Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

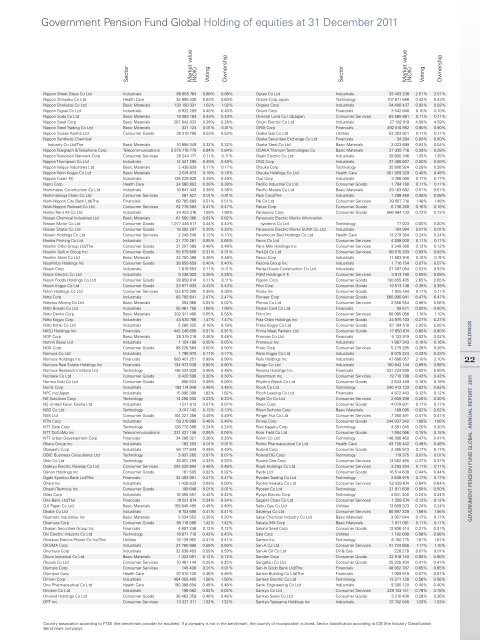

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

nippon sheet Glass Co ltd industrials 88 855 764 0.88% 0.88%<br />

nippon shinyaku Co ltd Health Care 32 899 430 0.63% 0.63%<br />

nippon shokubai Co ltd basic m<strong>at</strong>erials 133 150 3<strong>31</strong> 1.02% 1.02%<br />

nippon signal Co ltd industrials 8 922 209 0.40% 0.40%<br />

nippon soda Co ltd basic m<strong>at</strong>erials 18 083 183 0.43% 0.43%<br />

nippon steel Corp basic m<strong>at</strong>erials 267 642 033 0.26% 0.26%<br />

nippon steel trading Co ltd basic m<strong>at</strong>erials 321 124 0.01% 0.01%<br />

nippon suisan Kaisha ltd Consumer Goods 30 <strong>31</strong>0 795 0.53% 0.53%<br />

nippon synthetic Chemical<br />

industry Co ltd/the basic m<strong>at</strong>erials 10 858 349 0.32% 0.32%<br />

nippon telegraph & telephone Corp telecommunic<strong>at</strong>ions 3 375 776 779 0.84% 0.84%<br />

nippon television network Corp Consumer services 26 244 177 0.11% 0.11%<br />

nippon thompson Co ltd industrials 12 447 295 0.49% 0.49%<br />

nippon valqua industries ltd basic m<strong>at</strong>erials 2 438 839 0.17% 0.17%<br />

nippon Yakin Kogyo Co ltd basic m<strong>at</strong>erials 2 674 873 0.18% 0.18%<br />

nippon Yusen KK industrials 126 229 926 0.49% 0.49%<br />

nipro Corp Health Care 24 580 802 0.38% 0.38%<br />

nishim<strong>at</strong>su Construction Co ltd industrials 10 847 443 0.38% 0.38%<br />

nishim<strong>at</strong>suya Chain Co ltd Consumer services 281 527 0.01% 0.01%<br />

nishi-nippon City bank ltd/the Financials 69 785 689 0.51% 0.51%<br />

nishi-nippon railroad Co ltd Consumer services 52 778 583 0.47% 0.47%<br />

nishio rent all Co ltd industrials 24 453 276 1.99% 1.99%<br />

nissan Chemical industries ltd basic m<strong>at</strong>erials 61 560 366 0.62% 0.62%<br />

nissan motor Co ltd Consumer Goods 1 077 446 517 0.44% 0.44%<br />

nissan sh<strong>at</strong>ai Co ltd Consumer Goods 18 392 207 0.20% 0.20%<br />

nissen <strong>Holding</strong>s Co ltd Consumer services 2 249 546 0.13% 0.13%<br />

nissha Printing Co ltd industrials 21 770 281 0.65% 0.65%<br />

nisshin oillio Group ltd/the Consumer Goods 21 207 088 0.48% 0.48%<br />

nisshin seifun Group inc Consumer Goods 55 579 656 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

nisshin steel Co ltd basic m<strong>at</strong>erials 43 750 488 0.48% 0.48%<br />

nisshinbo <strong>Holding</strong>s inc Consumer Goods 38 650 659 0.40% 0.40%<br />

nissin Corp industrials 1 618 653 0.11% 0.11%<br />

nissin electric Co ltd industrials 9 238 920 0.26% 0.26%<br />

nissin Foods <strong>Holding</strong>s Co ltd Consumer Goods 28 858 614 0.11% 0.11%<br />

