Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

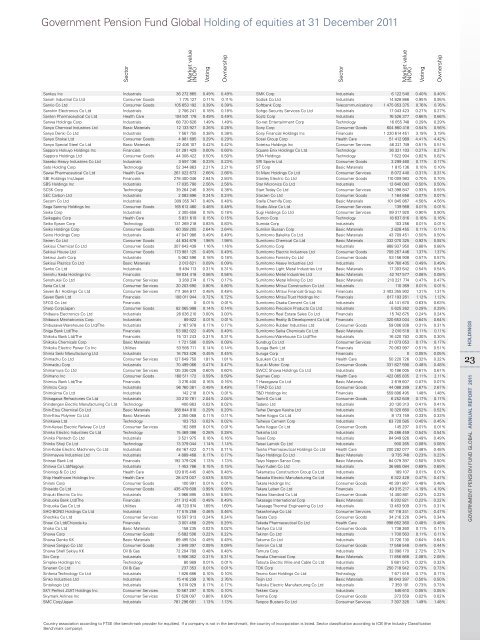

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

sankyu inc industrials 36 272 865 0.49% 0.49%<br />

sanoh industrial Co ltd Consumer Goods 1 774 127 0.11% 0.11%<br />

sanrio Co ltd Consumer Goods 105 653 192 0.39% 0.39%<br />

sanshin electronics Co ltd industrials 2 706 241 0.18% 0.18%<br />

santen Pharmaceutical Co ltd Health Care 104 501 178 0.49% 0.49%<br />

sanwa <strong>Holding</strong>s Corp industrials 68 720 626 1.49% 1.49%<br />

sanyo Chemical industries ltd basic m<strong>at</strong>erials 12 133 927 0.26% 0.26%<br />

sanyo Denki Co ltd industrials 7 567 755 0.38% 0.38%<br />

sanyo shokai ltd Consumer Goods 4 981 695 0.29% 0.29%<br />

sanyo special steel Co ltd basic m<strong>at</strong>erials 22 406 107 0.42% 0.42%<br />

sapporo Hokuyo <strong>Holding</strong>s inc Financials 51 281 429 0.60% 0.60%<br />

sapporo <strong>Holding</strong>s ltd Consumer Goods 44 308 422 0.50% 0.50%<br />

sasebo Heavy industries Co ltd industrials 3 597 136 0.23% 0.23%<br />

s<strong>at</strong>o <strong>Holding</strong> Corp technology 52 344 863 2.21% 2.21%<br />

sawai Pharmaceutical Co ltd Health Care 261 022 673 2.66% 2.66%<br />

sbi <strong>Holding</strong>s inc/Japan Financials 278 400 046 2.84% 2.84%<br />

sbs <strong>Holding</strong>s inc industrials 17 035 790 2.56% 2.56%<br />

sCsK Corp technology 39 264 246 0.38% 0.38%<br />

seC Carbon ltd industrials 2 083 896 0.24% 0.24%<br />

secom Co ltd industrials 309 355 747 0.48% 0.48%<br />

sega sammy <strong>Holding</strong>s inc Consumer Goods 165 612 480 0.48% 0.48%<br />

seika Corp industrials 2 305 658 0.18% 0.18%<br />

seikagaku Corp Health Care 5 8<strong>31</strong> 619 0.15% 0.15%<br />

seiko epson Corp technology 1<strong>31</strong> 269 218 0.83% 0.83%<br />

seiko <strong>Holding</strong>s Corp Consumer Goods 60 358 205 2.64% 2.64%<br />

seino <strong>Holding</strong>s Corp industrials 47 047 986 0.49% 0.49%<br />

seiren Co ltd Consumer Goods 44 834 678 1.98% 1.98%<br />

sekisui Chemical Co ltd Consumer Goods 307 643 438 1.16% 1.16%<br />

sekisui House ltd Consumer Goods 173 981 125 0.49% 0.49%<br />

sekisui Jushi Corp industrials 5 062 596 0.18% 0.18%<br />

sekisui Plastics Co ltd basic m<strong>at</strong>erials 2 013 621 0.09% 0.09%<br />

senko Co ltd industrials 9 494 113 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

senshu ikeda <strong>Holding</strong>s inc Financials 59 034 418 0.56% 0.56%<br />

senshukai Co ltd Consumer services 3 260 274 0.17% 0.17%<br />

seria Co ltd Consumer services 20 203 690 0.80% 0.80%<br />

seven & i <strong>Holding</strong>s Co ltd Consumer services 711 364 817 0.48% 0.48%<br />

