Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

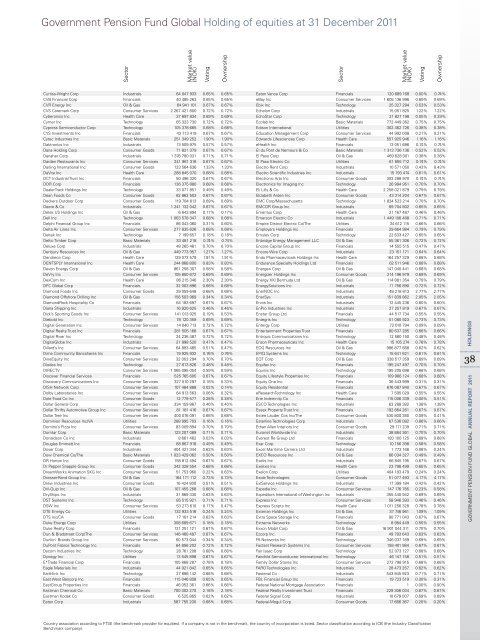

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

Curtiss-Wright Corp industrials 64 047 933 0.65% 0.65%<br />

Cvb Financial Corp Financials 40 485 263 0.65% 0.65%<br />

Cvr energy inc oil & Gas 64 941 101 0.67% 0.67%<br />

Cvs Caremark Corp Consumer services 2 267 421 800 0.72% 0.72%<br />

Cyberonics inc Health Care 37 897 834 0.69% 0.69%<br />

Cymer inc technology 65 323 730 0.72% 0.72%<br />

Cypress semiconductor Corp technology 105 378 665 0.68% 0.68%<br />

CYs investments inc Financials 43 713 419 0.67% 0.67%<br />

Cytec industries inc basic m<strong>at</strong>erials 251 349 252 1.90% 1.90%<br />

Daktronics inc industrials 13 509 975 0.57% 0.57%<br />

Dana <strong>Holding</strong> Corp Consumer Goods 71 821 379 0.67% 0.67%<br />

Danaher Corp industrials 1 376 780 0<strong>31</strong> 0.71% 0.71%<br />

Darden restaurants inc Consumer services 241 961 <strong>31</strong>6 0.67% 0.67%<br />

Darling intern<strong>at</strong>ional inc Consumer Goods 123 564 636 1.33% 1.33%<br />

Davita inc Health Care 288 845 070 0.68% 0.68%<br />

DCt industrial trust inc Financials 50 496 320 0.67% 0.67%<br />

DDr Corp Financials 136 375 880 0.68% 0.68%<br />

Dealertrack <strong>Holding</strong>s inc technology 33 071 851 0.49% 0.49%<br />

Dean Foods Co Consumer Goods 82 862 503 0.67% 0.67%<br />

Deckers outdoor Corp Consumer Goods 119 784 613 0.69% 0.69%<br />

Deere & Co industrials 1 241 132 042 0.67% 0.67%<br />

Delek us <strong>Holding</strong>s inc oil & Gas 6 643 894 0.17% 0.17%<br />

Dell inc technology 1 063 578 347 0.68% 0.68%<br />

Delphi Financial Group inc Financials 86 043 060 0.<strong>31</strong>% 0.60%<br />

Delta air lines inc Consumer services 277 835 626 0.68% 0.68%<br />

Deltek inc technology 7 199 657 0.18% 0.18%<br />

Deltic timber Corp basic m<strong>at</strong>erials 33 481 218 0.74% 0.74%<br />

Deluxe Corp industrials 48 265 481 0.70% 0.70%<br />

Denbury resources inc oil & Gas 449 773 957 1.27% 1.27%<br />

Dendreon Corp Health Care 129 072 579 1.91% 1.91%<br />

DentsPlY intern<strong>at</strong>ional inc Health Care 244 868 800 0.83% 0.83%<br />

Devon energy Corp oil & Gas 861 258 307 0.58% 0.58%<br />

Devry inc Consumer services 105 850 672 0.69% 0.69%<br />

DexCom inc Health Care 86 215 346 2.30% 2.30%<br />

DFC <strong>Global</strong> Corp Financials 32 003 896 0.68% 0.68%<br />

Diamond Foods inc Consumer Goods 29 059 648 0.68% 0.68%<br />

Diamond <strong>of</strong>fshore Drilling inc oil & Gas 156 503 969 0.34% 0.34%<br />

