Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

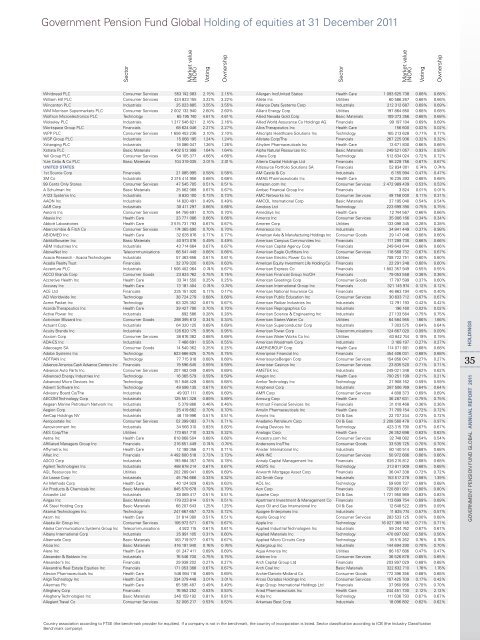

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

Whitbread PlC Consumer services 553 742 083 2.15% 2.15%<br />

William Hill PlC Consumer services 424 823 155 3.22% 3.22%<br />

Wincanton PlC industrials 25 023 885 3.55% 3.55%<br />

Wm morrison supermarkets PlC Consumer services 2 002 132 940 2.60% 2.60%<br />

Wolfson microelectronics PlC technology 65 195 740 4.61% 4.61%<br />

Wolseley PlC industrials 1 217 546 821 2.16% 2.16%<br />

Workspace Group PlC Financials 68 624 046 2.27% 2.27%<br />

WPP PlC Consumer services 1 656 453 236 2.10% 2.10%<br />

WsP Group PlC industrials 15 068 195 1.24% 1.24%<br />

Xchanging PlC industrials 18 086 047 1.26% 1.26%<br />

Xstr<strong>at</strong>a PlC basic m<strong>at</strong>erials 4 402 512 998 1.64% 1.64%<br />

Yell Group PlC Consumer services 54 105 377 4.66% 4.66%<br />

Yule C<strong>at</strong>to & Co PlC basic m<strong>at</strong>erials 104 <strong>31</strong>9 035 2.01% 2.01%<br />

UNiTEd sTATEs<br />

1st source Corp Financials 21 085 995 0.58% 0.58%<br />

3m Co industrials 2 <strong>31</strong>5 414 956 0.68% 0.68%<br />

99 Cents only stores Consumer services 47 545 705 0.51% 0.51%<br />

a schulman inc basic m<strong>at</strong>erials 25 062 068 0.67% 0.67%<br />

a123 systems inc industrials 8 830 100 0.73% 0.73%<br />

aaon inc industrials 14 820 491 0.49% 0.49%<br />

aar Corp industrials 30 411 297 0.66% 0.66%<br />

aaron’s inc Consumer services 84 756 691 0.70% 0.70%<br />

abaxis inc Health Care 23 771 086 0.66% 0.66%<br />

abbott labor<strong>at</strong>ories Health Care 3 515 7<strong>31</strong> 793 0.67% 0.67%<br />

abercrombie & Fitch Co Consumer services 174 365 690 0.70% 0.70%<br />

abiomeD inc Health Care 32 635 876 0.77% 0.77%<br />

abitibibow<strong>at</strong>er inc basic m<strong>at</strong>erials 40 973 076 0.49% 0.49%<br />