seven bank ltd Financials 100 011 944 0.72% 0.72%<br />

sFCG Co ltd Financials 0 0.01% 0.01%<br />

sharp Corp/Japan Consumer Goods 82 065 998 0.14% 0.14%<br />

shibaura electronics Co ltd industrials 26 036 210 3.00% 3.00%<br />

shibaura mech<strong>at</strong>ronics Corp industrials 89 822 0.01% 0.01%<br />

shibusawa Warehouse Co ltd/the industrials 2 167 978 0.17% 0.17%<br />

shiga bank ltd/the Financials 53 082 022 0.49% 0.49%<br />

shikoku bank ltd/the Financials 15 1<strong>31</strong> 243 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

shikoku Chemicals Corp basic m<strong>at</strong>erials 1 721 506 0.09% 0.09%<br />

shikoku electric Power Co inc utilities 53 566 711 0.14% 0.14%<br />

shima seiki manufacturing ltd industrials 16 753 426 0.45% 0.45%<br />

shimachu Co ltd Consumer services 127 649 750 1.81% 1.81%<br />

shimadzu Corp industrials 70 499 066 0.47% 0.47%<br />

shimamura Co ltd Consumer services 135 336 026 0.60% 0.60%<br />

shimano inc Consumer Goods 160 511 172 0.59% 0.59%<br />

shimizu bank ltd/the Financials 3 276 400 0.16% 0.16%<br />

shimizu Corp industrials 96 760 381 0.49% 0.49%<br />

shimojima Co ltd industrials 142 218 0.01% 0.01%<br />

shinagawa refractories Co ltd industrials 33 210 781 2.04% 2.04%<br />

shindengen electric manufacturing Co ltd technology 400 863 0.02% 0.02%<br />

shin-etsu Chemical Co ltd basic m<strong>at</strong>erials 368 844 910 0.29% 0.29%<br />

shin-etsu Polymer Co ltd basic m<strong>at</strong>erials 2 355 068 0.11% 0.11%<br />

shinkawa ltd technology 103 753 0.02% 0.02%<br />

shin-Keisei electric railway Co ltd Consumer services 162 889 0.01% 0.01%<br />

shinko electric industries Co ltd technology 15 469 386 0.28% 0.28%<br />

shinko Plantech Co ltd industrials 3 521 975 0.16% 0.16%<br />

shinko shoji Co ltd technology 13 379 044 1.14% 1.14%<br />

shin-Kobe electric machinery Co ltd industrials 48 167 422 0.71% 0.71%<br />

shinmaywa industries ltd industrials 4 889 468 0.17% 0.17%<br />

shinsei bank ltd Financials 192 379 026 1.13% 1.13%<br />

shinwa Co ltd/nagoya industrials 1 453 786 0.15% 0.15%<br />

shionogi & Co ltd Health Care 129 815 445 0.48% 0.48%<br />

ship Healthcare <strong>Holding</strong>s inc Health Care 28 473 007 0.53% 0.53%<br />

shiroki Corp Consumer Goods 100 991 0.01% 0.01%<br />

shiseido Co ltd Consumer Goods 435 479 608 0.99% 0.99%<br />

shizuki electric Co inc industrials 3 966 895 0.55% 0.55%<br />

shizuoka bank ltd/the Financials 211 <strong>31</strong>2 435 0.49% 0.49%<br />

shizuoka Gas Co ltd utilities 48 720 974 1.69% 1.69%<br />

sHo-bonD <strong>Holding</strong>s Co ltd industrials 17 515 258 0.46% 0.46%<br />

shochiku Co ltd Consumer services 18 597 913 0.24% 0.24%<br />

shoei Co ltd/Chiyoda-ku Financials 3 001 458 0.29% 0.29%<br />

shoko Co ltd basic m<strong>at</strong>erials 158 235 0.02% 0.02%<br />

showa Corp Consumer Goods 5 682 506 0.22% 0.22%<br />

showa Denko KK basic m<strong>at</strong>erials 89 495 534 0.49% 0.49%<br />

showa sangyo Co ltd Consumer Goods 2 849 397 0.09% 0.09%<br />

showa shell sekiyu KK oil & Gas 72 204 780 0.48% 0.48%<br />

siix Corp industrials 5 906 362 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

simplex <strong>Holding</strong>s inc technology 80 989 0.01% 0.01%<br />

sinanen Co ltd oil & Gas 237 353 0.01% 0.01%<br />

sinfonia technology Co ltd industrials 1 826 686 0.10% 0.10%<br />

sinko industries ltd industrials 15 416 299 2.76% 2.76%<br />

sintokogio ltd industrials 5 074 929 0.17% 0.17%<br />

sKY Perfect Js<strong>at</strong> <strong>Holding</strong>s inc Consumer services 10 567 297 0.10% 0.10%<br />

