Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

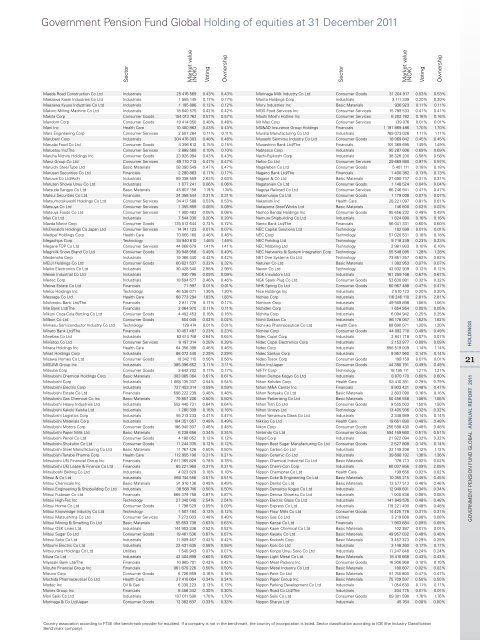

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

maeda road Construction Co ltd industrials 25 476 569 0.43% 0.43%<br />

maezawa Kasei industries Co ltd industrials 1 585 145 0.17% 0.17%<br />

maezawa Kyuso industries Co ltd industrials 1 195 886 0.12% 0.12%<br />

makino milling machine Co ltd industrials 18 640 575 0.42% 0.42%<br />

makita Corp Consumer Goods 154 013 762 0.57% 0.57%<br />

mandom Corp Consumer Goods 18 414 050 0.48% 0.48%<br />

mani inc Health Care 10 400 863 0.43% 0.43%<br />

mars engineering Corp Consumer services 2 507 284 0.11% 0.11%<br />

marubeni Corp industrials 304 476 303 0.48% 0.48%<br />

marudai Food Co ltd Consumer Goods 4 396 612 0.15% 0.15%<br />

maruetsu inc/the Consumer services 2 888 568 0.10% 0.10%<br />

maruha nichiro <strong>Holding</strong>s inc Consumer Goods 23 926 994 0.43% 0.43%<br />

marui Group Co ltd Consumer services 69 710 713 0.47% 0.47%<br />

maruichi steel tube ltd basic m<strong>at</strong>erials 58 390 549 0.47% 0.47%<br />

marusan securities Co ltd Financials 2 280 883 0.17% 0.17%<br />

maruwa Co ltd/aichi industrials 89 338 559 2.63% 2.63%<br />

maruzen showa unyu Co ltd industrials 1 077 241 0.06% 0.06%<br />

m<strong>at</strong>suda sangyo Co ltd basic m<strong>at</strong>erials 45 807 158 1.74% 1.74%<br />

m<strong>at</strong>sui securities Co ltd Financials 24 358 544 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

m<strong>at</strong>sumotokiyoshi <strong>Holding</strong>s Co ltd Consumer services 34 417 588 0.53% 0.53%<br />

m<strong>at</strong>suya Co ltd Consumer services 1 355 859 0.08% 0.08%<br />

m<strong>at</strong>suya Foods Co ltd Consumer services 1 900 483 0.08% 0.08%<br />

max Co ltd industrials 7 544 330 0.20% 0.20%<br />

mazda motor Corp Consumer Goods 135 512 644 0.72% 0.72%<br />

mcDonald’s <strong>Holding</strong>s Co Japan ltd Consumer services 14 741 123 0.07% 0.07%<br />

medipal <strong>Holding</strong>s Corp Health Care 70 065 160 0.46% 0.46%<br />

megachips Corp technology 34 940 610 1.46% 1.46%<br />

megane toP Co ltd Consumer services 44 068 679 1.41% 1.41%<br />

megmilk snow brand Co ltd Consumer Goods 39 948 956 0.49% 0.49%<br />

meidensha Corp industrials 19 366 440 0.42% 0.42%<br />

meiJi <strong>Holding</strong>s Co ltd Consumer Goods 60 621 537 0.32% 0.32%<br />