abm industries inc industrials 43 714 664 0.67% 0.67%<br />

abovenet inc telecommunic<strong>at</strong>ions 66 541 449 0.66% 0.66%<br />

acacia research - acacia technologies industrials 57 463 656 0.61% 0.61%<br />

acadia realty trust Financials 32 379 320 0.63% 0.63%<br />

accenture PlC industrials 1 506 402 064 0.74% 0.67%<br />

aCCo brands Corp Consumer Goods 23 824 762 0.75% 0.75%<br />

accretive Health inc Health Care 33 741 550 0.25% 0.25%<br />

accuray inc Health Care 13 181 404 0.74% 0.74%<br />

aCe ltd Financials 235 151 920 0.17% 0.17%<br />

aCi Worldwide inc technology 38 724 279 0.68% 0.68%<br />

acme Packet inc technology 83 325 352 0.67% 0.67%<br />

acorda therapeutics inc Health Care 39 427 790 0.70% 0.70%<br />

active Power inc industrials 892 586 0.28% 0.28%<br />

activision blizzard inc Consumer Goods 288 395 613 0.34% 0.34%<br />

actuant Corp industrials 64 320 125 0.69% 0.69%<br />

acuity brands inc industrials 126 620 175 0.95% 0.95%<br />

acxiom Corp Consumer services 38 876 382 0.68% 0.68%<br />

aDa-es inc industrials 7 466 691 0.55% 0.55%<br />

adecoagro sa Consumer Goods 14 540 362 0.25% 0.25%<br />

adobe systems inc technology 623 666 625 0.75% 0.75%<br />

aDtran inc technology 77 715 918 0.68% 0.68%<br />

advance america Cash advance Centers inc Financials 19 596 645 0.59% 0.59%<br />

advance auto Parts inc Consumer services 207 482 049 0.69% 0.69%<br />

advanced energy industries inc technology 16 365 579 0.59% 0.59%<br />

advanced micro Devices inc technology 151 848 428 0.68% 0.68%<br />

advent s<strong>of</strong>tware inc technology 49 596 135 0.67% 0.67%<br />

advisory board Co/the industrials 49 937 111 0.69% 0.69%<br />

aeCom technology Corp industrials 125 551 328 0.89% 0.89%<br />

aegean marine Petroleum network inc industrials 5 379 866 0.46% 0.46%<br />

aegion Corp industrials 25 419 682 0.70% 0.70%<br />

aerCap <strong>Holding</strong>s nv industrials 48 119 996 0.51% 0.51%<br />

aeropostale inc Consumer services 52 399 083 0.71% 0.71%<br />

aerovironment inc industrials 34 566 <strong>31</strong>0 0.83% 0.83%<br />

aes Corp/the utilities 173 651 710 0.32% 0.32%<br />

aetna inc Health Care 618 868 504 0.68% 0.68%<br />

affili<strong>at</strong>ed managers Group inc Financials 216 651 449 0.74% 0.74%<br />

affymetrix inc Health Care 12 199 356 0.71% 0.71%<br />

aflac inc Financials 4 492 600 518 3.73% 3.73%<br />

aGCo Corp industrials 193 884 357 0.78% 0.78%<br />

agilent technologies inc industrials 488 878 214 0.67% 0.67%<br />

aGl resources inc utilities 202 289 041 0.69% 0.69%<br />

air lease Corp industrials 45 794 666 0.33% 0.32%<br />

air methods Corp Health Care 40 124 929 0.63% 0.63%<br />

air Products & Chemicals inc basic m<strong>at</strong>erials 845 570 678 0.79% 0.79%<br />

aircastle ltd industrials 28 069 417 0.51% 0.51%<br />

airgas inc basic m<strong>at</strong>erials 179 223 814 0.51% 0.51%<br />

aK steel <strong>Holding</strong> Corp basic m<strong>at</strong>erials 68 207 643 1.25% 1.25%<br />

akamai technologies inc technology 247 667 657 0.72% 0.72%<br />

akorn inc Health Care <strong>31</strong> 814 380 0.51% 0.51%<br />

alaska air Group inc Consumer services 106 972 571 0.67% 0.67%<br />

alaska Communic<strong>at</strong>ions systems Group inc telecommunic<strong>at</strong>ions 4 922 115 0.61% 0.61%<br />

albany intern<strong>at</strong>ional Corp industrials 25 991 105 0.<strong>31</strong>% 0.60%<br />

albemarle Corp basic m<strong>at</strong>erials 183 719 977 0.67% 0.67%<br />

alcoa inc basic m<strong>at</strong>erials 416 191 940 0.76% 0.76%<br />

alere inc Health Care 81 247 411 0.69% 0.69%<br />

alexander & baldwin inc industrials 76 546 700 0.75% 0.75%<br />

alexander’s inc Financials 29 938 202 0.27% 0.27%<br />

alexandria real est<strong>at</strong>e <strong>equities</strong> inc Financials 171 053 388 0.67% 0.67%<br />

