Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

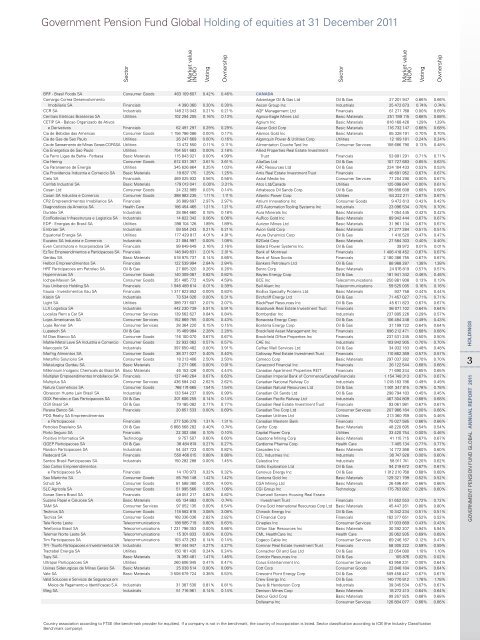

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

brF - brasil Foods sa Consumer Goods 463 109 607 0.42% 0.46%<br />

Camargo Correa Desenvolvimento<br />

imobiliario sa Financials 4 390 360 0.30% 0.30%<br />

CCr sa industrials 148 213 043 0.21% 0.21%<br />

Centrais eletricas brasileiras sa utilities 102 294 205 0.16% 0.13%<br />

CetiP sa - balcao organizado de <strong>at</strong>ivos<br />

e Deriv<strong>at</strong>ivos Financials 62 491 297 0.29% 0.29%<br />

Cia de bebidas das americas Consumer Goods 1 156 786 086 0.00% 0.17%<br />

Cia de Gas de sao Paulo utilities 26 247 669 0.00% 0.16%<br />

Cia de saneamento de minas Gerais-CoPasa utilities 13 472 550 0.11% 0.11%<br />

Cia energetica de sao Paulo utilities 754 551 683 0.00% 2.18%<br />

Cia Ferro ligas da bahia - Ferbasa basic m<strong>at</strong>erials 115 843 021 0.00% 4.99%<br />

Cia Hering Consumer Goods 612 0<strong>31</strong> 357 3.61% 3.61%<br />

Cia Paranaense de energia utilities 345 626 864 0.25% 1.03%<br />

Cia Providencia industria e Comercio sa basic m<strong>at</strong>erials 19 837 175 1.25% 1.25%<br />

Cielo sa Financials 469 025 932 0.56% 0.56%<br />

Confab industrial sa basic m<strong>at</strong>erials 179 013 041 0.00% 3.<strong>31</strong>%<br />

Cosan ltd Consumer Goods 24 232 889 0.03% 0.14%<br />

Cosan sa industria e Comercio Consumer Goods 388 983 235 1.11% 1.11%<br />

Cr2 empreendimentos imobiliarios sa Financials 26 989 697 2.97% 2.97%<br />

Diagnosticos da america sa Health Care 186 454 465 1.21% 1.21%<br />

Dur<strong>at</strong>ex sa industrials 28 064 660 0.18% 0.18%<br />

ecorodovias infraestrutura e logistica sa industrials 14 822 342 0.06% 0.06%<br />

eDP - energias do brasil sa utilities 398 104 126 1.89% 1.89%<br />

embraer sa industrials 59 554 243 0.21% 0.21%<br />

equ<strong>at</strong>orial energia sa utilities 177 429 817 4.01% 4.01%<br />

euc<strong>at</strong>ex sa industria e Comercio industrials 21 084 997 0.00% 1.08%<br />

even Construtora e incorporadora sa Financials 99 649 649 2.16% 2.16%<br />

ez tec empreendimentos e Participacoes sa Financials 148 949 8<strong>31</strong> 2.01% 2.01%<br />

Gerdau sa basic m<strong>at</strong>erials 518 975 737 0.14% 0.66%<br />

Helbor empreendimentos sa Financials 122 539 994 2.84% 2.84%<br />

Hrt Participacoes em Petroleo sa oil & Gas 27 805 320 0.26% 0.26%<br />

Hypermarcas sa Consumer Goods 140 309 087 0.82% 0.82%<br />

iochpe-maxion sa Consumer Goods 351 485 772 4.59% 4.59%<br />

itau unibanco <strong>Holding</strong> sa Financials 1 946 489 614 0.01% 0.39%<br />

itausa - investimentos itau sa Financials 1 <strong>31</strong>7 823 852 0.00% 0.83%<br />

