Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

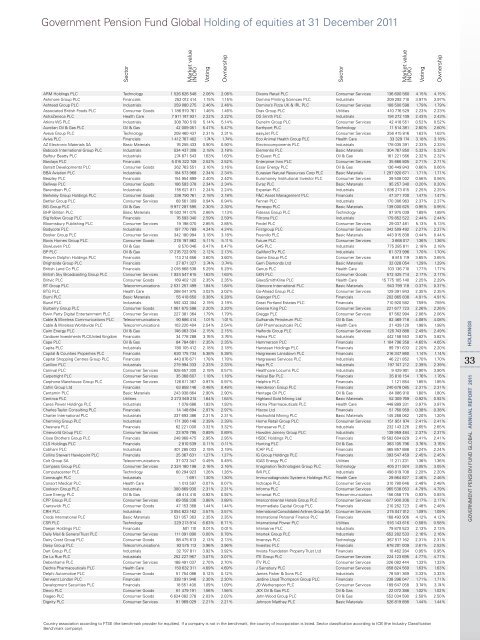

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

arm <strong>Holding</strong>s PlC technology 1 526 626 548 2.06% 2.06%<br />

ashmore Group PlC Financials 252 012 414 1.15% 1.15%<br />

ashtead Group PlC industrials 259 080 275 2.46% 2.46%<br />

associ<strong>at</strong>ed british Foods PlC Consumer Goods 1 186 970 761 1.46% 1.46%<br />

astraZeneca PlC Health Care 7 911 747 9<strong>31</strong> 2.22% 2.22%<br />

<strong>at</strong>kins Ws PlC industrials 308 780 519 5.14% 5.14%<br />

aurelian oil & Gas PlC oil & Gas 42 009 051 5.47% 5.47%<br />

aveva Group PlC technology 208 460 437 2.<strong>31</strong>% 2.<strong>31</strong>%<br />

aviva PlC Financials 1 412 767 402 1.74% 1.74%<br />

aZ electronic m<strong>at</strong>erials sa basic m<strong>at</strong>erials 76 255 433 0.90% 0.90%<br />

babcock intern<strong>at</strong>ional Group PlC industrials 534 437 308 2.18% 2.18%<br />

balfour be<strong>at</strong>ty PlC industrials 274 871 543 1.63% 1.63%<br />

barclays PlC Financials 5 015 322 749 2.52% 2.52%<br />

barr<strong>at</strong>t Developments PlC Consumer Goods 262 763 551 3.16% 3.16%<br />

bba avi<strong>at</strong>ion PlC industrials 184 573 968 2.34% 2.34%<br />

beazley PlC Financials 154 954 899 2.40% 2.40%<br />

bellway PlC Consumer Goods 186 583 378 2.34% 2.34%<br />

berendsen PlC industrials 155 621 811 2.24% 2.24%<br />

berkeley Group <strong>Holding</strong>s PlC Consumer Goods 338 790 761 2.18% 2.18%<br />

betfair Group PlC Consumer services 68 561 309 0.94% 0.94%<br />

bG Group PlC oil & Gas 9 977 287 595 2.30% 2.30%<br />

bHP billiton PlC basic m<strong>at</strong>erials 10 502 741 075 2.86% 1.13%<br />

big Yellow Group PlC Financials 76 593 340 2.59% 2.59%<br />

bloomsbury Publishing PlC Consumer services 19 198 070 2.85% 2.85%<br />

bodycote PlC industrials 197 770 789 4.24% 4.24%<br />

booker Group PlC Consumer services 342 180 994 3.18% 3.18%<br />

bovis Homes Group PlC Consumer Goods 278 197 862 5.11% 5.11%<br />

bowleven PlC oil & Gas 8 570 046 0.47% 0.47%<br />

bP PlC oil & Gas 17 276 722 970 2.12% 2.13%<br />

brewin Dolphin <strong>Holding</strong>s PlC Financials 113 214 656 3.60% 3.60%<br />

brightside Group PlC Financials 27 871 327 3.74% 3.74%<br />

british land Co PlC Financials 2 018 868 538 5.29% 5.29%<br />

british sky broadcasting Group PlC Consumer services 1 924 547 615 1.63% 1.63%<br />

britvic PlC Consumer Goods 169 402 120 2.35% 2.35%<br />

bt Group PlC telecommunic<strong>at</strong>ions 2 5<strong>31</strong> 257 499 1.84% 1.84%<br />

btG PlC Health Care 288 041 975 3.02% 3.02%<br />

bumi PlC basic m<strong>at</strong>erials 55 418 650 0.38% 0.28%<br />

bunzl PlC industrials 592 432 304 2.19% 2.19%<br />

burberry Group PlC Consumer Goods 1 061 675 598 2.20% 2.20%<br />

bwin.Party Digital entertainment PlC Consumer services 227 381 364 1.79% 1.79%<br />