skymark airlines inc Consumer services 57 628 097 0.80% 0.80%<br />

smC Corp/Japan industrials 781 296 681 1.13% 1.13%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

smK Corp industrials 6 122 540 0.40% 0.40%<br />

sodick Co ltd industrials 14 828 866 0.95% 0.95%<br />

s<strong>of</strong>tbank Corp telecommunic<strong>at</strong>ions 1 475 053 375 0.76% 0.76%<br />

sohgo security services Co ltd industrials 17 043 423 0.27% 0.27%<br />

sojitz Corp industrials 76 526 377 0.66% 0.66%<br />

so-net entertainment Corp technology 16 055 748 0.29% 0.29%<br />

sony Corp Consumer Goods 604 860 418 0.54% 0.56%<br />

sony Financial <strong>Holding</strong>s inc Financials 1 220 614 451 3.19% 3.19%<br />

sosei Group Corp Health Care 51 412 989 4.41% 4.42%<br />

sotetsu <strong>Holding</strong>s inc Consumer services 46 221 749 0.51% 0.51%<br />

square enix <strong>Holding</strong>s Co ltd technology 36 321 103 0.27% 0.27%<br />

sra <strong>Holding</strong>s technology 7 622 904 0.82% 0.82%<br />

sri sports ltd Consumer Goods 3 299 460 0.17% 0.17%<br />

st Corp basic m<strong>at</strong>erials 1 815 136 0.10% 0.10%<br />

st marc <strong>Holding</strong>s Co ltd Consumer services 8 072 440 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

stanley electric Co ltd Consumer Goods 110 009 983 0.70% 0.70%<br />

star micronics Co ltd industrials 12 640 093 0.50% 0.50%<br />

start today Co ltd Consumer services 143 398 847 0.93% 0.93%<br />

starzen Co ltd Consumer Goods 1 164 658 0.07% 0.07%<br />

stella Chemifa Corp basic m<strong>at</strong>erials 101 845 867 4.56% 4.56%<br />

studio alice Co ltd Consumer services 139 968 0.01% 0.01%<br />

sugi <strong>Holding</strong>s Co ltd Consumer services 99 <strong>31</strong>7 920 0.90% 0.90%<br />

sumco Corp technology 18 637 816 0.16% 0.16%<br />

sumida Corp industrials 103 256 0.01% 0.01%<br />

sumikin bussan Corp basic m<strong>at</strong>erials 2 828 455 0.11% 0.11%<br />

sumitomo bakelite Co ltd basic m<strong>at</strong>erials 43 709 451 0.50% 0.50%<br />

sumitomo Chemical Co ltd basic m<strong>at</strong>erials 332 070 325 0.92% 0.92%<br />

sumitomo Corp industrials 888 937 950 0.88% 0.88%<br />

sumitomo electric industries ltd Consumer Goods 709 267 446 1.37% 1.37%<br />

sumitomo Forestry Co ltd Consumer Goods 53 156 908 0.57% 0.57%<br />

sumitomo Heavy industries ltd industrials 104 760 405 0.49% 0.49%<br />

sumitomo light metal industries ltd basic m<strong>at</strong>erials 17 303 642 0.54% 0.54%<br />

sumitomo metal industries ltd basic m<strong>at</strong>erials 42 747 577 0.08% 0.08%<br />

sumitomo metal mining Co ltd basic m<strong>at</strong>erials 210 221 774 0.47% 0.47%<br />

sumitomo mitsui Construction Co ltd industrials 110 369 0.01% 0.01%<br />

sumitomo mitsui Financial Group inc Financials 2 403 355 902 1.<strong>31</strong>% 1.<strong>31</strong>%<br />

sumitomo mitsui trust <strong>Holding</strong>s inc Financials 817 193 261 1.12% 1.12%<br />

sumitomo osaka Cement Co ltd industrials 44 141 670 0.63% 0.63%<br />

sumitomo Precision Products Co ltd industrials 5 625 262 0.29% 0.29%<br />

sumitomo real est<strong>at</strong>e sales Co ltd Financials 15 742 675 0.24% 0.24%<br />

sumitomo realty & Development Co ltd Financials 320 653 004 0.64% 0.64%<br />

sumitomo rubber industries ltd Consumer Goods 59 006 938 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

sumitomo seika Chemicals Co ltd basic m<strong>at</strong>erials 2 010 518 0.11% 0.11%<br />

