Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

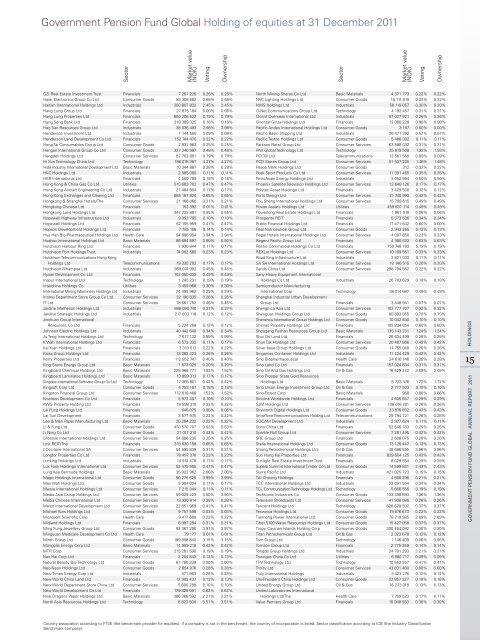

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

GZi real est<strong>at</strong>e investment trust Financials 7 261 226 0.26% 0.26%<br />

Haier electronics Group Co ltd Consumer Goods 85 308 582 0.68% 0.68%<br />

Haitian intern<strong>at</strong>ional <strong>Holding</strong>s ltd industrials 200 807 832 2.45% 2.45%<br />

Hang lung Group ltd Financials 27 875 184 0.06% 0.06%<br />

Hang lung Properties ltd Financials 600 206 522 0.79% 0.79%<br />

Hang seng bank ltd Financials 218 389 325 0.16% 0.16%<br />

Hao tian resources Group ltd industrials 38 036 403 2.98% 2.98%<br />

Henderson investment ltd industrials 1 144 550 0.09% 0.09%<br />

Henderson land Development Co ltd Financials 152 744 470 0.22% 0.22%<br />

Heng tai Consumables Group ltd Consumer Goods 2 8<strong>31</strong> 983 0.25% 0.25%<br />

Hengan intern<strong>at</strong>ional Group Co ltd Consumer Goods 327 246 997 0.48% 0.48%<br />

Hengdeli <strong>Holding</strong>s ltd Consumer services 67 702 891 0.79% 0.79%<br />

Hi sun technology China ltd technology 186 076 387 4.27% 4.27%<br />

Hidili industry intern<strong>at</strong>ional Development ltd basic m<strong>at</strong>erials 10 344 887 0.28% 0.28%<br />

HKC <strong>Holding</strong>s ltd industrials 2 585 080 0.11% 0.11%<br />

HKr intern<strong>at</strong>ional ltd Financials 4 500 799 0.18% 0.18%<br />

Hong Kong & China Gas Co ltd utilities 515 663 702 0.47% 0.47%<br />

Hong Kong aircraft engineering Co ltd industrials 21 484 804 0.17% 0.17%<br />

Hong Kong exchanges and Clearing ltd Financials 665 187 820 0.65% 0.65%<br />

Hongkong & shanghai Hotels/the Consumer services 21 166 866 0.21% 0.21%<br />

Hongkong Chinese ltd Financials 152 392 0.01% 0.01%<br />

Hongkong land <strong>Holding</strong>s ltd Financials 347 233 891 0.55% 0.55%<br />

Hopewell Highway infrastructure ltd industrials 9 093 795 0.10% 0.10%<br />

Hopewell <strong>Holding</strong>s ltd Financials 62 155 959 0.47% 0.47%<br />

Hopson Development <strong>Holding</strong>s ltd Financials 7 785 106 0.14% 0.14%<br />

Hua Han bio-Pharmaceutical <strong>Holding</strong>s ltd Health Care 94 898 904 3.94% 3.94%<br />

Huabao intern<strong>at</strong>ional <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 86 694 897 0.90% 0.90%<br />