Cable & Wireless Communic<strong>at</strong>ions PlC telecommunic<strong>at</strong>ions 90 686 414 1.01% 1.01%<br />

Cable & Wireless Worldwide PlC telecommunic<strong>at</strong>ions 103 220 404 2.54% 2.54%<br />

Cairn energy PlC oil & Gas 746 063 334 2.15% 2.15%<br />

Candover investments PlC/united Kingdom Financials 34 778 288 3.76% 3.76%<br />

Cape PlC oil & Gas 84 784 661 2.35% 2.35%<br />

Capita PlC industrials 780 105 412 2.18% 2.18%<br />

Capital & Counties Properties PlC Financials 630 175 734 5.38% 5.38%<br />

Capital shopping Centres Group PlC Financials 443 876 671 1.78% 1.78%<br />

Carillion PlC industrials 279 994 333 2.33% 2.33%<br />

Carnival PlC Consumer services 928 657 300 2.19% 0.57%<br />

Carpetright PlC Consumer services 35 368 607 1.18% 1.18%<br />

Carphone Warehouse Group PlC Consumer services 126 611 367 0.97% 0.97%<br />

C<strong>at</strong>lin Group ltd Financials 63 858 146 0.48% 0.48%<br />

Centamin PlC basic m<strong>at</strong>erials 243 938 864 2.90% 2.90%<br />

Centrica PlC utilities 2 273 949 274 1.64% 1.64%<br />

Ceres Power <strong>Holding</strong>s PlC industrials 1 078 686 1.93% 1.93%<br />

Charles taylor Consulting PlC Financials 14 148 694 2.97% 2.97%<br />

Charter intern<strong>at</strong>ional PlC industrials 337 693 386 2.<strong>31</strong>% 2.<strong>31</strong>%<br />

Chemring Group PlC industrials 171 306 146 2.39% 2.39%<br />

Chesnara PlC Financials 62 221 000 3.32% 3.32%<br />

Cineworld Group PlC Consumer services 23 979 795 0.89% 0.89%<br />

Close brothers Group PlC Financials 248 968 475 2.95% 2.95%<br />

Cls <strong>Holding</strong>s PlC Financials 2 810 539 0.11% 0.11%<br />

Cobham PlC industrials 401 285 003 2.19% 2.19%<br />

Collins stewart Hawkpoint PlC Financials 25 367 6<strong>31</strong> 1.27% 1.27%<br />

Colt Group sa telecommunic<strong>at</strong>ions 37 073 347 0.49% 0.49%<br />

Compass Group PlC Consumer services 2 324 180 198 2.16% 2.16%<br />

Computacenter PlC technology 60 294 923 1.26% 1.26%<br />

Connaught PlC industrials 1 691 1.30% 1.30%<br />

Consort medical PlC Health Care 1 013 597 0.07% 0.07%<br />

Cookson Group PlC industrials 300 869 930 2.<strong>31</strong>% 2.<strong>31</strong>%<br />

Cove energy PlC oil & Gas 48 414 410 0.92% 0.92%<br />

CPP Group PlC Consumer services 69 058 336 3.88% 3.88%<br />

Cranswick PlC Consumer Goods 47 153 368 1.44% 1.44%<br />

CrH PlC industrials 3 054 823 162 3.57% 3.57%<br />

Croda intern<strong>at</strong>ional PlC basic m<strong>at</strong>erials 5<strong>31</strong> 057 363 2.35% 2.35%<br />

Csr PlC technology 229 213 914 6.63% 6.71%<br />

Daejan <strong>Holding</strong>s PlC Financials 501 110 0.01% 0.01%<br />

Daily mail & General trust PlC Consumer services 111 091 890 0.00% 0.78%<br />

Dairy Crest Group PlC Consumer Goods 88 475 813 2.13% 2.13%<br />

Daisy Group PlC telecommunic<strong>at</strong>ions 93 575 113 3.96% 3.96%<br />

Dart Group PlC industrials 32 797 811 3.92% 3.92%<br />

De la rue PlC industrials 252 227 967 3.07% 3.07%<br />

Debenhams PlC Consumer services 188 491 037 2.70% 2.70%<br />

Dechra Pharmaceuticals PlC Health Care 150 632 <strong>31</strong>1 4.69% 4.69%<br />

