Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

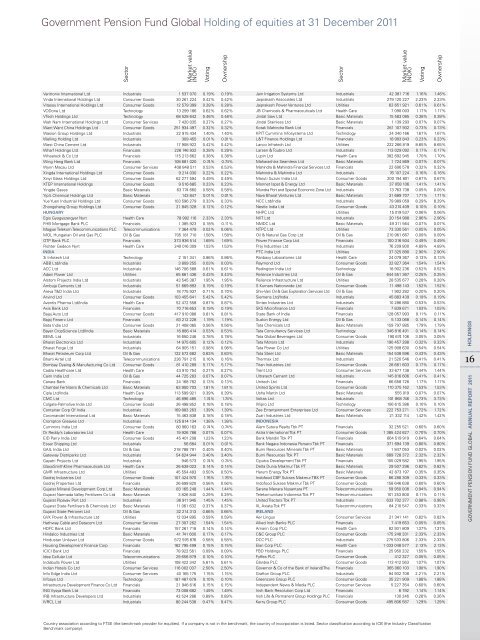

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

varitronix intern<strong>at</strong>ional ltd industrials 1 537 070 0.19% 0.19%<br />

vinda intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer Goods 30 261 224 0.42% 0.42%<br />

vitasoy intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer Goods 12 579 399 0.28% 0.28%<br />

voDone ltd technology 13 299 186 0.62% 0.62%<br />

vtech <strong>Holding</strong>s ltd technology 68 528 642 0.46% 0.46%<br />

Wah nam intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 7 420 035 0.27% 0.27%<br />

Want Want China <strong>Holding</strong>s ltd Consumer Goods 251 934 497 0.32% 0.32%<br />

Wasion Group <strong>Holding</strong>s ltd industrials 22 915 434 1.40% 1.40%<br />

Welling <strong>Holding</strong> ltd industrials 309 455 0.01% 0.01%<br />

West China Cement ltd industrials 17 908 922 0.42% 0.42%<br />

Wharf <strong>Holding</strong>s ltd Financials 226 746 932 0.28% 0.28%<br />

Wheelock & Co ltd Financials 115 213 662 0.38% 0.38%<br />

Wing Hang bank ltd Financials 108 681 020 0.74% 0.74%<br />

Wynn macau ltd Consumer services 408 848 511 0.53% 0.53%<br />

Xingda intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer Goods 9 214 030 0.22% 0.22%<br />

Xinyi Glass <strong>Holding</strong>s ltd Consumer Goods 62 277 594 0.49% 0.49%<br />

XteP intern<strong>at</strong>ional <strong>Holding</strong>s Consumer Goods 9 516 685 0.23% 0.23%<br />

Yingde Gases basic m<strong>at</strong>erials 63 774 660 0.58% 0.58%<br />

Yip’s Chemical <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 143 847 0.01% 0.01%<br />

Yue Yuen industrial <strong>Holding</strong>s ltd Consumer Goods 103 596 279 0.33% 0.33%<br />

Zhongsheng Group <strong>Holding</strong>s ltd Consumer Goods 21 845 328 0.12% 0.12%<br />

HUNgARy<br />

egis Gyogyszergyar nyrt Health Care 78 992 116 2.33% 2.33%<br />

FHb mortgage bank PlC Financials 1 385 923 0.18% 0.11%<br />

magyar telekom telecommunic<strong>at</strong>ions PlC telecommunic<strong>at</strong>ions 7 364 479 0.02% 0.06%<br />

mol Hungarian oil and Gas PlC oil & Gas 705 181 710 1.58% 1.58%<br />

otP bank PlC Financials 373 936 514 1.69% 1.69%<br />

richter Gedeon nyrt Health Care 240 016 309 1.53% 1.53%<br />

iNdiA<br />

3i infotech ltd technology 2 151 341 0.86% 0.86%<br />

abb ltd/india industrials 3 809 255 0.03% 0.03%<br />

aCC ltd industrials 146 706 588 0.61% 0.61%<br />

adani Power ltd utilities 65 661 436 0.43% 0.43%<br />

alstom Projects india ltd industrials 43 545 387 1.95% 1.95%<br />

ambuja Cements ltd industrials 51 669 893 0.19% 0.19%<br />

areva t&D india ltd industrials 18 775 937 0.71% 0.70%<br />

arvind ltd Consumer Goods 103 455 641 5.42% 5.42%<br />

aventis Pharma ltd/india Health Care 52 472 558 0.87% 0.87%<br />

axis bank ltd Financials 70 716 653 0.19% 0.19%<br />

bajaj auto ltd Consumer Goods 417 910 088 0.81% 0.81%<br />

bajaj Finserv ltd Financials 83 212 228 1.19% 1.19%<br />

b<strong>at</strong>a india ltd Consumer Goods 21 408 065 0.56% 0.56%<br />

bayer Cropscience ltd/india basic m<strong>at</strong>erials 16 886 414 0.53% 0.53%<br />