Hutchison Harbour ring ltd Financials 7 930 844 0.17% 0.17%<br />

Hutchison Port <strong>Holding</strong>s trust industrials 74 002 580 0.23% 0.23%<br />

Hutchison telecommunic<strong>at</strong>ions Hong Kong<br />

<strong>Holding</strong>s ltd telecommunic<strong>at</strong>ions 19 330 202 0.17% 0.17%<br />

Hutchison Whampoa ltd industrials 969 074 902 0.45% 0.45%<br />

Hysan Development Co ltd Financials 102 050 033 0.49% 0.49%<br />

inspur intern<strong>at</strong>ional ltd technology 1 245 2<strong>31</strong> 0.19% 0.19%<br />

interchina <strong>Holding</strong>s Co utilities 3 459 968 0.30% 0.30%<br />

intern<strong>at</strong>ional mining machinery <strong>Holding</strong>s ltd industrials 24 495 962 0.29% 0.29%<br />

intime Department store Group Co ltd Consumer services 32 196 835 0.26% 0.26%<br />

it ltd Consumer services 18 667 252 0.46% 0.46%<br />

Jardine m<strong>at</strong>heson <strong>Holding</strong>s ltd industrials 688 090 740 0.37% 0.37%<br />

Jardine str<strong>at</strong>egic <strong>Holding</strong>s ltd industrials 217 833 118 0.12% 0.12%<br />

Jinchuan Group intern<strong>at</strong>ional<br />

resources Co ltd Financials 5 224 258 0.12% 0.12%<br />

Johnson electric <strong>Holding</strong>s ltd industrials 40 442 640 0.34% 0.34%<br />

Ju teng intern<strong>at</strong>ional <strong>Holding</strong>s ltd technology 7 617 132 0.99% 0.99%<br />

K Wah intern<strong>at</strong>ional <strong>Holding</strong>s ltd Financials 6 573 332 0.17% 0.17%<br />

Kai Yuan <strong>Holding</strong>s ltd Financials 3 <strong>31</strong>0 012 0.22% 0.22%<br />

Kaisa Group <strong>Holding</strong>s ltd Financials 13 062 423 0.26% 0.26%<br />

Kerry Properties ltd Financials 112 852 747 0.40% 0.40%<br />

King stone energy Group ltd basic m<strong>at</strong>erials 1 673 025 0.20% 0.20%<br />

Kingboard Chemical <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 228 968 771 1.52% 1.52%<br />

Kingboard lamin<strong>at</strong>es <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 13 859 <strong>31</strong>3 0.17% 0.17%<br />

Kingdee intern<strong>at</strong>ional s<strong>of</strong>tware Group Co ltd technology 17 065 801 0.42% 0.42%<br />

Kings<strong>of</strong>t Corp ltd Consumer Goods 4 753 167 0.18% 0.18%<br />

Kingston Financial Group ltd Consumer services 112 618 488 1.52% 1.52%<br />

Kowloon Development Co ltd Financials 5 972 407 0.10% 0.10%<br />

KWG Property <strong>Holding</strong> ltd Financials 18 598 <strong>31</strong>0 0.32% 0.32%<br />

lai Fung <strong>Holding</strong>s ltd Financials 646 875 0.06% 0.06%<br />

lai sun Development Financials 3 577 975 0.22% 0.22%<br />

lee & man Paper manufacturing ltd basic m<strong>at</strong>erials 20 264 232 0.22% 0.22%<br />

li & Fung ltd Consumer Goods 470 570 707 0.53% 0.53%<br />

li ning Co ltd Consumer Goods 21 017 <strong>31</strong>0 0.42% 0.42%<br />

lifestyle intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 54 686 235 0.25% 0.25%<br />

link reit/the Financials <strong>31</strong>9 630 158 0.65% 0.65%<br />

l’occitane intern<strong>at</strong>ional sa Consumer services 54 595 839 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

