Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

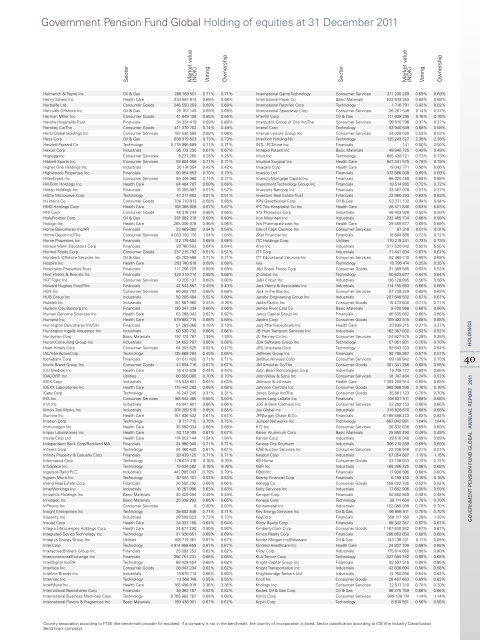

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

Helmerich & Payne inc oil & Gas 266 169 501 0.71% 0.71%<br />

Henry schein inc Health Care 234 587 614 0.68% 0.68%<br />

Herbalife ltd Consumer Goods 246 550 259 0.69% 0.69%<br />

Hercules <strong>of</strong>fshore inc oil & Gas 25 167 143 0.69% 0.69%<br />

Herman miller inc Consumer Goods 41 649 158 0.65% 0.65%<br />

Hersha Hospitality trust Financials 34 334 419 0.69% 0.69%<br />

Hershey Co/the Consumer Goods 411 370 702 0.14% 0.49%<br />

Hertz <strong>Global</strong> <strong>Holding</strong>s inc Consumer services 197 534 593 0.68% 0.68%<br />

Hess Corp oil & Gas 836 <strong>31</strong>9 523 0.73% 0.73%<br />

Hewlett-Packard Co technology 2 178 986 689 0.71% 0.71%<br />

Hexcel Corp industrials 95 172 235 0.67% 0.67%<br />

hhgregg inc Consumer services 8 237 260 0.26% 0.26%<br />

Hibbett sports inc Consumer services 50 804 058 0.71% 0.71%<br />

Higher one <strong>Holding</strong>s inc industrials 26 174 054 0.42% 0.42%<br />

Highwoods Properties inc Financials 90 054 853 0.70% 0.70%<br />

Hillenbrand inc Consumer services 59 446 968 0.71% 0.71%<br />

Hill-rom <strong>Holding</strong>s inc Health Care 84 484 707 0.68% 0.68%<br />

Hilltop <strong>Holding</strong>s inc Financials 16 355 897 0.57% 0.57%<br />

Hittite microwave Corp technology 47 217 002 0.51% 0.51%<br />

HJ Heinz Co Consumer Goods 700 710 913 0.68% 0.68%<br />

Hms <strong>Holding</strong>s Corp Health Care 108 368 828 0.67% 0.67%<br />

Hni Corp Consumer Goods 46 376 244 0.66% 0.66%<br />

HollyFrontier Corp oil & Gas 201 082 218 0.69% 0.69%<br />

Hologic inc Health Care 265 006 878 0.96% 0.96%<br />

Home bancshares inc/ar Financials 23 469 060 0.54% 0.54%<br />

Home Depot inc/the Consumer services 4 033 193 170 1.04% 1.04%<br />

Home Properties inc Financials 112 179 604 0.68% 0.68%<br />

Horace mann educ<strong>at</strong>ors Corp Financials 20 760 503 0.64% 0.64%<br />

Hormel Foods Corp Consumer Goods 237 215 792 0.51% 0.51%<br />

Hornbeck <strong>of</strong>fshore services inc oil & Gas 45 709 599 0.71% 0.71%<br />