Klabin sa industrials 73 534 026 0.00% 0.<strong>31</strong>%<br />

light sa utilities 389 737 607 2.07% 2.07%<br />

llX logistica sa industrials 442 230 739 5.91% 5.91%<br />

localiza rent a Car sa Consumer services 139 562 627 0.84% 0.84%<br />

lojas americanas sa Consumer services 152 869 755 0.00% 0.43%<br />

lojas renner sa Consumer services 28 364 220 0.15% 0.15%<br />

lup<strong>at</strong>ech sa oil & Gas 15 469 984 2.28% 2.28%<br />

m Dias branco sa Consumer Goods 116 100 070 0.67% 0.67%<br />

mahle-metal leve sa industria e Comercio Consumer Goods 32 932 062 0.57% 0.57%<br />

marcopolo sa industrials 397 650 482 0.00% 3.91%<br />

marfrig alimentos sa Consumer Goods 38 371 027 0.40% 0.40%<br />

metalfrio solutions sa Consumer Goods 18 213 406 2.50% 2.50%<br />

metalurgica Gerdau sa basic m<strong>at</strong>erials 2 271 066 0.00% 0.01%<br />

millennium inorganic Chemicals do brasil sa basic m<strong>at</strong>erials 46 153 426 0.00% 4.44%<br />

multiplan empreendimentos imobiliarios sa Financials 137 440 264 0.67% 0.63%<br />

multiplus sa Consumer services 436 584 242 2.62% 2.62%<br />

n<strong>at</strong>ura Cosmeticos sa Consumer Goods 768 174 665 1.54% 1.54%<br />

obrascon Huarte lain brasil sa industrials 133 544 237 0.99% 0.99%<br />

oGX Petroleo e Gas Participacoes sa oil & Gas 201 606 255 0.14% 0.14%<br />

osX brasil sa oil & Gas 79 185 082 0.77% 0.77%<br />

Parana banco sa Financials 20 851 533 0.00% 0.69%<br />

PDG realty sa empreendimentos<br />

e Participacoes Financials 277 526 379 1.<strong>31</strong>% 1.<strong>31</strong>%<br />

Petroleo brasileiro sa oil & Gas 6 868 568 282 0.40% 0.74%<br />

Porto seguro sa Financials 22 302 456 0.10% 0.10%<br />

Positivo inform<strong>at</strong>ica sa technology 9 757 507 0.60% 0.60%<br />

QGeP Participacoes sa oil & Gas 38 484 874 0.27% 0.27%<br />

randon Participacoes sa industrials 54 447 723 0.00% 0.82%<br />

redecard sa Financials 550 466 015 0.88% 0.88%<br />

santos brasil Participacoes sa industrials 150 282 288 0.00% 1.45%<br />

sao Carlos empreendimentos<br />

e Participacoes sa Financials 14 170 973 0.32% 0.32%<br />

sao martinho sa Consumer Goods 85 756 148 1.42% 1.42%<br />

schulz sa Consumer Goods 81 588 380 0.00% 4.00%<br />

slC agricola sa Consumer Goods 51 995 566 1.06% 1.06%<br />

sonae sierra brasil sa Financials 48 051 217 0.82% 0.82%<br />

suzano Papel e Celulose sa basic m<strong>at</strong>erials 65 134 883 0.00% 0.74%<br />

tam sa Consumer services 97 052 135 0.00% 0.54%<br />

technos sa Consumer Goods 118 582 815 3.08% 3.08%<br />

tecnisa sa Consumer Goods 168 336 036 2.82% 2.82%<br />

tele norte leste telecommunic<strong>at</strong>ions 188 585 719 0.80% 0.63%<br />

telefonica brasil sa telecommunic<strong>at</strong>ions 1 2<strong>31</strong> 796 353 0.00% 0.66%<br />

telemar norte leste sa telecommunic<strong>at</strong>ions 15 301 833 0.00% 0.03%<br />

tim Participacoes sa telecommunic<strong>at</strong>ions 103 473 263 0.14% 0.14%<br />

tPi - triunfo Participacoes e investimentos sa industrials 187 444 947 4.27% 4.27%<br />

tractebel energia sa utilities 150 161 430 0.24% 0.24%<br />

tupy sa basic m<strong>at</strong>erials 74 393 481 1.47% 1.46%<br />

ultrapar Participacoes sa utilities 260 606 945 0.47% 0.47%<br />

usinas siderurgicas de minas Gerais sa basic m<strong>at</strong>erials 25 038 514 0.00% 0.08%<br />

vale sa basic m<strong>at</strong>erials 3 508 679 724 0.38% 0.53%<br />

valid solucoes e servicos de seguranca em<br />

meios de Pagamento e identificacao s.a industrials <strong>31</strong> 387 530 0.81% 0.81%<br />