longfor Properties Co ltd Financials 78 497 376 0.23% 0.23%<br />

lonking <strong>Holding</strong>s ltd industrials 14 974 478 0.17% 0.17%<br />

luk Fook <strong>Holding</strong>s intern<strong>at</strong>ional ltd Consumer services 53 475 955 0.47% 0.47%<br />

lung Kee bermuda <strong>Holding</strong>s basic m<strong>at</strong>erials 35 922 962 2.06% 2.06%<br />

magic <strong>Holding</strong>s intern<strong>at</strong>ional ltd Consumer Goods 90 275 625 3.99% 3.99%<br />

man Wah <strong>Holding</strong>s ltd Consumer Goods 5 904 024 0.17% 0.17%<br />

maoye intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 7 215 344 0.11% 0.11%<br />

media asia Group <strong>Holding</strong>s ltd Consumer services 59 029 423 3.50% 3.50%<br />

media Chinese intern<strong>at</strong>ional ltd Consumer services 13 930 814 0.38% 0.38%<br />

melco intern<strong>at</strong>ional Development ltd Consumer services 22 651 969 0.41% 0.41%<br />

michael Kors <strong>Holding</strong>s ltd Consumer Goods 9 757 598 0.03% 0.03%<br />

microport scientific Corp Health Care 9 417 660 0.22% 0.22%<br />

midland <strong>Holding</strong>s ltd Financials 6 997 284 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

ming Fung Jewellery Group ltd Consumer Goods 52 367 290 3.97% 3.97%<br />

mingyuan medicare Development Co ltd Health Care 79 177 0.01% 0.01%<br />

minth Group ltd Consumer Goods 189 808 842 3.15% 3.15%<br />

mongolia energy Corp ltd basic m<strong>at</strong>erials 14 959 218 0.42% 0.42%<br />

mtr Corp Consumer services 215 281 590 0.19% 0.19%<br />

nan Hai Corp ltd Financials 2 204 843 0.13% 0.13%<br />

n<strong>at</strong>ural beauty bio-technology ltd Consumer Goods 61 780 339 3.00% 3.00%<br />

neo-neon <strong>Holding</strong>s ltd Consumer Goods 2 654 076 0.28% 0.28%<br />

new times energy Corp ltd industrials 571 963 0.28% 0.28%<br />

new World China land ltd Financials 12 905 437 0.13% 0.13%<br />

new World Department store China ltd Consumer services 5 600 288 0.10% 0.10%<br />

new World Development Co ltd Financials 179 829 091 0.62% 0.62%<br />

nine Dragons Paper <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 386 368 592 2.21% 2.21%<br />

north asia resources <strong>Holding</strong>s ltd technology 6 823 500 3.51% 3.51%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

north mining shares Co ltd basic m<strong>at</strong>erials 4 371 773 0.22% 0.22%<br />

nvC lighting <strong>Holding</strong>s ltd Consumer Goods 15 111 010 0.22% 0.22%<br />

nWs <strong>Holding</strong>s ltd industrials 58 119 057 0.20% 0.20%<br />

o-net Communic<strong>at</strong>ions Group ltd technology 4 192 457 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

orient overseas intern<strong>at</strong>ional ltd industrials 57 027 921 0.26% 0.26%<br />

oriental Ginza <strong>Holding</strong>s ltd Financials 12 060 229 0.98% 0.98%<br />

Pacific andes intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer Goods 3 187 0.00% 0.00%<br />

Pacific basin shipping ltd industrials 26 471 392 0.57% 0.57%<br />

Pacific textile <strong>Holding</strong>s ltd Consumer Goods 5 486 302 0.11% 0.11%<br />

Parkson retail Group ltd Consumer services 63 888 032 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

PaX <strong>Global</strong> technology ltd technology 25 819 508 1.93% 1.93%<br />

PCCW ltd telecommunic<strong>at</strong>ions 13 561 560 0.09% 0.09%<br />

PCD stores Group ltd Consumer services 51 537 205 1.48% 1.48%<br />

Peace mark <strong>Holding</strong>s ltd Consumer Goods <strong>31</strong>2 0.32% 0.32%<br />