nissin Kogyo Co ltd Consumer Goods 23 977 833 0.43% 0.43%<br />

nitori <strong>Holding</strong>s Co ltd Consumer services 123 570 306 0.39% 0.39%<br />

nitta Corp industrials 83 705 641 2.47% 2.47%<br />

nittetsu mining Co ltd basic m<strong>at</strong>erials 354 866 0.02% 0.02%<br />

nitto boseki Co ltd industrials 55 461 756 1.08% 1.08%<br />

nitto Denko Corp basic m<strong>at</strong>erials 202 911 466 0.55% 0.55%<br />

nitto Kogyo Corp industrials 44 530 766 1.47% 1.47%<br />

nitto Kohki Co ltd industrials 5 280 325 0.18% 0.18%<br />

nKsJ <strong>Holding</strong>s inc Financials 442 246 658 0.91% 0.91%<br />

noF Corp basic m<strong>at</strong>erials 28 <strong>31</strong>9 218 0.48% 0.48%<br />

nohmi bosai ltd industrials 1 154 186 0.05% 0.05%<br />

noK Corp Consumer Goods 88 226 584 0.50% 0.50%<br />

nomura Co ltd industrials 1 795 970 0.17% 0.17%<br />

nomura <strong>Holding</strong>s inc Financials 683 401 251 0.99% 0.99%<br />

nomura real est<strong>at</strong>e <strong>Holding</strong>s inc Financials 134 972 038 0.80% 0.80%<br />

nomura research institute ltd technology 146 324 829 0.48% 0.48%<br />

noritake Co ltd Consumer Goods 8 420 596 0.30% 0.30%<br />

noritsu Koki Co ltd Consumer Goods 890 624 0.09% 0.09%<br />

noritz Corp industrials 192 174 948 3.48% 3.48%<br />

nPC inc/Japan industrials 15 990 398 1.82% 1.82%<br />

ns solutions Corp technology 14 290 300 0.23% 0.23%<br />

ns united Kaiun Kaisha ltd industrials 1 511 612 0.07% 0.07%<br />

nsD Co ltd technology 3 017 142 0.13% 0.13%<br />

nsK ltd Consumer Goods 104 221 358 0.49% 0.49%<br />

ntn Corp industrials 59 210 889 0.46% 0.46%<br />

ntt D<strong>at</strong>a Corp technology 128 770 366 0.24% 0.24%<br />

ntt DoComo inc telecommunic<strong>at</strong>ions 2<strong>31</strong> 421 146 0.05% 0.05%<br />

ntt urban Development Corp Financials 34 296 321 0.26% 0.26%<br />

obara Group inc industrials 182 203 0.01% 0.01%<br />

obayashi Corp industrials 94 177 843 0.49% 0.49%<br />

obiC business Consultants ltd technology 3 937 265 0.07% 0.07%<br />

obic Co ltd technology 38 001 259 0.33% 0.33%<br />

odakyu electric railway Co ltd Consumer services 204 520 894 0.48% 0.48%<br />

oenon <strong>Holding</strong>s inc Consumer Goods 181 505 0.02% 0.02%<br />

ogaki Kyoritsu bank ltd/the Financials 32 493 991 0.47% 0.47%<br />

ohara inc industrials 1 428 833 0.09% 0.09%<br />

ohashi technica inc Consumer Goods 109 648 0.01% 0.01%<br />

oiles Corp industrials 16 055 557 0.42% 0.42%<br />

oita bank ltd/the Financials 10 021 874 0.34% 0.34%<br />

oJi Paper Co ltd basic m<strong>at</strong>erials 158 846 465 0.49% 0.49%<br />

okabe Co ltd industrials 6 743 690 0.41% 0.41%<br />

okamoto industries inc basic m<strong>at</strong>erials 5 034 052 0.20% 0.20%<br />

okamura Corp Consumer Goods 65 116 586 1.42% 1.42%<br />

okasan securities Group inc Financials 4 807 248 0.12% 0.12%<br />

oki electric industry Co ltd technology 16 671 710 0.43% 0.43%<br />

okinawa electric Power Co inc/the utilities 18 139 962 0.41% 0.41%<br />

oKuma Corp industrials 37 780 986 0.59% 0.59%<br />

okumura Corp industrials 32 838 463 0.59% 0.59%<br />

okura industrial Co ltd basic m<strong>at</strong>erials 1 323 591 0.12% 0.12%<br />

