan Coal industry Group Co ltd basic m<strong>at</strong>erials 6 765 177 0.02% 0.02%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

10<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011