Peak sport Products Co ltd Consumer services 11 391 465 0.35% 0.35%<br />

Petroasian energy <strong>Holding</strong>s ltd industrials 3 052 994 0.50% 0.50%<br />

Phoenix s<strong>at</strong>ellite television <strong>Holding</strong>s ltd Consumer services 12 648 126 0.17% 0.17%<br />

Polytec asset <strong>Holding</strong>s ltd Financials 3 429 500 0.12% 0.12%<br />

Ports Design ltd Consumer services 21 740 993 0.42% 0.42%<br />

Pou sheng intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 15 799 615 0.49% 0.49%<br />

Power assets <strong>Holding</strong>s ltd utilities 459 6<strong>31</strong> 114 0.49% 0.49%<br />

Powerlong real est<strong>at</strong>e <strong>Holding</strong>s ltd Financials 1 961 910 0.06% 0.06%<br />

Prosperity reit Financials 5 373 506 0.34% 0.34%<br />

Public Financial <strong>Holding</strong>s ltd Financials 17 471 642 0.60% 0.60%<br />

real nutriceutical Group ltd Consumer Goods 2 943 265 0.13% 0.13%<br />

regal Hotels intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 4 097 650 0.23% 0.23%<br />

regent Pacific Group ltd Financials 4 380 533 0.63% 0.63%<br />

renhe Commercial <strong>Holding</strong>s Co ltd Financials 750 748 783 5.19% 5.19%<br />

reXlot <strong>Holding</strong>s ltd Consumer services 10 169 551 0.33% 0.33%<br />

road King infrastructure ltd industrials 2 821 033 0.11% 0.11%<br />

sa sa intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer services 18 146 515 0.20% 0.20%<br />

sands China ltd Consumer services 298 794 562 0.22% 0.22%<br />

sany Heavy equipment intern<strong>at</strong>ional<br />

<strong>Holding</strong>s Co ltd industrials 26 703 629 0.18% 0.18%<br />

semiconductor manufacturing<br />

intern<strong>at</strong>ional Corp technology 39 014 687 0.49% 0.49%<br />

shanghai industrial urban Development<br />

Group ltd Financials 3 448 941 0.07% 0.07%<br />

shangri-la asia ltd Consumer services 103 777 707 0.32% 0.32%<br />

shenguan <strong>Holding</strong>s Group ltd Consumer Goods 80 893 055 0.70% 0.70%<br />

shenzhou intern<strong>at</strong>ional Group <strong>Holding</strong>s ltd Consumer Goods 10 042 840 0.10% 0.10%<br />

shimao Property <strong>Holding</strong>s ltd Financials 105 834 654 0.60% 0.60%<br />

shougang Fushan resources Group ltd basic m<strong>at</strong>erials 135 143 2<strong>31</strong> 1.24% 1.24%<br />

shui on land ltd Financials 26 634 499 0.28% 0.28%<br />

shun tak <strong>Holding</strong>s ltd Consumer services 20 487 866 0.42% 0.42%<br />

silver base Group <strong>Holding</strong>s ltd Consumer Goods 14 765 040 0.26% 0.26%<br />

singamas Container <strong>Holding</strong>s ltd industrials 11 424 429 0.42% 0.42%<br />

sino biopharmaceutical Health Care 24 616 146 0.28% 0.28%<br />

sino land Co ltd Financials 157 024 834 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

sino oil and Gas <strong>Holding</strong>s ltd oil & Gas 76 529 242 3.09% 3.09%<br />

sino Prosper st<strong>at</strong>e Gold resources<br />

<strong>Holding</strong>s ltd basic m<strong>at</strong>erials 8 723 476 1.72% 1.72%<br />

sino union energy investment Group ltd oil & Gas 2 777 503 0.10% 0.10%<br />

sino-Forest Corp basic m<strong>at</strong>erials 958 0.66% 0.66%<br />

sinolink Worldwide <strong>Holding</strong>s ltd Financials 4 605 647 0.29% 0.29%<br />