okuwa Co ltd Consumer services 10 481 144 0.25% 0.25%<br />

olympic Corp Consumer services 145 406 0.01% 0.01%<br />

olympus Corp Health Care 97 610 100 0.46% 0.46%<br />

omron Corp industrials 454 055 485 1.58% 1.58%<br />

ono Pharmaceutical Co ltd Health Care 190 388 694 0.48% 0.48%<br />

onoken Co ltd industrials 199 082 0.02% 0.02%<br />

onward <strong>Holding</strong>s Co ltd Consumer Goods 36 462 359 0.48% 0.48%<br />

oPt inc Consumer services 13 321 <strong>31</strong>1 1.32% 1.32%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

optex Co ltd industrials 33 403 238 2.51% 2.51%<br />

oracle Corp Japan technology 107 611 656 0.43% 0.43%<br />

organo Corp industrials 24 400 437 0.92% 0.92%<br />

orient Corp Financials 3 542 840 0.10% 0.10%<br />

oriental land Co ltd/Japan Consumer services 63 565 881 0.11% 0.11%<br />

origin electric Co ltd industrials 27 182 019 4.59% 4.59%<br />

oriX Corp Financials 492 074 952 0.90% 0.90%<br />

osaka Gas Co ltd utilities 53 303 921 0.11% 0.11%<br />

osaka securities exchange Co ltd Financials 34 284 0.00% 0.00%<br />

osaka steel Co ltd basic m<strong>at</strong>erials 2 023 689 0.04% 0.04%<br />

osaKa titanium technologies Co basic m<strong>at</strong>erials 27 335 716 0.28% 0.28%<br />

osaki electric Co ltd industrials 29 800 346 1.35% 1.35%<br />

osG Corp industrials 37 460 607 0.50% 0.50%<br />

otsuka Corp technology 35 806 924 0.28% 0.28%<br />

otsuka <strong>Holding</strong>s Co ltd Health Care 451 559 329 0.48% 0.48%<br />

oyo Corp industrials 3 766 060 0.17% 0.17%<br />

Pacific industrial Co ltd Consumer Goods 1 784 180 0.11% 0.11%<br />

Pacific metals Co ltd basic m<strong>at</strong>erials 29 163 682 0.51% 0.51%<br />

Pack Corp/the industrials 1 298 460 0.08% 0.08%<br />

Pal Co ltd Consumer services 39 567 710 1.48% 1.48%<br />

Paltac Corp Consumer Goods 6 736 260 0.16% 0.16%<br />

Panasonic Corp Consumer Goods 566 994 133 0.72% 0.72%<br />

Panasonic electric Works inform<strong>at</strong>ion<br />

systems Co ltd technology 77 023 0.00% 0.00%<br />

Panasonic electric Works sunX Co ltd industrials 104 994 0.01% 0.01%<br />

Paramount bed <strong>Holding</strong>s Co ltd Health Care 13 279 364 0.24% 0.24%<br />

Parco Co ltd Consumer services 4 269 000 0.11% 0.11%<br />

Paris miki <strong>Holding</strong>s inc Consumer services 3 249 360 0.12% 0.12%<br />

Park24 Co ltd Consumer services 98 615 293 0.83% 0.83%<br />

Pasco Corp industrials 11 603 916 0.74% 0.74%<br />

Pasona Group inc industrials 1 716 154 0.07% 0.07%<br />

Penta-ocean Construction Co ltd industrials 27 497 054 0.53% 0.53%<br />

PGm <strong>Holding</strong>s K K Consumer services 3 913 180 0.09% 0.09%<br />

Pigeon Corp Consumer Goods 130 655 405 2.65% 2.65%<br />

Pilot Corp Consumer Goods 10 513 148 0.39% 0.39%<br />

Piolax inc Consumer Goods 1 925 164 0.11% 0.11%<br />

Pioneer Corp Consumer Goods 565 995 941 6.47% 6.47%<br />

Plenus Co ltd Consumer services 2 556 554 0.06% 0.06%<br />

Pocket Card Co ltd Financials 59 571 0.00% 0.00%<br />

Point inc Consumer services 68 085 056 1.10% 1.10%<br />

Pola orbis <strong>Holding</strong>s inc Consumer Goods 24 975 103 0.27% 0.27%<br />