Hospira inc Health Care 203 740 618 0.68% 0.68%<br />

Hospitality Properties trust Financials 117 256 725 0.69% 0.69%<br />

Host Hotels & resorts inc Financials 420 219 714 0.68% 0.68%<br />

Hot topic inc Consumer services 13 255 1<strong>31</strong> 0.80% 0.80%<br />

Howard Hughes Corp/the Financials 42 543 897 0.43% 0.43%<br />

Hsn inc Consumer services 86 352 703 0.68% 0.68%<br />

Hub Group inc industrials 50 205 404 0.52% 0.69%<br />

Hubbell inc industrials 181 567 960 0.23% 0.76%<br />

Hudson City bancorp inc Financials 130 347 339 0.66% 0.66%<br />

Human Genome sciences inc Health Care 63 268 042 0.62% 0.62%<br />

Humana inc Health Care 579 882 715 0.68% 0.68%<br />

Huntington bancshares inc/oH Financials 51 289 066 0.18% 0.18%<br />

Huntington ingalls industries inc industrials 60 530 732 0.66% 0.66%<br />

Huntsman Corp basic m<strong>at</strong>erials 197 173 787 1.39% 1.39%<br />

Huron Consulting Group inc industrials 34 652 707 0.66% 0.66%<br />

Hy<strong>at</strong>t Hotels Corp Consumer services 64 303 625 0.02% 0.17%<br />

iaC/interactiveCorp technology 135 668 264 0.40% 0.65%<br />

iberiabank Corp Financials 61 611 420 0.71% 0.71%<br />

iconix brand Group inc Consumer Goods 47 694 716 0.67% 0.67%<br />

iCu medical inc Health Care 16 412 638 0.44% 0.44%<br />

iDaCorP inc utilities 88 550 085 0.70% 0.70%<br />

iDeX Corp industrials 115 528 601 0.63% 0.63%<br />

iDeXX labor<strong>at</strong>ories inc Health Care 175 442 283 0.68% 0.68%<br />

iG<strong>at</strong>e Corp technology 16 243 245 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

iHs inc Consumer services 168 542 465 0.50% 0.50%<br />

ii-vi inc industrials 45 041 801 0.66% 0.66%<br />

illinois tool Works inc industrials 874 289 519 0.65% 0.65%<br />

illumina inc Health Care 151 836 532 0.67% 0.67%<br />

im<strong>at</strong>ion Corp technology 9 717 715 0.75% 0.75%<br />

immunogen inc Health Care 35 660 034 0.68% 0.68%<br />

impax labor<strong>at</strong>ories inc Health Care 53 719 105 0.67% 0.67%<br />

incyte Corp ltd Health Care 174 002 144 1.54% 1.54%<br />

independent bank Corp/rockland ma Financials 24 980 940 0.71% 0.71%<br />

infinera Corp technology 24 460 640 0.61% 0.61%<br />

infinity Property & Casualty Corp Financials 28 439 125 0.71% 0.71%<br />

inform<strong>at</strong>ica Corp technology 178 619 376 0.76% 0.76%<br />

infospace inc technology 19 624 582 0.76% 0.76%<br />

ingersoll-rand PlC industrials 447 385 043 0.79% 0.79%<br />

ingram micro inc technology 87 651 101 0.53% 0.53%<br />

inland real est<strong>at</strong>e Corp Financials 26 502 292 0.66% 0.66%<br />

innerWorkings inc industrials 16 267 996 0.63% 0.63%<br />

innophos <strong>Holding</strong>s inc basic m<strong>at</strong>erials 30 429 094 0.49% 0.49%<br />

innospec inc basic m<strong>at</strong>erials 25 338 292 0.65% 0.65%<br />

inPhonic inc Consumer services 0 0.00% 0.00%<br />

insight enterprises inc technology 28 602 846 0.71% 0.71%<br />

insperity inc industrials 28 508 623 0.73% 0.73%<br />

insulet Corp Health Care 34 037 156 0.64% 0.64%<br />

integra lifesciences <strong>Holding</strong>s Corp Health Care 24 671 290 0.50% 0.50%<br />

integr<strong>at</strong>ed Device technology inc technology <strong>31</strong> 938 651 0.69% 0.69%<br />

integrys energy Group inc utilities 168 719 361 0.67% 0.67%<br />

intel Corp technology 4 914 858 659 0.67% 0.67%<br />

interactive brokers Group inc Financials 25 093 253 0.62% 0.62%<br />

intercontinentalexchange inc Financials 356 751 2<strong>31</strong> 0.68% 0.68%<br />