beml ltd industrials 16 650 246 0.78% 0.78%<br />

bhar<strong>at</strong> electronics ltd industrials 14 975 605 0.12% 0.12%<br />

bhar<strong>at</strong> Forge ltd industrials 64 905 151 0.98% 0.98%<br />

bhar<strong>at</strong> Petroleum Corp ltd oil & Gas 122 572 682 0.63% 0.63%<br />

bharti airtel ltd telecommunic<strong>at</strong>ions 236 791 215 0.16% 0.16%<br />

bombay Dyeing & manufacturing Co ltd Consumer Goods 81 410 289 5.17% 5.17%<br />

Cadila Healthcare ltd Health Care 43 910 754 0.27% 0.27%<br />

Cairn india ltd oil & Gas 44 725 283 0.07% 0.07%<br />

Canara bank Financials 24 168 782 0.13% 0.13%<br />

Chambal Fertilizers & Chemicals ltd basic m<strong>at</strong>erials 63 950 703 1.81% 1.81%<br />

Cipla ltd/india Health Care 113 599 921 0.39% 0.39%<br />

CmC ltd technology 46 896 485 1.74% 1.74%<br />

Colg<strong>at</strong>e-Palmolive india ltd Consumer Goods 26 498 852 0.18% 0.18%<br />

Container Corp <strong>of</strong> india industrials 169 883 263 1.39% 1.39%<br />

Coromandel intern<strong>at</strong>ional ltd basic m<strong>at</strong>erials 15 463 838 0.18% 0.18%<br />

Crompton Greaves ltd industrials 125 814 134 1.38% 1.38%<br />

Cummins india ltd Consumer Goods 80 960 163 0.74% 0.74%<br />

Dr reddy’s labor<strong>at</strong>ories ltd Health Care 19 926 786 0.07% 0.07%<br />

eiD Parry india ltd Consumer Goods 45 401 208 1.23% 1.23%<br />

essar shipping ltd industrials 56 684 0.01% 0.01%<br />

Gail india ltd oil & Gas 218 788 791 0.40% 0.40%<br />

G<strong>at</strong>eway Distriparks ltd industrials 54 624 944 3.40% 3.40%<br />

Gay<strong>at</strong>ri Projects ltd industrials 946 573 0.74% 0.74%<br />

GlaxosmithKline Pharmaceuticals ltd Health Care 26 639 023 0.14% 0.14%<br />

Gmr infrastructure ltd utilities 45 554 483 0.50% 0.50%<br />

Godrej industries ltd Consumer Goods 107 424 970 1.76% 1.76%<br />

Godrej Properties ltd Financials 26 699 820 0.56% 0.56%<br />

Gujar<strong>at</strong> mineral Development Corp ltd basic m<strong>at</strong>erials 83 165 248 1.44% 1.44%<br />

Gujar<strong>at</strong> narmada valley Fertilizers Co ltd basic m<strong>at</strong>erials 3 826 840 0.29% 0.29%<br />

Gujar<strong>at</strong> Pipavav Port ltd industrials 36 911 945 1.45% 1.45%<br />

Gujar<strong>at</strong> st<strong>at</strong>e Fertilisers & Chemicals ltd basic m<strong>at</strong>erials 11 061 632 0.37% 0.37%<br />

Gujar<strong>at</strong> st<strong>at</strong>e Petronet ltd oil & Gas 32 214 <strong>31</strong>3 0.66% 0.66%<br />

GvK Power & infrastructure ltd utilities 12 034 895 0.59% 0.59%<br />

H<strong>at</strong>hway Cable and D<strong>at</strong>acom ltd Consumer services 27 307 262 1.54% 1.54%<br />

HDFC bank ltd Financials 157 261 718 0.14% 0.14%<br />

Hindalco industries ltd basic m<strong>at</strong>erials 41 741 600 0.17% 0.17%<br />

Hindustan unilever ltd Consumer Goods 572 976 876 0.58% 0.58%<br />

Housing Development Finance Corp Financials 162 795 499 0.15% 0.15%<br />

iCiCi bank ltd Financials 78 922 561 0.09% 0.09%<br />

idea Cellular ltd telecommunic<strong>at</strong>ions 29 656 879 0.10% 0.10%<br />

indiabulls Power ltd utilities 108 422 342 5.61% 5.61%<br />

indian Hotels Co ltd Consumer services 116 002 037 2.50% 2.50%<br />

info edge india ltd Consumer services 40 165 175 1.15% 1.15%<br />

infosys ltd technology 187 487 679 0.10% 0.10%<br />

infrastructure Development Finance Co ltd Financials 21 946 616 0.15% 0.15%<br />

inG vysya bank ltd Financials 73 008 682 1.49% 1.49%<br />

irb infrastructure Developers ltd industrials 43 524 286 0.89% 0.89%<br />

ivrCl ltd industrials 80 244 538 9.47% 9.47%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

