Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

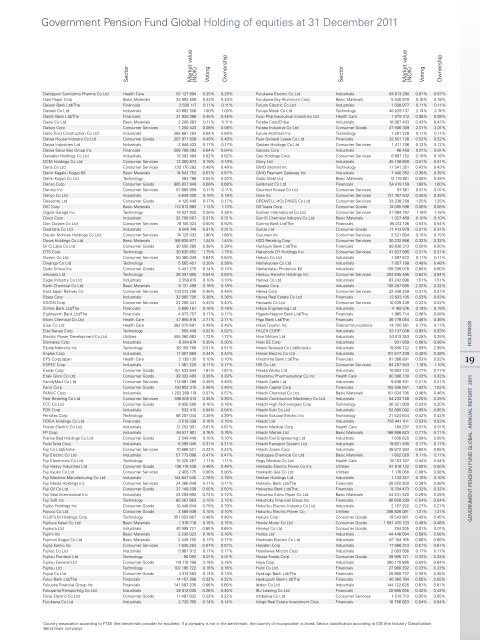

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

Dainippon sumitomo Pharma Co ltd Health Care 67 127 694 0.25% 0.25%<br />

Daio Paper Corp basic m<strong>at</strong>erials 22 992 509 0.43% 0.43%<br />

Daisan bank ltd/the Financials 2 500 117 0.11% 0.11%<br />

Daiseki Co ltd industrials 43 882 508 1.00% 1.00%<br />

Daishi bank ltd/the Financials <strong>31</strong> 929 386 0.45% 0.45%<br />

Daiso Co ltd basic m<strong>at</strong>erials 2 206 063 0.11% 0.11%<br />

Daisyo Corp Consumer services 1 250 423 0.08% 0.08%<br />

Daito trust Construction Co ltd industrials 265 661 254 0.64% 0.64%<br />

Daiwa House industry Co ltd Consumer Goods 207 971 638 0.49% 0.49%<br />

Daiwa industries ltd industrials 2 648 423 0.17% 0.17%<br />

Daiwa securities Group inc Financials 209 798 292 0.64% 0.64%<br />

Daiwabo <strong>Holding</strong>s Co ltd industrials 16 302 494 0.62% 0.62%<br />

DCm <strong>Holding</strong>s Co ltd Consumer services 13 300 873 0.19% 0.19%<br />

Dena Co ltd Consumer services 130 170 282 0.48% 0.48%<br />

Denki Kagaku Kogyo KK basic m<strong>at</strong>erials 74 542 752 0.67% 0.67%<br />

Denki Kogyo Co ltd technology 363 786 0.02% 0.02%<br />

Denso Corp Consumer Goods 985 837 949 0.68% 0.68%<br />

Dentsu inc Consumer services 57 885 958 0.11% 0.11%<br />

Denyo Co ltd industrials 3 649 300 0.18% 0.18%<br />

Descente ltd Consumer Goods 4 125 440 0.17% 0.17%<br />

DiC Corp basic m<strong>at</strong>erials 112 612 883 1.13% 1.13%<br />

Digital Garage inc technology 10 027 925 0.26% 0.26%<br />

Disco Corp industrials 32 700 007 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Don Quijote Co ltd Consumer services 78 745 324 0.50% 0.50%<br />

Doshisha Co ltd industrials 9 845 745 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Doutor nichires <strong>Holding</strong>s Co ltd Consumer services 74 125 032 1.86% 1.86%<br />

Dowa <strong>Holding</strong>s Co ltd basic m<strong>at</strong>erials 168 635 877 1.44% 1.44%<br />

Dr Ci:labo Co ltd Consumer Goods 30 556 385 0.38% 0.38%<br />

Dts Corp technology 30 635 852 1.75% 1.75%<br />

Duskin Co ltd Consumer services 50 460 049 0.64% 0.64%<br />

Dwango Co ltd technology 5 565 451 0.28% 0.28%<br />

Dydo Drinco inc Consumer Goods 5 441 275 0.14% 0.14%<br />

eaccess ltd technology 26 3<strong>31</strong> 805 0.54% 0.54%<br />

eagle industry Co ltd industrials 2 358 015 0.10% 0.10%<br />

earth Chemical Co ltd basic m<strong>at</strong>erials 8 1<strong>31</strong> 499 0.18% 0.18%<br />