interDigital inc/Pa technology 80 429 454 0.68% 0.68%<br />

interface inc Consumer Goods 28 043 234 0.62% 0.62%<br />

interline brands inc industrials 19 678 713 0.66% 0.66%<br />

intermec inc technology 13 568 749 0.55% 0.55%<br />

intermune inc Health Care 165 496 919 3.36% 3.36%<br />

intern<strong>at</strong>ional bancshares Corp Financials 38 362 167 0.52% 0.52%<br />

intern<strong>at</strong>ional business machines Corp technology 8 765 983 787 0.68% 0.68%<br />

intern<strong>at</strong>ional Flavors & Fragrances inc basic m<strong>at</strong>erials 169 436 301 0.67% 0.67%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

intern<strong>at</strong>ional Game technology Consumer services 211 230 269 0.69% 0.69%<br />

intern<strong>at</strong>ional Paper Co basic m<strong>at</strong>erials 522 633 353 0.68% 0.68%<br />

intern<strong>at</strong>ional rectifier Corp technology 1 716 791 0.02% 0.02%<br />

intern<strong>at</strong>ional speedway Corp Consumer services 26 261 549 0.14% 0.37%<br />

interoil Corp oil & Gas 111 639 295 0.76% 0.76%<br />

interpublic Group <strong>of</strong> Cos inc/the Consumer services 98 910 796 0.37% 0.37%<br />

intersil Corp technology 53 940 649 0.68% 0.68%<br />

interval leisure Group inc Consumer services 24 028 030 0.53% 0.53%<br />

interXion <strong>Holding</strong> nv technology 125 243 527 2.38% 2.38%<br />

intl. FCstone inc Financials 141 0.00% 0.00%<br />

intrepid Potash inc basic m<strong>at</strong>erials 49 840 725 0.49% 0.49%<br />

intuit inc technology 685 438 121 0.73% 0.73%<br />

intuitive surgical inc Health Care 847 341 575 0.79% 0.79%<br />

invacare Corp Health Care 19 042 771 0.50% 0.66%<br />

invesco ltd Financials 372 866 009 0.69% 0.69%<br />

invesco mortgage Capital inc Financials 66 025 180 0.68% 0.68%<br />

investment technology Group inc Financials 18 514 805 0.72% 0.72%<br />

investors bancorp inc Financials 33 467 078 0.37% 0.37%<br />

investors real est<strong>at</strong>e trust Financials 22 960 293 0.63% 0.63%<br />

ion Geophysical Corp oil & Gas 53 371 132 0.94% 0.94%<br />

iPC the Hospitalist Co inc Health Care 28 471 840 0.63% 0.63%<br />

iPG Photonics Corp industrials 48 403 928 0.50% 0.50%<br />

iron mountain inc industrials 232 465 734 0.68% 0.68%<br />

isis Pharmaceuticals inc Health Care 29 455 877 0.69% 0.69%<br />

isle <strong>of</strong> Capri Casinos inc Consumer services 87 <strong>31</strong>8 0.01% 0.01%<br />

istar Financial inc Financials 18 694 666 0.72% 0.72%<br />

itC <strong>Holding</strong>s Corp utilities 170 219 241 0.73% 0.73%<br />

itron inc industrials 517 620 042 5.95% 5.95%<br />

itt Corp industrials 71 441 934 0.67% 0.67%<br />

itt educ<strong>at</strong>ional services inc Consumer services 62 469 710 0.69% 0.69%<br />

ixia technology 10 796 474 0.25% 0.25%<br />

J&J snack Foods Corp Consumer Goods <strong>31</strong> 369 565 0.53% 0.53%<br />

j2 <strong>Global</strong> inc technology 50 633 677 0.64% 0.64%<br />

Jabil Circuit inc industrials 136 128 845 0.56% 0.56%<br />

Jack Henry & associ<strong>at</strong>es inc industrials 114 155 683 0.66% 0.66%<br />

Jack in the box inc Consumer services 37 739 229 0.69% 0.69%<br />

Jacobs engineering Group inc industrials 207 648 502 0.67% 0.67%<br />

Jakks Pacific inc Consumer Goods 15 473 600 0.71% 0.71%<br />

James river Coal Co basic m<strong>at</strong>erials 9 700 868 0.66% 0.66%<br />

Janus Capital Group inc Financials 46 505 682 0.66% 0.66%<br />

Jarden Corp Consumer Goods 109 422 515 0.68% 0.68%<br />

Jazz Pharmaceuticals inc Health Care 25 838 215 0.27% 0.27%<br />

Jb Hunt transport services inc industrials 162 367 602 0.52% 0.52%<br />

JC Penney Co inc Consumer services 124 827 575 0.28% 0.28%<br />

JDa s<strong>of</strong>tware Group inc technology 57 861 8<strong>31</strong> 0.70% 0.70%<br />