Jain irrig<strong>at</strong>ion systems ltd industrials 42 381 716 1.16% 1.46%<br />

Jaiprakash associ<strong>at</strong>es ltd industrials 279 120 227 2.23% 2.23%<br />

Jaiprakash Power ventures ltd utilities 62 651 921 0.61% 0.61%<br />

Jb Chemicals & Pharmaceuticals ltd Health Care 7 090 003 1.17% 1.17%<br />

Jindal saw ltd basic m<strong>at</strong>erials 15 583 085 0.38% 0.38%<br />

Jindal stainless ltd basic m<strong>at</strong>erials 1 139 293 0.07% 0.07%<br />

Kotak mahindra bank ltd Financials 261 107 932 0.73% 0.73%<br />

KPit Cummins infosystems ltd technology 24 340 166 1.67% 1.67%<br />

l&t Finance <strong>Holding</strong>s ltd Financials 18 993 843 0.23% 0.23%<br />

lanco infr<strong>at</strong>ech ltd utilities 222 266 819 8.65% 8.65%<br />

larsen & toubro ltd industrials 113 029 092 0.17% 0.17%<br />

lupin ltd Health Care 382 692 945 1.70% 1.70%<br />

maharashtra seamless ltd basic m<strong>at</strong>erials 1 724 869 0.07% 0.07%<br />

mahindra & mahindra Financial services ltd Financials 22 606 578 0.32% 0.32%<br />

mahindra & mahindra ltd industrials 76 107 224 0.16% 0.16%<br />

maruti suzuki india ltd Consumer Goods 200 194 801 0.67% 0.67%<br />

monnet isp<strong>at</strong> & energy ltd basic m<strong>at</strong>erials 37 058 106 1.41% 1.41%<br />

mundra Port and special economic Zone ltd industrials 13 763 738 0.05% 0.05%<br />

nava bhar<strong>at</strong> ventures ltd basic m<strong>at</strong>erials <strong>31</strong> 689 707 1.71% 1.71%<br />

nCC ltd/india industrials 79 989 059 8.29% 8.29%<br />

nestle india ltd Consumer Goods 43 274 409 0.10% 0.10%<br />

nHPC ltd utilities 15 019 537 0.06% 0.06%<br />

niit ltd industrials 20 154 988 2.96% 2.96%<br />

nmDC ltd basic m<strong>at</strong>erials 49 <strong>31</strong>1 564 0.07% 0.07%<br />

ntPC ltd utilities 73 330 561 0.05% 0.05%<br />

oil & n<strong>at</strong>ural Gas Corp ltd oil & Gas 210 961 667 0.09% 0.09%<br />

Power Finance Corp ltd Financials 100 <strong>31</strong>6 504 0.49% 0.49%<br />

Praj industries ltd industrials 76 209 800 4.89% 4.89%<br />

PtC india ltd utilities 37 325 890 2.90% 2.90%<br />

ranbaxy labor<strong>at</strong>ories ltd Health Care 24 079 367 0.13% 0.13%<br />

raymond ltd Consumer Goods 32 827 364 1.54% 1.54%<br />

redington india ltd technology 18 902 236 0.52% 0.52%<br />

reliance industries ltd oil & Gas 644 551 367 0.25% 0.25%<br />

reliance infrastructure ltd utilities 28 535 677 0.28% 0.28%<br />

s Kumars n<strong>at</strong>ionwide ltd Consumer Goods 11 498 143 1.52% 1.52%<br />

shiv-vani oil & Gas explor<strong>at</strong>ion services ltd oil & Gas 1 902 282 0.20% 0.20%<br />

siemens ltd/india industrials 45 883 439 0.19% 0.19%<br />

sintex industries ltd industrials 10 286 880 0.53% 0.53%<br />

sKs micr<strong>of</strong>inance ltd Financials 7 839 671 1.03% 1.03%<br />

st<strong>at</strong>e bank <strong>of</strong> india Financials 128 057 993 0.11% 0.11%<br />

suzlon energy ltd oil & Gas 5 133 068 0.14% 0.14%<br />

t<strong>at</strong>a Chemicals ltd basic m<strong>at</strong>erials 159 797 885 1.79% 1.79%<br />

t<strong>at</strong>a Consultancy services ltd technology 346 816 491 0.14% 0.14%<br />