meiko electronics Co ltd industrials 30 428 540 2.98% 2.98%<br />

meisei industrial Co ltd industrials 930 795 0.09% 0.09%<br />

meitec Corp industrials 18 694 677 0.46% 0.46%<br />

meiwa est<strong>at</strong>e Co ltd Financials 71 997 0.01% 0.01%<br />

melco <strong>Holding</strong>s inc technology 46 536 071 1.30% 1.30%<br />

message Co ltd Health Care 68 773 294 1.83% 1.83%<br />

michinoku bank ltd/the Financials 2 811 778 0.17% 0.17%<br />

mie bank ltd/the Financials 2 064 970 0.11% 0.11%<br />

mikuni Coca-Cola bottling Co ltd Consumer Goods 4 402 453 0.16% 0.16%<br />

milbon Co ltd Consumer Goods 504 045 0.02% 0.02%<br />

mimasu semiconductor industry Co ltd technology 129 474 0.01% 0.01%<br />

min<strong>at</strong>o bank ltd/the Financials 10 457 487 0.23% 0.23%<br />

minebea Co ltd industrials 63 614 748 0.64% 0.64%<br />

ministop Co ltd Consumer services 9 197 <strong>31</strong>4 0.28% 0.28%<br />

miraca <strong>Holding</strong>s inc Health Care 64 356 398 0.46% 0.46%<br />

mirait <strong>Holding</strong>s Corp industrials 88 072 440 2.29% 2.29%<br />

misawa Homes Co ltd Consumer Goods 10 342 115 0.56% 0.56%<br />

misumi Group inc industrials 385 396 652 3.11% 3.11%<br />

mitsuba Corp Consumer Goods 3 642 202 0.17% 0.17%<br />

mitsubishi Chemical <strong>Holding</strong>s Corp basic m<strong>at</strong>erials 303 085 364 0.61% 0.61%<br />

mitsubishi Corp industrials 1 068 135 337 0.54% 0.54%<br />

mitsubishi electric Corp industrials 727 453 <strong>31</strong>4 0.59% 0.59%<br />

mitsubishi est<strong>at</strong>e Co ltd Financials 598 222 239 0.48% 0.48%<br />

mitsubishi Gas Chemical Co inc basic m<strong>at</strong>erials 79 857 206 0.50% 0.50%<br />

mitsubishi Heavy industries ltd industrials 552 440 7<strong>31</strong> 0.64% 0.64%<br />

mitsubishi Kakoki Kaisha ltd industrials 1 280 309 0.16% 0.16%<br />

mitsubishi logistics Corp industrials 55 213 233 0.47% 0.47%<br />

mitsubishi m<strong>at</strong>erials Corp industrials 104 351 057 0.49% 0.49%<br />

mitsubishi motors Corp Consumer Goods 186 940 307 0.48% 0.48%<br />

mitsubishi Paper mills ltd basic m<strong>at</strong>erials 6 238 656 0.34% 0.34%<br />

mitsubishi Pencil Co ltd Consumer Goods 4 188 052 0.12% 0.12%<br />

mitsubishi shokuhin Co ltd Consumer Goods 11 244 335 0.12% 0.12%<br />

mitsubishi steel manufacturing Co ltd basic m<strong>at</strong>erials 11 767 426 0.50% 0.50%<br />

mitsubishi tanabe Pharma Corp Health Care 112 955 190 0.21% 0.21%<br />

mitsubishi uFJ Financial Group inc Financials 2 811 365 828 0.78% 0.78%<br />

mitsubishi uFJ lease & Finance Co ltd Financials 65 221 960 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

mitsuboshi belting Co ltd industrials 4 023 829 0.18% 0.18%<br />

mitsui & Co ltd industrials 860 744 556 0.51% 0.51%<br />

mitsui Chemicals inc basic m<strong>at</strong>erials 91 916 136 0.49% 0.49%<br />

mitsui engineering & shipbuilding Co ltd industrials 38 568 746 0.50% 0.50%<br />

mitsui Fudosan Co ltd Financials 665 379 758 0.87% 0.87%<br />

mitsui High-tec inc technology 27 340 045 2.54% 2.54%<br />

mitsui Home Co ltd Consumer Goods 1 798 529 0.09% 0.09%<br />

mitsui Knowledge industry Co ltd technology 1 507 184 0.12% 0.12%<br />

mitsui m<strong>at</strong>sushima Co ltd Consumer services 7 273 003 0.48% 0.48%<br />

mitsui mining & smelting Co ltd basic m<strong>at</strong>erials 55 653 738 0.63% 0.63%<br />

mitsui osK lines ltd industrials 144 903 336 0.52% 0.52%<br />

mitsui sugar Co ltd Consumer Goods 19 461 536 0.67% 0.67%<br />

mitsui-soko Co ltd industrials 11 809 467 0.42% 0.42%<br />

mitsumi electric Co ltd industrials 22 4<strong>31</strong> 635 0.58% 0.58%<br />

mitsuuroko <strong>Holding</strong>s Co ltd utilities 1 545 943 0.07% 0.07%<br />