sJm <strong>Holding</strong>s ltd Consumer services 138 016 201 0.26% 0.26%<br />

skyworth Digital <strong>Holding</strong>s ltd Consumer Goods 23 676 832 0.43% 0.43%<br />

smartone telecommunic<strong>at</strong>ions <strong>Holding</strong> ltd telecommunic<strong>at</strong>ions 29 794 721 0.28% 0.28%<br />

soCam Development ltd industrials 2 927 624 0.11% 0.11%<br />

soho China ltd Financials 52 546 783 0.25% 0.25%<br />

sparkle roll Group ltd Consumer services 7 261 495 0.42% 0.42%<br />

sre Group ltd Financials 2 608 075 0.20% 0.20%<br />

stella intern<strong>at</strong>ional <strong>Holding</strong>s ltd Consumer Goods 13 126 447 0.13% 0.13%<br />

strong Petrochemical <strong>Holding</strong>s ltd oil & Gas 48 686 595 3.96% 3.96%<br />

sun Hung Kai Properties ltd Financials 829 604 125 0.43% 0.43%<br />

sunlight real est<strong>at</strong>e investment trust Financials 8 029 554 0.29% 0.29%<br />

superb summit intern<strong>at</strong>ional timber Co ltd Consumer Goods 14 599 8<strong>31</strong> 2.43% 2.43%<br />

swire Pacific ltd industrials 421 825 723 0.15% 0.15%<br />

tai Cheung <strong>Holding</strong>s Financials 4 668 296 0.21% 0.21%<br />

tCC intern<strong>at</strong>ional <strong>Holding</strong>s ltd industrials 23 091 554 0.34% 0.34%<br />

tCl Communic<strong>at</strong>ion technology <strong>Holding</strong>s ltd technology 5 666 556 0.19% 0.19%<br />

techtronic industries Co Consumer Goods 133 398 693 1.36% 1.36%<br />

television broadcasts ltd Consumer services 41 908 086 0.26% 0.26%<br />

tencent <strong>Holding</strong>s ltd technology 826 629 502 0.37% 0.37%<br />

texwinca <strong>Holding</strong>s ltd Consumer Goods 19 676 673 0.22% 0.22%<br />

tianneng Power intern<strong>at</strong>ional ltd Consumer Goods 78 719 985 2.69% 2.69%<br />

tibet 5100 W<strong>at</strong>er resources <strong>Holding</strong>s ltd Consumer Goods 15 427 058 0.37% 0.37%<br />

tingyi Cayman islands <strong>Holding</strong> Corp Consumer Goods 300 464 092 0.30% 0.30%<br />

titan Petrochemicals Group ltd oil & Gas 2 323 678 0.12% 0.12%<br />

tom Group ltd technology 1 146 409 0.06% 0.06%<br />

tomson Group ltd Financials 2 775 359 0.14% 0.14%<br />

tongda Group <strong>Holding</strong>s ltd industrials 24 781 293 3.21% 3.21%<br />

towngas China Co ltd utilities 6 980 717 0.09% 0.09%<br />

tPv technology ltd technology 10 553 557 0.41% 0.41%<br />

trinity ltd Consumer services 43 8<strong>31</strong> 460 0.60% 0.60%<br />

truly intern<strong>at</strong>ional <strong>Holding</strong>s industrials 3 423 276 0.12% 0.12%<br />

uni-President China <strong>Holding</strong>s ltd Consumer Goods 22 857 227 0.18% 0.18%<br />

united energy Group ltd oil & Gas 16 273 018 0.13% 0.13%<br />

united labor<strong>at</strong>ories intern<strong>at</strong>ional<br />

<strong>Holding</strong>s ltd/the Health Care 7 769 523 0.17% 0.17%<br />

value Partners Group ltd Financials 15 948 933 0.30% 0.30%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

15<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011