Delphi automotive PlC Consumer Goods 51 754 086 0.12% 0.12%<br />

Derwent london PlC Financials 338 191 946 2.30% 2.30%<br />

Development securities PlC Financials 18 551 400 1.09% 1.09%<br />

Devro PlC Consumer Goods 61 479 191 1.56% 1.56%<br />

Diageo PlC Consumer Goods 6 624 082 378 2.03% 2.03%<br />

Dignity PlC Consumer services 91 969 029 2.21% 2.21%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

Dixons retail PlC Consumer services 136 600 560 4.15% 4.15%<br />

Domino Printing sciences PlC industrials 209 292 710 3.97% 3.97%<br />

Domino’s Pizza uK & irl PlC Consumer services 108 500 598 1.79% 1.79%<br />

Drax Group PlC utilities 410 776 529 2.23% 2.23%<br />

Ds smith PlC industrials 194 272 109 2.43% 2.43%<br />

Dunelm Group PlC Consumer services 42 418 551 0.52% 0.52%<br />

earthport PlC technology 11 514 381 2.60% 2.60%<br />

easyJet PlC Consumer services 256 415 816 1.63% 1.63%<br />

eco animal Health Group PlC Health Care 33 329 174 3.18% 3.18%<br />

electrocomponents PlC industrials 178 035 391 2.33% 2.33%<br />

elementis PlC basic m<strong>at</strong>erials 304 767 850 5.32% 5.32%<br />

enQuest PlC oil & Gas 161 221 566 2.32% 2.32%<br />

enterprise inns PlC Consumer services 35 666 805 2.71% 2.71%<br />

essar energy PlC oil & Gas 136 449 843 0.66% 0.66%<br />

eurasian n<strong>at</strong>ural resources Corp PlC basic m<strong>at</strong>erials 1 297 920 671 1.71% 1.71%<br />

euromoney institutional investor PlC Consumer services 39 508 002 0.56% 0.56%<br />

evraz PlC basic m<strong>at</strong>erials 95 257 340 0.20% 0.20%<br />

experian PlC industrials 1 836 273 015 2.25% 2.25%<br />

F&C asset management PlC Financials 47 371 700 1.47% 1.47%<br />

Fenner PlC industrials 170 306 963 2.37% 2.37%<br />

Ferrexpo PlC basic m<strong>at</strong>erials 139 000 625 0.95% 0.95%<br />

Fidessa Group PlC technology 97 975 039 1.89% 1.89%<br />

Filtrona PlC industrials 179 852 522 2.44% 2.44%<br />

Findel PlC Consumer services 29 037 481 5.13% 5.13%<br />

Firstgroup PlC Consumer services 342 509 492 2.27% 2.27%<br />

Fresnillo PlC basic m<strong>at</strong>erials 443 915 838 0.44% 0.44%<br />

Future PlC Consumer services 3 668 017 1.36% 1.36%<br />

G4s PlC industrials 775 285 811 2.18% 2.18%<br />

Galliford try PlC industrials 61 373 996 1.70% 1.70%<br />

Game Group PlC Consumer services 8 815 119 3.65% 3.65%<br />

Gem Diamonds ltd basic m<strong>at</strong>erials 32 028 054 1.29% 1.29%<br />

Genus PlC Health Care 103 136 710 1.77% 1.77%<br />

GKn PlC Consumer Goods 572 425 714 2.17% 2.17%<br />

GlaxosmithKline PlC Health Care 15 775 105 140 2.25% 2.29%<br />

Glencore intern<strong>at</strong>ional PlC basic m<strong>at</strong>erials 943 799 118 0.37% 0.37%<br />

Go-ahead Group PlC Consumer services 129 391 843 2.35% 2.35%<br />

Grainger PlC Financials 202 865 838 4.91% 4.91%<br />

Gre<strong>at</strong> Portland est<strong>at</strong>es PlC Financials 710 920 582 7.59% 7.59%<br />