Diamondrock Hospitality Co Financials 64 183 697 0.67% 0.67%<br />

Diana shipping inc industrials 16 920 625 0.46% 0.46%<br />

Dick’s sporting Goods inc Consumer services 141 013 925 0.19% 0.53%<br />

Diebold inc technology 78 120 359 0.69% 0.69%<br />

Digital Gener<strong>at</strong>ion inc Consumer services 14 040 713 0.72% 0.72%<br />

Digital realty trust inc Financials 281 505 168 0.67% 0.67%<br />

Digital river inc technology 24 236 487 0.72% 0.72%<br />

DigitalGlobe inc industrials 21 998 520 0.47% 0.47%<br />

Dillard’s inc Consumer services 64 893 465 0.51% 0.47%<br />

Dime Community bancshares inc Financials 19 925 932 0.76% 0.76%<br />

Dineequity inc Consumer services 32 003 294 0.70% 0.70%<br />

Diodes inc technology 27 613 826 0.48% 0.48%<br />

DireCtv Consumer services 1 065 095 054 0.59% 0.59%<br />

Discover Financial services Financials 525 765 605 0.67% 0.67%<br />

Discovery Communic<strong>at</strong>ions inc Consumer services 327 510 297 0.18% 0.33%<br />

DisH network Corp Consumer services 107 484 888 0.02% 0.14%<br />

Dolby labor<strong>at</strong>ories inc Consumer services 64 913 563 0.06% 0.32%<br />

Dole Food Co inc Consumer Goods 12 779 577 0.28% 0.28%<br />

Dollar General Corp Consumer services 334 159 867 0.40% 0.40%<br />

Dollar thrifty automotive Group inc Consumer services 81 181 416 0.67% 0.67%<br />

Dollar tree inc Consumer services 400 076 091 0.68% 0.68%<br />

Dominion resources inc/va utilities 288 995 703 0.16% 0.16%<br />

Domino’s Pizza inc Consumer services 83 009 894 0.70% 0.70%<br />

Domtar Corp basic m<strong>at</strong>erials 123 207 089 0.71% 0.71%<br />

Donaldson Co inc industrials 8 661 462 0.03% 0.03%<br />

Douglas emmett inc Financials 68 867 918 0.49% 0.49%<br />

Dover Corp industrials 404 421 344 0.63% 0.63%<br />

Dow Chemical Co/the basic m<strong>at</strong>erials 1 023 429 062 0.50% 0.50%<br />

Dr Horton inc Consumer Goods 158 812 494 0.67% 0.67%<br />

Dr Pepper snapple Group inc Consumer Goods 342 328 554 0.68% 0.68%<br />

DreamWorks anim<strong>at</strong>ion sKG inc Consumer services 51 753 960 0.22% 0.63%<br />

Dresser-rand Group inc oil & Gas 164 171 112 0.73% 0.73%<br />

Drew industries inc Consumer Goods 16 424 800 0.51% 0.51%<br />

Dril-Quip inc oil & Gas 107 455 268 0.68% 0.68%<br />

Dryships inc industrials <strong>31</strong> 869 330 0.63% 0.63%<br />

Dst systems inc technology 85 515 921 0.71% 0.71%<br />

DsW inc Consumer services 53 273 610 0.17% 0.47%<br />

Dte energy Co utilities 132 933 516 0.24% 0.24%<br />

Dts inc/Ca Consumer Goods 17 181 214 0.63% 0.63%<br />

Duke energy Corp utilities 308 689 671 0.18% 0.18%<br />

Duke realty Corp Financials 121 251 121 0.67% 0.67%<br />

Dun & bradstreet Corp/the Consumer services 146 460 487 0.67% 0.67%<br />

Dunkin’ brands Group inc Consumer services 60 573 044 0.34% 0.34%<br />

DuPont Fabros technology inc Financials 64 856 202 0.72% 0.72%<br />

Dycom industries inc technology 28 761 208 0.68% 0.68%<br />

Dynegy inc utilities 13 545 898 0.67% 0.67%<br />

e*trade Financial Corp Financials 105 868 287 0.78% 0.78%<br />

eagle m<strong>at</strong>erials inc industrials 44 921 842 0.65% 0.65%<br />

earthlink inc technology 27 686 142 0.68% 0.68%<br />

east West bancorp inc Financials 115 046 808 0.65% 0.65%<br />

eastGroup Properties inc Financials 46 052 361 0.66% 0.66%<br />

eastman Chemical Co basic m<strong>at</strong>erials 700 302 270 2.18% 2.18%<br />