east Japan railway Co Consumer services 733 012 256 0.48% 0.48%<br />

ebara Corp industrials 32 885 700 0.38% 0.38%<br />

eDion Corp Consumer services 22 290 441 0.43% 0.43%<br />

ehime bank ltd/the Financials 5 606 181 0.18% 0.18%<br />

eighteenth bank ltd/the Financials 4 673 757 0.17% 0.17%<br />

eiken Chemical Co ltd Health Care 47 855 916 2.71% 2.71%<br />

eisai Co ltd Health Care 362 075 691 0.49% 0.49%<br />

eizo nanao Corp technology 550 449 0.02% 0.02%<br />

electric Power Development Co ltd utilities 455 060 663 1.72% 1.72%<br />

elem<strong>at</strong>ec Corp industrials 6 264 874 0.30% 0.30%<br />

elpida memory inc technology 38 159 789 0.51% 0.51%<br />

enplas Corp industrials 11 057 850 0.44% 0.44%<br />

ePs Corp/Japan Health Care 2 138 130 0.10% 0.10%<br />

esPeC Corp industrials 1 461 225 0.17% 0.17%<br />

exedy Corp Consumer Goods 151 532 844 1.81% 1.81%<br />

ezaki Glico Co ltd Consumer Goods 38 332 483 0.39% 0.39%<br />

Familymart Co ltd Consumer services 114 681 288 0.49% 0.49%<br />

Fancl Corp Consumer Goods 130 802 <strong>31</strong>5 2.46% 2.46%<br />

FanuC Corp industrials 1 252 268 119 0.57% 0.57%<br />

Fast retailing Co ltd Consumer services 398 605 074 0.35% 0.35%<br />

FCC Co ltd Consumer Goods 9 935 590 0.16% 0.16%<br />

FDK Corp industrials 532 415 0.04% 0.04%<br />

Ferrotec Corp technology 58 207 044 3.39% 3.39%<br />

FiDea <strong>Holding</strong>s Co ltd Financials 3 519 338 0.16% 0.16%<br />

Foster electric Co ltd industrials 12 252 991 0.61% 0.61%<br />

FP Corp industrials 64 817 801 0.76% 0.76%<br />

France bed <strong>Holding</strong>s Co ltd Consumer Goods 2 549 449 0.10% 0.10%<br />

Fudo tetra Corp industrials 6 395 045 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Fuji Co ltd/ehime Consumer services 10 886 521 0.22% 0.22%<br />

Fuji electric Co ltd industrials 57 773 696 0.47% 0.47%<br />

Fuji electronics Co ltd technology 15 325 267 1.11% 1.11%<br />

Fuji Heavy industries ltd Consumer Goods 136 174 438 0.48% 0.48%<br />

Fuji Kyuko Co ltd Consumer services 2 405 175 0.06% 0.06%<br />

Fuji machine manufacturing Co ltd industrials 144 847 545 2.78% 2.78%<br />

Fuji media <strong>Holding</strong>s inc Consumer services 24 386 049 0.11% 0.11%<br />

Fuji oil Co ltd Consumer Goods 37 149 209 0.50% 0.50%<br />

Fuji seal intern<strong>at</strong>ional inc industrials 23 293 892 0.72% 0.72%<br />

Fuji s<strong>of</strong>t inc technology 80 367 863 2.15% 2.15%<br />

Fujibo <strong>Holding</strong>s inc Consumer Goods 10 448 644 0.79% 0.79%<br />

Fujicco Co ltd Consumer Goods 2 589 938 0.10% 0.10%<br />

FuJiFilm <strong>Holding</strong>s Corp technology 351 053 867 0.48% 0.48%<br />

Fujikura Kasei Co ltd basic m<strong>at</strong>erials 1 376 716 0.15% 0.15%<br />

Fujikura ltd industrials 40 995 721 0.65% 0.65%<br />

Fujimi inc basic m<strong>at</strong>erials 3 230 023 0.16% 0.16%<br />

Fujimori Kogyo Co ltd basic m<strong>at</strong>erials 2 449 792 0.17% 0.17%<br />

Fujita Kanko inc Consumer services 1 635 252 0.07% 0.07%<br />

Fujitec Co ltd industrials 5 981 912 0.17% 0.17%<br />

Fujitsu Frontech ltd technology 90 093 0.01% 0.01%<br />

Fujitsu General ltd Consumer Goods 119 110 788 3.19% 3.19%<br />

Fujitsu ltd technology 102 195 722 0.16% 0.16%<br />

Fujiya Co ltd Consumer Goods 4 374 583 0.13% 0.13%<br />

Fukui bank ltd/the Financials 14 157 398 0.32% 0.32%<br />

Fukuoka Financial Group inc Financials 141 597 335 0.66% 0.66%<br />

Fukuyama transporting Co ltd industrials 26 012 005 0.26% 0.26%<br />

Funai electric Co ltd Consumer Goods 11 497 932 0.22% 0.22%<br />

Furukawa Co ltd industrials 2 726 765 0.14% 0.14%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