sumitomo Warehouse Co ltd/the industrials 16 420 783 0.30% 0.30%<br />

sundrug Co ltd Consumer services 21 073 053 0.17% 0.17%<br />

suruga bank ltd Financials 70 063 997 0.51% 0.51%<br />

suruga Corp Financials 0 0.05% 0.05%<br />

suzuken Co ltd Health Care 50 220 726 0.32% 0.32%<br />

suzuki motor Corp Consumer Goods 3<strong>31</strong> 827 590 0.48% 0.48%<br />

sWCC showa <strong>Holding</strong>s Co ltd industrials 10 186 005 0.61% 0.61%<br />

sysmex Corp Health Care 422 065 835 2.11% 2.11%<br />

t Hasegawa Co ltd basic m<strong>at</strong>erials 2 619 607 0.07% 0.07%<br />

t raD Co ltd Consumer Goods 44 088 289 2.67% 2.67%<br />

t&D <strong>Holding</strong>s inc Financials 559 896 495 1.48% 1.48%<br />

tachi-s Co ltd Consumer Goods 6 252 649 0.17% 0.17%<br />

tadano ltd industrials 20 130 <strong>31</strong>3 0.41% 0.41%<br />

taihei Dengyo Kaisha ltd industrials 10 320 660 0.52% 0.52%<br />

taihei Kogyo Co ltd industrials 8 173 159 0.33% 0.33%<br />

taiheiyo Cement Corp industrials 63 720 585 0.45% 0.45%<br />

taiho Kogyo Co ltd Consumer Goods 145 297 0.01% 0.01%<br />

taikisha ltd industrials 25 486 459 0.54% 0.54%<br />

taisei Corp industrials 84 949 926 0.49% 0.49%<br />

taisei lamick Co ltd industrials 900 265 0.08% 0.08%<br />

taisho Pharmaceutical <strong>Holding</strong>s Co ltd Health Care 200 282 077 0.48% 0.48%<br />

taiyo <strong>Holding</strong>s Co ltd basic m<strong>at</strong>erials 9 735 748 0.23% 0.23%<br />

taiyo nippon sanso Corp basic m<strong>at</strong>erials 84 079 397 0.50% 0.50%<br />

taiyo Yuden Co ltd industrials 36 865 084 0.69% 0.69%<br />

takam<strong>at</strong>su Construction Group Co ltd industrials 189 107 0.01% 0.01%<br />

takaoka electric manufacturing Co ltd industrials 6 322 428 0.47% 0.47%<br />

takara <strong>Holding</strong>s inc Consumer Goods 40 391 867 0.48% 0.48%<br />

takara leben Co ltd Financials 49 <strong>31</strong>5 217 4.19% 4.19%<br />

takara standard Co ltd Consumer Goods 14 400 801 0.22% 0.22%<br />

takasago intern<strong>at</strong>ional Corp basic m<strong>at</strong>erials 6 202 821 0.22% 0.22%<br />

takasago thermal engineering Co ltd industrials 13 463 909 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

takashimaya Co ltd Consumer services 67 118 241 0.47% 0.47%<br />

tak<strong>at</strong>a Corp Consumer Goods 34 216 226 0.34% 0.34%<br />

takeda Pharmaceutical Co ltd Health Care 998 662 360 0.48% 0.48%<br />

takihyo Co ltd Consumer Goods 1 738 260 0.11% 0.11%<br />

takiron Co ltd industrials 1 700 563 0.11% 0.11%<br />

takuma Co ltd industrials 13 726 130 0.64% 0.64%<br />

tamron Co ltd Consumer Goods 17 558 548 0.44% 0.44%<br />

tamura Corp industrials 32 098 170 2.72% 2.72%<br />

tanaka Chemical Corp basic m<strong>at</strong>erials 11 856 868 2.08% 2.08%<br />

t<strong>at</strong>suta electric Wire and Cable Co ltd industrials 5 681 575 0.32% 0.32%<br />

tDK Corp industrials 250 718 942 0.73% 0.73%<br />

tecmo Koei <strong>Holding</strong>s Co ltd technology 7 671 616 0.17% 0.17%<br />

teijin ltd basic m<strong>at</strong>erials 90 643 397 0.50% 0.50%<br />

teikoku electric manufacturing Co ltd industrials 7 359 101 0.73% 0.73%<br />

tekken Corp industrials 546 610 0.05% 0.05%<br />

tenma Corp Consumer Goods 373 559 0.02% 0.02%<br />

tenpos busters Co ltd Consumer services 7 307 326 1.49% 1.48%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

23<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011