alexion Pharmaceuticals inc Health Care 546 994 116 0.69% 0.69%<br />

align technology inc Health Care 334 379 448 3.01% 3.01%<br />

alkermes Plc Health Care 65 595 487 0.49% 0.49%<br />

alleghany Corp Financials 76 952 252 0.53% 0.53%<br />

allegheny technologies inc basic m<strong>at</strong>erials 246 159 192 0.81% 0.81%<br />

allegiant travel Co Consumer services 32 006 217 0.53% 0.53%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

allergan inc/united st<strong>at</strong>es Health Care 1 093 625 738 0.68% 0.68%<br />

allete inc utilities 60 586 267 0.66% 0.66%<br />

alliance D<strong>at</strong>a systems Corp industrials 212 <strong>31</strong>2 687 0.69% 0.69%<br />

alliant energy Corp utilities 197 864 850 0.68% 0.68%<br />

allied nevada Gold Corp basic m<strong>at</strong>erials 109 373 356 0.68% 0.68%<br />

allied World assurance Co <strong>Holding</strong>s aG Financials 99 197 104 0.69% 0.69%<br />

allos therapeutics inc Health Care 156 600 0.02% 0.02%<br />

allscripts Healthcare solutions inc technology 165 213 628 0.77% 0.77%<br />

allst<strong>at</strong>e Corp/the Financials 267 225 936 0.32% 0.32%<br />

alnylam Pharmaceuticals inc Health Care 13 671 830 0.66% 0.66%<br />

alpha n<strong>at</strong>ural resources inc basic m<strong>at</strong>erials 249 521 057 0.93% 0.93%<br />

altera Corp technology 512 834 024 0.72% 0.72%<br />

alterra Capital <strong>Holding</strong>s ltd Financials 98 229 756 0.67% 0.67%<br />

altisource Portfolio solutions sa Financials 52 834 001 0.74% 0.74%<br />

am Castle & Co industrials 6 155 994 0.47% 0.47%<br />

amaG Pharmaceuticals inc Health Care 16 235 393 0.68% 0.68%<br />

amazon.com inc Consumer services 2 472 989 439 0.53% 0.53%<br />

ambac Financial Group inc Financials 3 824 0.01% 0.01%<br />

amC networks inc Consumer services 49 758 000 0.11% 0.<strong>31</strong>%<br />

amCol intern<strong>at</strong>ional Corp basic m<strong>at</strong>erials 27 195 040 0.54% 0.54%<br />

amdocs ltd technology 223 699 390 0.75% 0.75%<br />

amedisys inc Health Care 12 744 567 0.66% 0.66%<br />

amerco inc Consumer services 35 006 166 0.34% 0.34%<br />

ameren Corp utilities 133 098 345 0.28% 0.28%<br />

ameresco inc industrials 34 841 449 0.37% 0.98%<br />

american axle & manufacturing <strong>Holding</strong>s inc Consumer Goods 29 147 046 0.66% 0.66%<br />

american Campus Communities inc Financials 117 299 730 0.66% 0.66%<br />

american Capital agency Corp Financials 249 643 644 0.66% 0.66%<br />

american eagle outfitters inc Consumer services 118 568 732 0.67% 0.67%<br />

american electric Power Co inc utilities 708 722 751 0.60% 0.60%<br />

american equity investment life <strong>Holding</strong> Co Financials 22 291 248 0.60% 0.60%<br />

american express Co Financials 1 802 357 949 0.55% 0.55%<br />

american Financial Group inc/oH Financials 79 053 558 0.36% 0.36%<br />

american Greetings Corp Consumer Goods 17 797 599 0.37% 0.60%<br />

american intern<strong>at</strong>ional Group inc Financials 321 145 974 0.12% 0.12%<br />

american n<strong>at</strong>ional insurance Co Financials 46 863 194 0.40% 0.40%<br />

american Public educ<strong>at</strong>ion inc Consumer services 30 833 712 0.67% 0.67%<br />

american railcar industries inc industrials 12 791 193 0.42% 0.42%<br />

american reprographics Co industrials 196 160 0.02% 0.02%<br />

american science & engineering inc industrials 27 133 564 0.75% 0.75%<br />

american st<strong>at</strong>es W<strong>at</strong>er Co utilities 64 584 955 1.66% 1.66%<br />