Furukawa electric Co ltd industrials 84 613 260 0.87% 0.87%<br />

Furukawa-sky aluminum Corp basic m<strong>at</strong>erials 5 540 870 0.16% 0.16%<br />

Furuno electric Co ltd industrials 1 038 977 0.11% 0.11%<br />

Furuya metal Co ltd technology 46 029 137 2.74% 2.74%<br />

Fuso Pharmaceutical industries ltd Health Care 1 079 412 0.08% 0.08%<br />

Futaba Corp/Chiba industrials 18 907 403 0.43% 0.43%<br />

Futaba industrial Co ltd Consumer Goods 47 506 309 2.01% 2.01%<br />

Future architect inc technology 1 261 228 0.11% 0.11%<br />

Fuyo General lease Co ltd Financials 32 551 126 0.52% 0.52%<br />

Gakken <strong>Holding</strong>s Co ltd Consumer services 1 411 706 0.12% 0.12%<br />

Gecoss Corp industrials 66 459 0.01% 0.01%<br />

Geo <strong>Holding</strong>s Corp Consumer services 6 687 152 0.18% 0.18%<br />

Glory ltd industrials 45 138 800 0.51% 0.51%<br />

Gmo internet inc technology 11 541 351 0.43% 0.43%<br />

Gmo Payment G<strong>at</strong>eway inc industrials 7 440 352 0.36% 0.35%<br />

Godo steel ltd basic m<strong>at</strong>erials 12 118 801 0.48% 0.48%<br />

Goldcrest Co ltd Financials 54 418 159 1.60% 1.60%<br />

Gourmet Kineya Co ltd Consumer services 97 501 0.01% 0.01%<br />

Gree inc Consumer services 121 767 542 0.26% 0.26%<br />

GroWell HolDinGs Co ltd Consumer services 33 238 258 1.25% 1.25%<br />

Gs Yuasa Corp Consumer Goods 74 005 596 0.56% 0.56%<br />

Gulliver intern<strong>at</strong>ional Co ltd Consumer services <strong>31</strong> 084 797 1.18% 1.18%<br />

Gun-ei Chemical industry Co ltd basic m<strong>at</strong>erials 1 327 469 0.10% 0.10%<br />

Gunma bank ltd/the Financials 85 012 106 0.54% 0.54%<br />

Gunze ltd Consumer Goods 11 413 879 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Gurunavi inc Consumer services 2 521 804 0.15% 0.15%<br />

H2o retailing Corp Consumer services 30 232 856 0.32% 0.32%<br />

Hachijuni bank ltd/the Financials 88 636 <strong>31</strong>3 0.50% 0.50%<br />

Hakuhodo DY <strong>Holding</strong>s inc Consumer services 41 627 995 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Hakuto Co ltd industrials 1 597 672 0.11% 0.11%<br />

Hamakyorex Co ltd industrials 7 057 198 0.48% 0.48%<br />

Hamam<strong>at</strong>su Photonics KK industrials 139 306 078 0.80% 0.80%<br />

Hankyu Hanshin <strong>Holding</strong>s inc Consumer services 204 635 485 0.64% 0.64%<br />

Hanwa Co ltd industrials 83 242 896 1.51% 1.51%<br />

Haseko Corp industrials 138 287 695 2.32% 2.32%<br />

Heiwa Corp Consumer services 32 348 259 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Heiwa real est<strong>at</strong>e Co ltd Financials 12 633 105 0.53% 0.53%<br />

Heiwado Co ltd Consumer services 10 039 249 0.22% 0.22%<br />

Hibiya engineering ltd industrials 4 169 576 0.19% 0.19%<br />

Higashi-nippon bank ltd/the Financials 1 885 714 0.08% 0.08%<br />

Higo bank ltd/the Financials 36 778 054 0.46% 0.46%<br />

Hikari tsushin inc telecommunic<strong>at</strong>ions 14 750 501 0.17% 0.17%<br />