eastman Kodak Co Consumer Goods 6 525 865 0.62% 0.62%<br />

e<strong>at</strong>on Corp industrials 587 755 200 0.68% 0.68%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

e<strong>at</strong>on vance Corp Financials 120 689 168 0.00% 0.74%<br />

ebay inc Consumer services 1 605 136 996 0.69% 0.69%<br />

ebix inc technology 25 327 294 0.53% 0.53%<br />

echelon Corp industrials 15 051 825 1.22% 1.22%<br />

echostar Corp technology <strong>31</strong> 827 198 0.05% 0.29%<br />

ecolab inc basic m<strong>at</strong>erials 772 449 362 0.75% 0.75%<br />

edison intern<strong>at</strong>ional utilities 302 462 726 0.38% 0.38%<br />

educ<strong>at</strong>ion management Corp Consumer services 44 992 008 0.21% 0.21%<br />

edwards lifesciences Corp Health Care 557 925 946 1.16% 1.16%<br />

eHealth inc Financials 13 051 686 0.74% 0.74%<br />

ei du Pont de nemours & Co basic m<strong>at</strong>erials 1 <strong>31</strong>3 736 136 0.52% 0.52%<br />

el Paso Corp oil & Gas 469 628 001 0.38% 0.38%<br />

el Paso electric Co utilities 61 655 712 0.74% 0.74%<br />

electro rent Corp industrials 10 571 050 0.43% 0.43%<br />

electro scientific industries inc industrials 15 193 474 0.61% 0.61%<br />

electronic arts inc Consumer Goods 303 288 970 0.74% 0.74%<br />

electronics for imaging inc technology 26 994 951 0.70% 0.70%<br />

eli lilly & Co Health Care 2 258 021 879 0.79% 0.79%<br />

elizabeth arden inc Consumer Goods 43 <strong>31</strong>4 204 0.67% 0.67%<br />

emC Corp/massachusetts technology 1 834 523 214 0.70% 0.70%<br />

emCor Group inc industrials 69 704 802 0.65% 0.65%<br />

emeritus Corp Health Care 21 167 487 0.46% 0.46%<br />

emerson electric Co industrials 1 449 106 468 0.71% 0.71%<br />

empire District electric Co/the utilities 34 612 115 0.66% 0.66%<br />

employers <strong>Holding</strong>s inc Financials 29 664 984 0.79% 0.79%<br />

emulex Corp technology 22 633 427 0.65% 0.65%<br />

enbridge energy management llC oil & Gas 55 361 306 0.72% 0.72%<br />

encore Capital Group inc Financials 14 555 515 0.47% 0.47%<br />

encore Wire Corp industrials 23 151 171 0.64% 0.64%<br />

endo Pharmaceuticals <strong>Holding</strong>s inc Health Care 164 257 329 0.68% 0.68%<br />

endurance specialty <strong>Holding</strong>s ltd Financials 62 511 946 0.68% 0.68%<br />

energen Corp oil & Gas 147 040 441 0.68% 0.68%<br />

energizer <strong>Holding</strong>s inc Consumer Goods 214 196 979 0.69% 0.69%<br />

energy XXi bermuda ltd oil & Gas 114 881 354 0.79% 0.79%<br />

energysolutions inc industrials 11 756 890 0.72% 0.72%<br />

enernoC inc industrials 48 218 813 2.77% 2.77%<br />

enersys industrials 151 839 862 2.05% 2.05%<br />

ennis inc industrials 12 445 236 0.60% 0.60%<br />

enPro industries inc industrials 27 257 819 0.67% 0.67%<br />

enstar Group ltd Financials 44 517 734 0.55% 0.55%<br />

entegris inc technology 51 080 923 0.73% 0.73%<br />

entergy Corp utilities 72 010 794 0.09% 0.09%<br />

entertainment Properties trust Financials 80 637 285 0.66% 0.66%<br />

entropic Communic<strong>at</strong>ions inc technology 12 580 150 0.48% 0.48%<br />