Press Kogyo Co ltd Consumer Goods 67 194 510 2.05% 2.05%<br />

Prima me<strong>at</strong> Packers ltd Consumer Goods 17 650 674 0.80% 0.80%<br />

Promise Co ltd Financials 5 133 919 0.02% 0.02%<br />

Pronexus inc industrials 1 887 343 0.16% 0.16%<br />

Proto Corp Consumer services 5 279 285 0.26% 0.26%<br />

raito Kogyo Co ltd industrials 8 075 224 0.43% 0.43%<br />

relo <strong>Holding</strong>s inc industrials 47 666 057 2.10% 2.10%<br />

rengo Co ltd industrials 100 842 144 0.89% 0.89%<br />

resona <strong>Holding</strong>s inc Financials 3<strong>31</strong> 224 599 0.50% 0.50%<br />

resorttrust inc Consumer services 19 710 788 0.43% 0.43%<br />

rhythm W<strong>at</strong>ch Co ltd Consumer Goods 2 643 459 0.18% 0.18%<br />

ricoh Co ltd technology 240 413 733 0.62% 0.62%<br />

ricoh leasing Co ltd Financials 4 872 443 0.12% 0.12%<br />

right on Co ltd Consumer services 2 609 299 0.20% 0.20%<br />

riken Corp Consumer Goods 4 079 8<strong>31</strong> 0.17% 0.17%<br />

riken technos Corp basic m<strong>at</strong>erials 169 095 0.02% 0.02%<br />

ringer Hut Co ltd Consumer services 7 350 491 0.41% 0.41%<br />

rinnai Corp Consumer Goods 244 937 342 1.06% 1.06%<br />

riso Kagaku Corp technology 4 381 045 0.20% 0.20%<br />

rock Field Co ltd Consumer Goods 1 994 066 0.15% 0.15%<br />

rohm Co ltd technology 148 366 460 0.47% 0.47%<br />

rohto Pharmaceutical Co ltd Health Care 43 726 442 0.48% 0.48%<br />

roland Corp Consumer Goods 2 365 973 0.17% 0.17%<br />

roland DG Corp technology 119 375 0.01% 0.01%<br />

round one Corp Consumer services 13 562 465 0.37% 0.37%<br />

royal <strong>Holding</strong>s Co ltd Consumer services 3 293 294 0.11% 0.11%<br />

ryobi ltd Consumer Goods 16 514 638 0.44% 0.44%<br />

ryoden trading Co ltd technology 2 649 975 0.17% 0.17%<br />

ryohin Keikaku Co ltd Consumer services 52 339 674 0.64% 0.64%<br />

ryosan Co ltd technology 21 911 638 0.50% 0.50%<br />

ryoyo electro Corp technology 4 841 300 0.24% 0.24%<br />

sagami Chain Co ltd Consumer services 1 256 574 0.12% 0.12%<br />

saibu Gas Co ltd utilities 13 809 203 0.24% 0.24%<br />

saizeriya Co ltd Consumer services 80 997 329 1.56% 1.56%<br />

sakai Chemical industry Co ltd basic m<strong>at</strong>erials 3 957 044 0.17% 0.17%<br />

sak<strong>at</strong>a inX Corp basic m<strong>at</strong>erials 1 911 001 0.11% 0.11%<br />

sak<strong>at</strong>a seed Corp Consumer Goods 12 836 414 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

sala Corp utilities 1 192 698 0.08% 0.08%<br />

samco inc technology 6 150 175 1.81% 1.81%<br />

san-a Co ltd Consumer services 41 734 656 1.11% 1.10%<br />

san-ai oil Co ltd oil & Gas 228 278 0.01% 0.01%<br />

sanden Corp Consumer Goods 22 818 140 0.90% 0.90%<br />

sangetsu Co ltd Consumer Goods 25 205 304 0.41% 0.41%<br />

san-in Godo bank ltd/the Financials 48 962 787 0.65% 0.65%<br />

sankei building Co ltd/the Financials 1 069 918 0.07% 0.07%<br />

sanken electric Co ltd technology 13 271 126 0.56% 0.56%<br />

sanki engineering Co ltd industrials 9 300 120 0.40% 0.40%<br />

sankyo Co ltd Consumer services 229 743 141 0.78% 0.78%<br />

sankyo seiko Co ltd Consumer Goods 3 210 438 0.26% 0.26%<br />

sankyo-t<strong>at</strong>eyama <strong>Holding</strong>s inc industrials 37 742 048 1.33% 1.33%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

22<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011