Hi-leX CorP industrials 33 137 038 0.93% 0.93%<br />

Hino motors ltd industrials 53 013 353 0.25% 0.25%<br />

Hioki ee Corp industrials 9<strong>31</strong> 959 0.06% 0.06%<br />

Hirano tecseed Co ltd/Kinzoku industrials 19 845 722 2.99% 2.99%<br />

Hirose electric Co ltd industrials 101 577 239 0.48% 0.48%<br />

Hiroshima bank ltd/the Financials 91 386 891 0.53% 0.53%<br />

His Co ltd Consumer services 64 257 943 1.10% 1.10%<br />

Hisaka Works ltd industrials 16 602 133 0.77% 0.77%<br />

Hisamitsu Pharmaceutical Co inc Health Care 80 386 130 0.33% 0.33%<br />

Hitachi Cable ltd industrials 9 836 491 0.21% 0.21%<br />

Hitachi Capital Corp Financials 105 506 561 1.02% 1.02%<br />

Hitachi Chemical Co ltd basic m<strong>at</strong>erials 101 634 795 0.46% 0.46%<br />

Hitachi Construction machinery Co ltd industrials 54 233 726 0.25% 0.25%<br />

Hitachi High-technologies Corp technology 36 321 809 0.20% 0.20%<br />

Hitachi Koki Co ltd industrials 52 890 092 0.95% 0.95%<br />

Hitachi Kokusai electric inc technology 21 524 644 0.42% 0.42%<br />

Hitachi ltd industrials 755 441 411 0.53% 0.53%<br />

Hitachi medical Corp Health Care 184 297 0.01% 0.01%<br />

Hitachi metals ltd basic m<strong>at</strong>erials 168 898 823 0.71% 0.71%<br />

Hitachi tool engineering ltd industrials 1 636 625 0.09% 0.09%<br />

Hitachi transport system ltd industrials 19 821 490 0.17% 0.17%<br />

Hitachi Zosen Corp industrials 38 872 383 0.65% 0.65%<br />

Hodogaya Chemical Co ltd basic m<strong>at</strong>erials 1 802 020 0.11% 0.11%<br />

Hogy medical Co ltd Health Care 18 153 187 0.44% 0.44%<br />

Hokkaido electric Power Co inc utilities 91 618 132 0.50% 0.50%<br />

Hokkaido Gas Co ltd utilities 1 176 060 0.08% 0.08%<br />

Hokkan <strong>Holding</strong>s ltd industrials 1 143 327 0.10% 0.10%<br />

Hokkoku bank ltd/the Financials 28 020 200 0.38% 0.38%<br />

Hokuetsu bank ltd/the Financials 9 704 473 0.32% 0.32%<br />

Hokuetsu Kishu Paper Co ltd basic m<strong>at</strong>erials 24 241 520 0.29% 0.29%<br />

Hokuhoku Financial Group inc Financials 86 658 299 0.54% 0.54%<br />

Hokuriku electric industry Co ltd industrials 2 167 202 0.27% 0.27%<br />

Hokuriku electric Power Co utilities 306 826 081 1.<strong>31</strong>% 1.<strong>31</strong>%<br />

Hokuto Corp Consumer Goods 19 543 881 0.45% 0.45%<br />

Honda motor Co ltd Consumer Goods 1 591 470 103 0.48% 0.48%<br />

Honeys Co ltd Consumer Goods 254 205 0.01% 0.01%<br />

Horiba ltd industrials 44 448 584 0.58% 0.58%<br />

Hoshizaki electric Co ltd industrials 67 104 765 0.66% 0.66%<br />

Hosiden Corp industrials 17 566 <strong>31</strong>3 0.61% 0.61%<br />

Hosokawa micron Corp industrials 2 083 586 0.17% 0.17%<br />

House Foods Corp Consumer Goods 39 995 721 0.33% 0.33%<br />

Hoya Corp industrials 360 170 886 0.64% 0.64%<br />

Hulic Co ltd Financials 27 966 292 0.23% 0.23%<br />

Hyakugo bank ltd/the Financials 20 960 737 0.35% 0.35%<br />

Hyakujushi bank ltd/the Financials 45 360 764 0.55% 0.55%<br />

ibiden Co ltd industrials 144 122 626 0.81% 0.81%<br />

ibJ leasing Co ltd Financials 20 665 055 0.42% 0.42%<br />

ichibanya Co ltd Consumer services 1 519 710 0.05% 0.05%<br />

ichigo real est<strong>at</strong>e investment Corp Financials 10 756 063 0.54% 0.54%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

19<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011