american superconductor Corp industrials 7 303 575 0.64% 0.64%<br />

american tower Corp telecommunic<strong>at</strong>ions 124 667 020 0.09% 0.09%<br />

american W<strong>at</strong>er Works Co inc utilities 63 842 744 0.19% 0.19%<br />

american Woodmark Corp industrials 3 168 197 0.27% 0.27%<br />

ameriGrouP Corp Health Care 114 071 601 0.68% 0.68%<br />

ameriprise Financial inc Financials 454 406 0<strong>31</strong> 0.68% 0.68%<br />

amerisourcebergen Corp Consumer services 154 856 047 0.27% 0.27%<br />

ameristar Casinos inc Consumer services 23 835 520 0.71% 0.71%<br />

ameteK inc industrials 249 021 348 0.62% 0.62%<br />

amgen inc Health Care 700 251 199 0.21% 0.21%<br />

amkor technology inc technology 27 908 162 0.59% 0.59%<br />

amphenol Corp industrials 287 506 769 0.64% 0.64%<br />

amr Corp Consumer services 4 808 373 0.69% 0.69%<br />

amsurg Corp Health Care 36 287 6<strong>31</strong> 0.75% 0.75%<br />

amtrust Financial services inc Financials <strong>31</strong> 010 468 0.36% 0.36%<br />

amylin Pharmaceuticals inc Health Care 71 709 154 0.72% 0.72%<br />

amyris inc oil & Gas 22 707 244 0.72% 0.72%<br />

anadarko Petroleum Corp oil & Gas 2 208 560 478 0.97% 0.97%<br />

analog Devices inc technology 423 <strong>31</strong>5 790 0.67% 0.67%<br />

analogic Corp Health Care 26 352 698 0.63% 0.63%<br />

ancestry.com inc Consumer services 32 748 082 0.54% 0.54%<br />

andersons inc/the Consumer Goods 33 535 725 0.70% 0.70%<br />

anixter intern<strong>at</strong>ional inc industrials 80 140 514 0.68% 0.68%<br />

ann inC Consumer services 50 972 686 0.66% 0.66%<br />

annaly Capital management inc Financials 626 215 812 0.68% 0.68%<br />

ansYs inc technology 213 811 909 0.68% 0.68%<br />

anworth mortgage asset Corp Financials 36 047 338 0.72% 0.72%<br />

ao smith Corp industrials 153 517 278 0.58% 1.39%<br />

aol inc technology 59 800 737 0.68% 0.68%<br />

aon Corp Financials 720 891 051 0.80% 0.80%<br />

apache Corp oil & Gas 1 721 950 989 0.83% 0.83%<br />

apartment investment & management Co Financials 113 699 754 0.69% 0.69%<br />

apco oil and Gas intern<strong>at</strong>ional inc oil & Gas 12 648 522 0.09% 0.09%<br />

apogee enterprises inc industrials 11 825 774 0.57% 0.57%<br />

apollo Group inc Consumer services 283 533 125 0.00% 0.68%<br />

apple inc technology 16 027 369 145 0.71% 0.71%<br />

applied industrial technologies inc industrials 59 244 762 0.67% 0.67%<br />

applied m<strong>at</strong>erials inc technology 470 897 092 0.56% 0.56%<br />

applied micro Circuits Corp technology 18 515 262 0.76% 0.76%<br />

aptargroup inc industrials 144 694 290 0.70% 0.70%<br />

aqua america inc utilities 86 167 686 0.47% 0.47%<br />

arbitron inc Consumer services 36 526 878 0.65% 0.65%<br />

arch Capital Group ltd Financials 203 897 029 0.68% 0.68%<br />

arch Coal inc basic m<strong>at</strong>erials 322 632 710 1.76% 1.76%<br />

archer-Daniels-midland Co Consumer Goods 772 396 356 0.68% 0.68%<br />

arcos Dorados <strong>Holding</strong>s inc Consumer services 107 425 709 0.17% 0.42%<br />

argo Group intern<strong>at</strong>ional <strong>Holding</strong>s ltd Financials 37 960 956 0.70% 0.70%<br />

ariad Pharmaceuticals inc Health Care 244 451 730 2.12% 2.12%<br />

ariba inc technology 111 636 793 0.67% 0.67%<br />

arkansas best Corp industrials 18 096 892 0.62% 0.62%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

35<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011