Weg sa industrials 51 716 961 0.14% 0.14%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

CANAdA<br />

advantage oil & Gas ltd oil & Gas 27 201 947 0.66% 0.66%<br />

aecon Group inc industrials 25 472 673 0.74% 0.74%<br />

aGF management ltd Financials 61 271 768 0.00% 0.69%<br />

agnico-eagle mines ltd basic m<strong>at</strong>erials 251 789 115 0.68% 0.68%<br />

agrium inc basic m<strong>at</strong>erials 816 168 426 1.29% 1.29%<br />

alacer Gold Corp basic m<strong>at</strong>erials 116 732 147 0.68% 0.68%<br />

alamos Gold inc basic m<strong>at</strong>erials 85 328 191 0.70% 0.70%<br />

algonquin Power & utilities Corp utilities 12 109 181 0.24% 0.24%<br />

aliment<strong>at</strong>ion Couche tard inc Consumer services 158 686 790 0.13% 0.48%<br />

allied Properties real est<strong>at</strong>e investment<br />

trust Financials 53 891 291 0.71% 0.71%<br />

altaGas ltd oil & Gas 107 727 683 0.65% 0.63%<br />

arC resources ltd oil & Gas 224 104 433 0.53% 0.53%<br />

artis real est<strong>at</strong>e investment trust Financials 48 691 952 0.67% 0.67%<br />

astral media inc Consumer services 77 204 290 0.00% 0.67%<br />

<strong>at</strong>co ltd/Canada utilities 125 098 647 0.00% 0.61%<br />

<strong>at</strong>habasca oil sands Corp oil & Gas 198 856 608 0.68% 0.68%<br />

<strong>at</strong>lantic Power Corp utilities 64 222 211 0.67% 0.67%<br />

<strong>at</strong>rium innov<strong>at</strong>ions inc Consumer Goods 9 472 613 0.42% 0.42%<br />

<strong>at</strong>s autom<strong>at</strong>ion tooling systems inc industrials 23 096 534 0.70% 0.70%<br />

aura minerals inc basic m<strong>at</strong>erials 7 054 445 0.42% 0.42%<br />

aurico Gold inc basic m<strong>at</strong>erials 89 942 444 0.67% 0.67%<br />

aurizon mines ltd basic m<strong>at</strong>erials <strong>31</strong> 961 134 0.67% 0.67%<br />

avion Gold Corp basic m<strong>at</strong>erials 21 277 284 0.51% 0.51%<br />

azure Dynamics Corp oil & Gas 1 410 520 0.47% 0.47%<br />

b2Gold Corp basic m<strong>at</strong>erials 27 584 303 0.40% 0.40%<br />

ballard Power systems inc oil & Gas 39 972 0.01% 0.01%<br />

bank <strong>of</strong> montreal Financials 1 406 418 452 0.67% 0.67%<br />

bank <strong>of</strong> nova scotia Financials 2 180 386 755 0.67% 0.67%<br />

bankers Petroleum ltd oil & Gas 88 988 287 1.38% 1.38%<br />

banro Corp basic m<strong>at</strong>erials 24 976 819 0.57% 0.57%<br />

baytex energy Corp oil & Gas 181 941 342 0.46% 0.46%<br />

bCe inc telecommunic<strong>at</strong>ions 250 881 808 0.13% 0.13%<br />

bell aliant inc telecommunic<strong>at</strong>ions 59 525 005 0.16% 0.16%<br />

bioexx specialty Proteins ltd basic m<strong>at</strong>erials 937 758 0.44% 0.44%<br />

birchcliff energy ltd oil & Gas 71 457 027 0.71% 0.71%<br />

blackPearl resources inc oil & Gas 45 611 823 0.67% 0.67%<br />

boardwalk real est<strong>at</strong>e investment trust Financials 98 071 102 0.64% 0.64%<br />

bombardier inc industrials 237 895 226 0.29% 0.57%<br />

bonavista energy Corp oil & Gas 106 484 248 0.49% 0.43%<br />

bonterra energy Corp oil & Gas 37 199 722 0.64% 0.64%<br />

brookfield asset management inc Financials 696 212 471 0.68% 0.68%<br />

brookfield <strong>of</strong>fice Properties inc Financials 237 5<strong>31</strong> 245 0.50% 0.50%<br />