miura Co ltd industrials 42 404 899 0.60% 0.60%<br />

miyazaki bank ltd/the Financials 10 965 701 0.42% 0.42%<br />

mizuho Financial Group inc Financials 961 870 226 0.50% 0.50%<br />

mizuno Corp Consumer Goods 6 726 859 0.16% 0.16%<br />

mochida Pharmaceutical Co ltd Health Care 27 410 064 0.34% 0.34%<br />

modec inc oil & Gas 6 330 223 0.13% 0.13%<br />

monex Group inc Financials 8 456 342 0.30% 0.30%<br />

mori seiki Co ltd industrials 107 011 580 1.70% 1.70%<br />

morinaga & Co ltd/Japan Consumer Goods 12 382 837 0.33% 0.33%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

morinaga milk industry Co ltd Consumer Goods <strong>31</strong> 204 917 0.53% 0.53%<br />

morita <strong>Holding</strong>s Corp industrials 3 111 339 0.20% 0.20%<br />

mory industries inc basic m<strong>at</strong>erials 936 923 0.11% 0.11%<br />

mos Food services inc Consumer services 15 789 533 0.41% 0.41%<br />

moshi moshi Hotline inc Consumer services 6 202 782 0.16% 0.16%<br />

mr max Corp Consumer services 139 076 0.01% 0.01%<br />

ms&aD insurance Group <strong>Holding</strong>s Financials 1 191 869 486 1.70% 1.70%<br />

mur<strong>at</strong>a manufacturing Co ltd industrials 769 073 026 1.11% 1.11%<br />

musashi seimitsu industry Co ltd Consumer Goods 18 069 842 0.45% 0.45%<br />

musashino bank ltd/the Financials 101 369 695 1.49% 1.49%<br />

nabtesco Corp industrials 95 287 606 0.69% 0.69%<br />

nachi-Fujikoshi Corp industrials 38 326 200 0.58% 0.58%<br />

nafco Co ltd Consumer services 29 669 880 0.97% 0.97%<br />

nagaileben Co ltd Consumer Goods 5 401 111 0.18% 0.18%<br />

nagano bank ltd/the Financials 1 400 382 0.13% 0.13%<br />

nagase & Co ltd basic m<strong>at</strong>erials 27 690 737 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

nag<strong>at</strong>anien Co ltd Consumer Goods 1 148 524 0.04% 0.04%<br />

nagoya railroad Co ltd Consumer services 66 246 941 0.47% 0.47%<br />

nakamuraya Co ltd Consumer Goods 1 179 008 0.07% 0.07%<br />

nakanishi inc Health Care 28 221 097 0.81% 0.81%<br />

nakayama steel Works ltd basic m<strong>at</strong>erials 146 600 0.02% 0.02%<br />

namco bandai <strong>Holding</strong>s inc Consumer Goods 95 656 232 0.49% 0.49%<br />

namura shipbuilding Co ltd industrials 1 624 890 0.16% 0.16%<br />

nanto bank ltd/the Financials 56 041 3<strong>31</strong> 0.60% 0.60%<br />

neC Capital solutions ltd technology 182 599 0.01% 0.01%<br />

neC Corp technology 57 020 5<strong>31</strong> 0.18% 0.18%<br />

neC Fielding ltd technology 9 718 249 0.23% 0.23%<br />

neC mobiling ltd technology 2 981 803 0.10% 0.10%<br />

neC networks & system integr<strong>at</strong>ion Corp technology 55 548 095 1.28% 1.28%<br />