JDs uniphase Corp technology 92 843 703 0.64% 0.64%<br />

Jefferies Group inc Financials 92 785 367 0.57% 0.57%<br />

Jetblue airways Corp Consumer services 69 190 942 0.75% 0.75%<br />

Jm smucker Co/the Consumer Goods 361 341 256 0.68% 0.68%<br />

John bean technologies Corp industrials 15 749 777 0.60% 0.60%<br />

John Wiley & sons inc Consumer services 91 747 484 0.24% 0.57%<br />

Johnson & Johnson Health Care 7 334 209 914 0.69% 0.69%<br />

Johnson Controls inc Consumer Goods 969 988 595 0.76% 0.76%<br />

Jones Group inc/the Consumer Goods 35 681 123 0.70% 0.70%<br />

Jones lang lasalle inc Financials 108 827 511 0.68% 0.68%<br />

Jos a bank Clothiers inc Consumer services 53 202 153 0.66% 0.66%<br />

Joy <strong>Global</strong> inc industrials <strong>31</strong>8 828 610 0.68% 0.68%<br />

JPmorgan Chase & Co Financials 6 185 588 223 0.82% 0.82%<br />

Juniper networks inc technology 667 842 891 1.04% 1.04%<br />

K12 inc Consumer services 26 832 636 0.69% 0.69%<br />

Kaiser aluminum Corp basic m<strong>at</strong>erials 25 860 490 0.49% 0.49%<br />

Kaman Corp industrials 29 510 546 0.69% 0.69%<br />

Kansas City southern industrials 306 210 289 0.69% 0.69%<br />

Kar auction services inc Consumer services 22 708 948 0.21% 0.21%<br />

Kaydon Corp industrials 67 354 687 1.15% 1.15%<br />

Kb Home Consumer Goods 22 138 033 0.72% 0.72%<br />

Kbr inc industrials 168 386 225 0.68% 0.68%<br />

KbW inc Financials 17 938 596 0.60% 0.60%<br />

Kearny Financial Corp Financials 6 189 450 0.16% 0.16%<br />

Kellogg Co Consumer Goods 558 282 705 0.52% 0.52%<br />

Kelly services inc industrials 17 662 906 0.00% 0.59%<br />

Kemper Corp Financials 50 862 809 0.48% 0.48%<br />

Kenexa Corp technology 30 111 604 0.70% 0.70%<br />

Kennametal inc industrials 122 089 008 0.70% 0.70%<br />

Key energy services inc oil & Gas 96 896 911 0.70% 0.70%<br />

KeyCorp Financials 558 117 160 1.28% 1.28%<br />

Kilroy realty Corp Financials 88 342 347 0.67% 0.67%<br />

Kimberly-Clark Corp Consumer Goods 1 167 630 932 0.67% 0.67%<br />

Kimco realty Corp Financials 266 663 850 0.68% 0.68%<br />

Kinder morgan inc/Delaware oil & Gas 143 138 1<strong>31</strong> 0.11% 0.09%<br />

Kindred Healthcare inc Health Care 24 937 799 0.68% 0.68%<br />

Kirby Corp industrials 175 814 880 0.80% 0.80%<br />

Kla-tencor Corp technology 327 084 752 0.68% 0.68%<br />

Knight Capital Group inc Financials 55 597 516 0.80% 0.80%<br />

Knight transport<strong>at</strong>ion inc industrials 42 836 694 0.58% 0.58%<br />

Knightsbridge tankers ltd industrials 12 760 058 0.64% 0.64%<br />

Knoll inc Consumer Goods 26 467 663 0.63% 0.63%<br />

Knology inc Consumer services 22 517 <strong>31</strong>0 0.70% 0.70%<br />

Kodiak oil & Gas Corp oil & Gas 96 375 759 0.66% 0.66%<br />

Kohl’s Corp Consumer services 849 138 174 1.14% 1.14%<br />

Kopin Corp technology 8 810 561 0.56% 0.56%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

40<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011