t<strong>at</strong>a <strong>Global</strong> beverages ltd Consumer Goods 190 674 106 3.05% 3.05%<br />

t<strong>at</strong>a motors ltd industrials 190 457 288 0.32% 0.33%<br />

t<strong>at</strong>a Power Co ltd utilities 125 908 630 0.54% 0.54%<br />

t<strong>at</strong>a steel ltd basic m<strong>at</strong>erials 154 538 596 0.43% 0.43%<br />

thermax ltd industrials 21 520 546 0.41% 0.41%<br />

titan industries ltd Consumer Goods 28 681 603 0.17% 0.17%<br />

trent ltd Consumer services 33 677 138 1.44% 1.44%<br />

ultr<strong>at</strong>ech Cement ltd industrials 145 816 606 0.41% 0.41%<br />

unitech ltd Financials 66 658 726 1.17% 1.17%<br />

united spirits ltd Consumer Goods 110 375 162 1.53% 1.53%<br />

usha martin ltd basic m<strong>at</strong>erials 555 019 0.07% 0.07%<br />

voltas ltd industrials 101 868 746 3.73% 3.73%<br />

Wipro ltd technology 106 615 386 0.10% 0.10%<br />

Zee entertainment enterprises ltd Consumer services 222 753 271 1.72% 1.72%<br />

Zuari industries ltd basic m<strong>at</strong>erials 21 332 114 1.42% 1.42%<br />

iNdONEsiA<br />

alam sutera realty tbk Pt Financials 32 255 521 0.60% 0.60%<br />

astra intern<strong>at</strong>ional tbk Pt Consumer Goods 1 385 424 627 0.70% 0.70%<br />

bank mandiri tbk Pt Financials 664 519 919 0.64% 0.64%<br />

bank negara indonesia Persero tbk Pt Financials 371 694 139 0.80% 0.80%<br />

bumi resources minerals tbk Pt basic m<strong>at</strong>erials 1 847 053 0.02% 0.02%<br />

bumi resources tbk Pt basic m<strong>at</strong>erials 689 728 372 2.32% 2.32%<br />

Ciputra Development tbk Pt Financials 105 029 582 1.95% 1.95%<br />

Delta Dunia makmur tbk Pt basic m<strong>at</strong>erials 29 507 296 0.82% 0.82%<br />

Harum energy tbk Pt basic m<strong>at</strong>erials 42 873 197 0.35% 0.35%<br />

ind<strong>of</strong>ood CbP sukses makmur tbK Pt Consumer Goods 66 288 309 0.33% 0.33%<br />

ind<strong>of</strong>ood sukses makmur tbk Pt Consumer Goods 158 646 638 0.60% 0.60%<br />

sarana menara nusantara Pt telecommunic<strong>at</strong>ions 59 950 008 0.94% 0.94%<br />

telekomunikasi indonesia tbk Pt telecommunic<strong>at</strong>ions 101 253 800 0.11% 0.11%<br />

united tractors tbk Pt industrials 633 702 377 0.98% 0.98%<br />

Xl axi<strong>at</strong>a tbk Pt telecommunic<strong>at</strong>ions 84 210 547 0.33% 0.33%<br />

iRELANd<br />

aer lingus Consumer services 21 341 141 0.82% 0.82%<br />

allied irish banks PlC Financials 7 419 653 0.05% 0.05%<br />

amarin Corp PlC Health Care 82 9<strong>31</strong> 809 1.37% 1.37%<br />

C&C Group PlC Consumer Goods 175 248 3<strong>31</strong> 2.33% 2.33%<br />

DCC PlC industrials 275 533 806 2.33% 2.33%<br />

elan Corp PlC Health Care 1 033 048 577 2.13% 2.13%<br />

FbD <strong>Holding</strong>s PlC Financials 25 950 232 1.55% 1.55%<br />

Fyffes PlC Consumer Goods 412 327 0.05% 0.05%<br />

Glanbia PlC Consumer Goods 113 412 563 1.07% 1.07%<br />

Governor & Co <strong>of</strong> the bank <strong>of</strong> ireland/the Financials 365 060 103 1.90% 1.90%<br />

Grafton Group PlC industrials 94 932 708 2.21% 2.21%<br />

Greencore Group PlC Consumer Goods 35 221 909 1.88% 1.88%<br />

independent news & media PlC Consumer services 5 227 354 0.60% 0.60%<br />

irish bank resolution Corp ltd Financials 6 792 1.14% 1.14%<br />

irish life & Permanent Group <strong>Holding</strong>s PlC Financials 130 246 0.26% 0.26%<br />

Kerry Group PlC Consumer Goods 495 806 587 1.29% 1.29%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

16<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011