net one systems Co ltd technology 73 851 357 0.82% 0.82%<br />

neturen Co ltd basic m<strong>at</strong>erials 1 382 953 0.07% 0.07%<br />

nexon Co ltd technology 42 932 939 0.12% 0.12%<br />

nGK insul<strong>at</strong>ors ltd industrials 161 259 168 0.67% 0.67%<br />

nGK spark Plug Co ltd Consumer Goods 53 630 881 0.32% 0.32%<br />

nHK spring Co ltd Consumer Goods 60 967 488 0.47% 0.47%<br />

nice <strong>Holding</strong>s inc industrials 2 510 123 0.20% 0.20%<br />

nichias Corp industrials 116 246 110 2.81% 2.81%<br />

nichicon Corp industrials 49 569 898 1.06% 1.06%<br />

nichiden Corp industrials 1 654 954 0.05% 0.05%<br />

nichiha Corp industrials 6 094 942 0.25% 0.25%<br />

nichii Gakkan Co industrials 86 178 067 1.62% 1.62%<br />

nichi-iko Pharmaceutical Co ltd Health Care 68 690 071 1.20% 1.20%<br />

nichirei Corp Consumer Goods 44 092 710 0.49% 0.49%<br />

nidec Copal Corp industrials 2 841 718 0.07% 0.07%<br />

nidec Copal electronics Corp industrials 2 153 977 0.09% 0.09%<br />

nidec Corp industrials 856 519 009 1.14% 1.14%<br />

nidec sankyo Corp industrials 9 957 960 0.14% 0.14%<br />

nidec-tosok Corp Consumer Goods 199 159 0.01% 0.01%<br />

nifco inc/Japan Consumer Goods 44 380 791 0.49% 0.49%<br />

niFtY Corp technology 18 195 111 1.21% 1.21%<br />

nihon Dempa Kogyo Co ltd industrials 8 870 170 0.60% 0.60%<br />

nihon Kohden Corp Health Care 53 410 391 0.79% 0.79%<br />

nihon m&a Center inc Financials 9 903 4<strong>31</strong> 0.48% 0.47%<br />

nihon nohyaku Co ltd basic m<strong>at</strong>erials 2 803 090 0.16% 0.16%<br />

nihon Parkerizing Co ltd basic m<strong>at</strong>erials 50 456 558 1.06% 1.06%<br />

nihon trim Co ltd Consumer Goods 9 555 003 1.50% 1.50%<br />

nihon unisys ltd technology 13 405 936 0.32% 0.32%<br />

nihon Yamamura Glass Co ltd industrials 2 348 989 0.14% 0.14%<br />

nikkiso Co ltd Health Care 19 661 890 0.48% 0.48%<br />

nikon Corp Consumer Goods 256 588 430 0.48% 0.48%<br />

nintendo Co ltd Consumer Goods 594 169 660 0.51% 0.51%<br />

nippo Corp industrials 21 922 094 0.32% 0.32%<br />

nippon beet sugar manufacturing Co ltd Consumer Goods 2 527 808 0.14% 0.14%<br />

nippon Carbon Co ltd industrials 22 149 208 1.12% 1.12%<br />

nippon Ceramic Co ltd industrials 39 698 192 1.36% 1.36%<br />

nippon Chemical industrial Co ltd basic m<strong>at</strong>erials 178 713 0.02% 0.02%<br />

nippon Chemi-Con Corp industrials 60 037 856 2.09% 2.09%<br />

nippon Chemiphar Co ltd Health Care 199 656 0.02% 0.02%<br />

nippon Coke & engineering Co ltd basic m<strong>at</strong>erials 10 355 215 0.45% 0.45%<br />

nippon Denko Co ltd basic m<strong>at</strong>erials 13 577 513 0.46% 0.46%<br />

nippon Densetsu Kogyo Co ltd industrials 12 949 691 0.34% 0.34%<br />

nippon Denwa shisetsu Co ltd industrials 1 000 838 0.08% 0.08%<br />

nippon electric Glass Co ltd industrials 141 849 676 0.48% 0.48%<br />

nippon express Co ltd industrials 119 221 490 0.48% 0.48%<br />

nippon Flour mills Co ltd Consumer Goods 14 425 778 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

nippon Gas Co ltd utilities 3 219 808 0.08% 0.08%<br />

nippon Kanzai Co ltd Financials 1 963 684 0.09% 0.09%<br />

nippon Kasei Chemical Co ltd basic m<strong>at</strong>erials 102 387 0.01% 0.01%<br />

nippon Kayaku Co ltd basic m<strong>at</strong>erials 49 957 032 0.48% 0.48%<br />

nippon Kodoshi Corp basic m<strong>at</strong>erials 3 457 323 0.29% 0.29%<br />

nippon Koei Co ltd industrials 3 148 260 0.17% 0.17%<br />

nippon Konpo unyu soko Co ltd industrials 11 247 848 0.24% 0.24%<br />

nippon light metal Co ltd basic m<strong>at</strong>erials 18 410 668 0.43% 0.43%<br />

nippon me<strong>at</strong> Packers inc Consumer Goods 16 906 968 0.10% 0.10%<br />

nippon metal industry Co ltd basic m<strong>at</strong>erials 180 807 0.02% 0.02%<br />

nippon Paint Co ltd basic m<strong>at</strong>erials 51 740 800 0.47% 0.47%<br />

nippon Paper Group inc basic m<strong>at</strong>erials 75 709 597 0.50% 0.50%<br />

nippon Parking Development Co ltd industrials 1 054 630 0.11% 0.11%<br />

nippon road Co ltd/the industrials 204 775 0.01% 0.01%<br />

nippon seiki Co ltd Consumer Goods 69 301 598 1.76% 1.76%<br />

nippon sharyo ltd industrials 45 764 0.00% 0.00%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

21<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011