Cae inc industrials 103 842 905 0.70% 0.70%<br />

Calfrac Well services ltd oil & Gas 34 932 183 0.48% 0.48%<br />

Calloway real est<strong>at</strong>e investment trust Financials 110 862 369 0.57% 0.57%<br />

Cameco Corp basic m<strong>at</strong>erials 297 037 282 0.70% 0.70%<br />

Canaccord Financial inc Financials 26 122 544 0.68% 0.68%<br />

Canadian apartment Properties reit Financials 71 690 244 0.65% 0.65%<br />

Canadian imperial bank <strong>of</strong> Commerce/Canada Financials 1 154 748 <strong>31</strong>3 0.67% 0.67%<br />

Canadian n<strong>at</strong>ional railway Co industrials 1 018 183 786 0.49% 0.49%<br />

Canadian n<strong>at</strong>ural resources ltd oil & Gas 1 901 347 015 0.78% 0.78%<br />

Canadian oil sands ltd oil & Gas 298 794 183 0.45% 0.45%<br />

Canadian Pacific railway ltd industrials 467 304 809 0.68% 0.68%<br />

Canadian real est<strong>at</strong>e investment trust Financials 93 061 981 0.67% 0.67%<br />

Canadian tire Corp ltd Consumer services 207 966 164 0.00% 0.66%<br />

Canadian utilities ltd utilities 213 360 769 0.00% 0.46%<br />

Canadian Western bank Financials 75 027 585 0.66% 0.66%<br />

Canfor Corp basic m<strong>at</strong>erials 48 220 695 0.54% 0.54%<br />

Capital Power Corp utilities 33 420 754 0.00% 0.46%<br />

Capstone mining Corp basic m<strong>at</strong>erials 41 115 715 0.67% 0.67%<br />

Cardiome Pharma Corp Health Care 7 405 134 0.77% 0.77%<br />

Cascades inc basic m<strong>at</strong>erials 14 772 368 0.60% 0.60%<br />

CCl industries inc industrials 36 747 928 0.00% 0.60%<br />

Celestica inc industrials 58 911 741 0.20% 0.62%<br />

Celtic explor<strong>at</strong>ion ltd oil & Gas 94 219 672 0.67% 0.67%<br />

Cenovus energy inc oil & Gas 1 012 210 768 0.68% 0.68%<br />

Centerra Gold inc basic m<strong>at</strong>erials 129 321 799 0.52% 0.52%<br />

CGa mining ltd basic m<strong>at</strong>erials 26 496 491 0.66% 0.66%<br />

CGi Group inc technology 175 763 892 0.28% 0.60%<br />

Chartwell seniors Housing real est<strong>at</strong>e<br />

investment trust Financials 51 652 553 0.72% 0.72%<br />

China Gold intern<strong>at</strong>ional resources Corp ltd basic m<strong>at</strong>erials 45 447 261 0.80% 0.80%<br />

Chinook energy inc oil & Gas 10 342 234 0.51% 0.51%<br />

Ci Financial Corp Financials 182 377 651 0.52% 0.52%<br />

Cineplex inc Consumer services 37 933 669 0.43% 0.43%<br />

Clifton star resources inc basic m<strong>at</strong>erials 30 392 207 5.94% 5.94%<br />

Cml HealthCare inc Health Care 35 062 935 0.69% 0.69%<br />

Cogeco Cable inc Consumer services 69 246 167 0.12% 0.47%<br />

Cominar real est<strong>at</strong>e investment trust Financials 58 305 222 0.59% 0.59%<br />

Connacher oil and Gas ltd oil & Gas 22 054 080 1.10% 1.10%<br />

Corridor resources inc oil & Gas 105 876 0.02% 0.02%<br />

Corus entertainment inc Consumer services 63 958 2<strong>31</strong> 0.00% 0.64%<br />

Cott Corp Consumer Goods 22 846 184 0.64% 0.64%<br />

Crescent Point energy Corp oil & Gas 509 458 447 0.67% 0.67%<br />

Crew energy inc oil & Gas 140 770 812 1.78% 1.78%<br />

Davis & Henderson Corp industrials 39 345 534 0.67% 0.67%<br />

Denison mines Corp basic m<strong>at</strong>erials 18 272 413 0.64% 0.64%<br />

Detour Gold Corp basic m<strong>at</strong>erials 99 267 925 0.68% 0.68%<br />

Dollarama inc Consumer services 126 804 077 0.66% 0.66%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

3<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011