enzon Pharmaceuticals inc Health Care 15 105 274 0.78% 0.78%<br />

eoG resources inc oil & Gas 986 877 668 0.62% 0.62%<br />

ePiQ systems inc technology 15 641 621 0.61% 0.61%<br />

eQt Corp oil & Gas 338 517 359 0.69% 0.69%<br />

equifax inc Financials 195 247 497 0.70% 0.70%<br />

equinix inc technology 195 205 698 0.68% 0.68%<br />

equity lifestyle Properties inc Financials 109 966 124 0.68% 0.68%<br />

equity one inc Financials 36 443 999 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

equity residential Financials 676 087 840 0.67% 0.67%<br />

eresearchtechnology inc Health Care 7 595 029 0.55% 0.55%<br />

erie indemnity Co Financials 115 006 339 0.00% 0.51%<br />

esCo technologies inc industrials 63 288 382 1.38% 1.38%<br />

essex Property trust inc Financials 192 664 261 0.67% 0.67%<br />

estee lauder Cos inc/the Consumer Goods 530 800 380 0.09% 0.41%<br />

esterline technologies Corp industrials 67 536 082 0.66% 0.66%<br />

ethan allen interiors inc Consumer Goods 29 111 239 0.71% 0.71%<br />

euronet Worldwide inc industrials 38 884 361 0.70% 0.70%<br />

everest re Group ltd Financials 183 100 125 0.68% 0.68%<br />

exar Corp technology 10 156 398 0.58% 0.58%<br />

excel maritime Carriers ltd industrials 1 773 168 0.08% 0.24%<br />

eXCo resources inc oil & Gas 66 034 327 0.49% 0.49%<br />

exelis inc industrials 66 845 195 0.67% 0.67%<br />

exelixis inc Health Care 23 798 499 0.65% 0.65%<br />

exelon Corp utilities 404 183 479 0.24% 0.24%<br />

exide technologies Consumer Goods 51 077 493 4.17% 4.17%<br />

exlservice <strong>Holding</strong>s inc industrials 17 399 184 0.42% 0.42%<br />

expedia inc Consumer services 147 176 785 0.23% 0.58%<br />

expeditors intern<strong>at</strong>ional <strong>of</strong> Washington inc industrials 355 440 942 0.69% 0.69%<br />

express inc Consumer services 58 946 393 0.46% 0.46%<br />

express scripts inc Health Care 1 011 256 328 0.78% 0.78%<br />

exterran <strong>Holding</strong>s inc oil & Gas 37 746 961 1.09% 1.09%<br />

extra space storage inc Financials 90 771 043 0.67% 0.67%<br />

extreme networks technology 8 984 449 0.55% 0.55%<br />

exxon mobil Corp oil & Gas 16 901 044 <strong>31</strong>1 0.70% 0.70%<br />

ezcorp inc Financials 49 783 643 0.63% 0.63%<br />

F5 networks inc technology 346 037 189 0.69% 0.69%<br />

Factset research systems inc Consumer services 158 401 984 0.67% 0.67%<br />

Fair isaac Corp technology 52 073 127 0.68% 0.68%<br />

Fairchild semiconductor intern<strong>at</strong>ional inc technology 46 147 158 0.51% 0.51%<br />

Family Dollar stores inc Consumer services 272 798 915 0.68% 0.68%<br />

Faro technologies inc industrials 28 473 257 0.62% 0.62%<br />

Fastenal Co industrials 543 845 923 0.71% 0.71%<br />

Fbl Financial Group inc Financials 19 723 519 0.30% 0.<strong>31</strong>%<br />

Federal n<strong>at</strong>ional mortgage associ<strong>at</strong>ion Financials 1 0.00% 0.00%<br />

Federal realty investment trust Financials 229 306 034 0.67% 0.67%<br />

Federal signal Corp industrials 10 679 007 0.69% 0.69%<br />

Federal-mogul Corp Consumer Goods 17 666 367 0.20% 0.20%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

38<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011