Greene King PlC Consumer services 221 677 723 2.26% 2.26%<br />

Greggs PlC Consumer services 97 562 994 2.06% 2.06%<br />

Gulfsands Petroleum PlC oil & Gas 82 469 718 4.08% 4.08%<br />

GW Pharmaceuticals PlC Health Care 21 439 120 1.98% 1.98%<br />

Halfords Group PlC Consumer services 126 743 888 2.49% 2.49%<br />

Halma PlC industrials 442 158 553 3.82% 3.82%<br />

Hammerson PlC Financials 1 104 796 358 4.65% 4.65%<br />

Hansteen <strong>Holding</strong>s PlC Financials 99 791 633 2.20% 2.20%<br />

Hargreaves lansdown PlC Financials 216 347 860 1.14% 1.14%<br />

Hargreaves services PlC industrials 46 221 852 1.70% 1.70%<br />

Hays PlC industrials 197 747 212 2.39% 2.39%<br />

Healthcare locums PlC industrials 9 429 901 3.90% 3.90%<br />

Helical bar PlC Financials 35 818 154 1.76% 1.76%<br />

Helphire PlC Financials 1 121 854 1.85% 1.85%<br />

Henderson Group PlC Financials 240 678 085 2.<strong>31</strong>% 2.<strong>31</strong>%<br />

Heritage oil PlC oil & Gas 84 086 910 1.80% 1.80%<br />

Highland Gold mining ltd basic m<strong>at</strong>erials 52 309 769 0.92% 0.92%<br />

Hikma Pharmaceuticals PlC Health Care 448 889 3<strong>31</strong> 3.97% 3.97%<br />

Hiscox ltd Financials 51 760 959 0.38% 0.38%<br />

Hochschild mining PlC basic m<strong>at</strong>erials 145 268 062 1.20% 1.20%<br />

Home retail Group PlC Consumer services 151 951 974 2.41% 2.41%<br />

Homeserve PlC industrials 232 143 226 2.65% 2.65%<br />

Howden Joinery Group PlC industrials 139 959 484 2.37% 2.37%<br />

HsbC <strong>Holding</strong>s PlC Financials 19 582 604 829 2.41% 2.41%<br />

Hunting PlC oil & Gas 383 105 796 3.76% 3.76%<br />

iCaP PlC Financials 465 857 888 2.24% 2.24%<br />

iG Group <strong>Holding</strong>s PlC Financials 393 547 459 2.45% 2.45%<br />

iGas energy PlC utilities 11 211 2<strong>31</strong> 1.36% 1.36%<br />

imagin<strong>at</strong>ion technologies Group PlC technology 405 211 924 3.05% 3.05%<br />

imi PlC industrials 498 819 708 2.20% 2.20%<br />

immunodiagnostic systems <strong>Holding</strong>s PlC Health Care 29 864 827 2.46% 2.46%<br />

inchcape PlC Consumer services <strong>31</strong>0 780 646 2.48% 2.48%<br />

informa PlC Consumer services 965 538 053 4.79% 4.79%<br />

inmars<strong>at</strong> PlC telecommunic<strong>at</strong>ions 156 058 775 0.93% 0.93%<br />

intercontinental Hotels Group PlC Consumer services 677 900 206 2.17% 2.17%<br />

intermedi<strong>at</strong>e Capital Group PlC Financials 210 262 723 2.48% 2.48%<br />

intern<strong>at</strong>ional Consolid<strong>at</strong>ed airlines Group sa Consumer services 275 047 012 1.09% 1.09%<br />

intern<strong>at</strong>ional Personal Finance PlC Financials 168 493 906 4.12% 4.12%<br />

intern<strong>at</strong>ional Power PlC utilities 916 143 616 0.58% 0.58%<br />

interserve PlC industrials 79 870 523 2.13% 2.13%<br />

intertek Group PlC industrials 652 282 533 2.16% 2.16%<br />

invensys PlC technology 367 517 162 2.<strong>31</strong>% 2.<strong>31</strong>%<br />

investec PlC Financials 678 201 009 3.61% 2.53%<br />

invista Found<strong>at</strong>ion Property trust ltd Financials 10 462 284 0.95% 0.95%<br />

ite Group PlC Consumer services 224 123 695 4.77% 4.77%<br />

itv PlC Consumer services 326 082 444 1.33% 1.33%<br />

J sainsbury PlC Consumer services 858 824 569 1.63% 1.63%<br />

James Fisher & sons PlC industrials 78 591 369 3.33% 3.33%<br />

Jardine lloyd thompson Group PlC Financials 238 396 047 1.71% 1.71%<br />

JD Wetherspoon PlC Consumer services 189 647 058 3.74% 3.74%<br />

JKX oil & Gas PlC oil & Gas 22 072 388 1.02% 1.02%<br />

John Wood Group PlC oil & Gas 552 034 590 2.50% 2.50%<br />

Johnson m<strong>at</strong>they PlC basic m<strong>at</strong>erials 526 819 898 1.44% 1.44%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

33<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011